Sponsored By

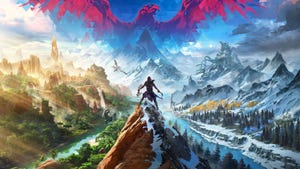

Key art for Arkane's 2023 shooter, Redfall.

Business

Redfall's future development, offline mode dead with Arkane Austin's closureRedfall's future development, offline mode dead with Arkane Austin's closure

Before its untimely end, Arkane Austin was allegedly set to take another stab at Redfall, and whip it into considerably better shape.

Daily news, dev blogs, and stories from Game Developer straight to your inbox