Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs or learn how to Submit Your Own Blog Post

A toolbox for approaching the strategic analysis of new game ideas.

July 5, 2024

This is the third part of my series of articles on meta-marketing to empower small PC and console game developers and publishers to find their footing in the market. Larger publishers are also warmly welcomed, as are those targeting other platforms. The rules of marketing apply to all!

In the first part, I discussed what has happened in our industry recently. I outlined the fundamental problem facing game developers and publishers—the market is hugely overloaded with thousands of games. In the second part, I outlined gamers' evolving expectations, the revenue dominance of a few games over thousands, industry consolidation's effect on smaller studios, and economics and data's importance in game development.

Here, I will demonstrate a toolbox for approaching the strategic analysis of new game ideas to have any chance of succeeding in the cluttered market.

In traditional industries, various options are available when the market becomes very competitive and new challenges arise. It's also valuable to consider these options in the game development industry, as strategic marketing principles apply across all industries. We have four main market strategies at our disposal, but I will focus on the two most popular ones for this discussion.

A publisher or developer may choose to compete by utilizing existing game mechanics, features, and settings similar to those previously released by them, targeting the same player base. This approach is resource-intensive and challenging, often leading to price wars and intense competition among numerous rivals.

The main advantage of this strategy is that it allows the developer or publisher to operate within their established comfort zone without the need to innovate.

It's important to note that game development penetration in the console and PC market still ranges from 30% to 50%, depending on the country and measurement methods. This indicates that not everyone plays games, suggesting that there is still untapped market potential to explore.

Regarding market development, a publisher or developer can expand their reach by targeting new segments of gamers or exploring new geographical markets. They might also opt for a more targeted approach, honing in on particular markets to serve local fans—be they Polish, German, British, or French enthusiasts. While this strategy may initially seem unconventional, it holds considerable merit upon closer examination.

Naturally, the allure of the vast American and Chinese markets is undeniable, with every enterprise vying to maximize sales in these lucrative arenas. However, therein lies the crux of the challenge: the fierce rivalry.

The battle for the attention of American and Chinese gamers is intense, necessitating colossal promotional budgets and rendering the prospect of making a significant impact increasingly slender.

It's a well-acknowledged fact that Europe's premier markets—namely the British, German, and French—command between 6 to 11% of the US market's valuation. Yet, in absolute figures, this translates to a substantial $4 to over $6 billion for each market. Securing even a fraction of this pie can spell success for the astute indie developer or publisher.

The essence of market development also lies in exploring new player segments. While unearthing untapped gamers in today's saturated environment might seem akin to finding a needle in a haystack, it is not only feasible but also a venture worth pursuing. The strategy pivots on diversifying communication to resonate with previously unengaged segments.

Consider forging connections with cultural mediums beyond gaming—films, television series, literature, and music. Such cross-pollination can pique the interest of non-gamers in the gaming universe.

To put it briefly, the current landscape calls for initiatives to captivate those distant from gaming—the individual whose last game purchase was a year prior or the daily mobile casual gamer. This endeavor extends beyond marketing tactics and omnichannel engagement; it necessitates reimagining game design to welcome not just the mid-core but also the casual gamer. This isn't a call for an influx of cozy or hypercasual games but an invitation to weave comfort into the fabric of expansive, serious games designed for major consoles and PCs.

Is this an arduous undertaking? Undoubtedly. But has it become imperative? It certainly has.

Market evolution also encompasses the adoption of novel distribution avenues. Increasingly, manufacturers, particularly the smaller entities, are contemplating this shift. A prime example is the burgeoning domain of subscription services like Xbox Game Pass and PS Now—potentially joined by streaming platforms—representing both a significant hurdle and a golden opportunity for developers. A veteran gaming journalist collaborating with us at Try Evidence encapsulated this sentiment: "My affinity for indie games is strong, yet I increasingly gravitate towards titles on Game Pass or those heavily discounted. Integrating indie games into these services while ensuring visibility and a steady revenue stream simultaneously exerts immense pressure on developers who remain outside these ecosystems."

In the quest for market insights, every marketing strategy hinges on recognizing strategic opportunities that emerge from the disparity between demand and supply. Market research leveraging foundational and reactive data is pivotal in pinpointing these gaps. Essentially, it delves into player behavior and preferences from multiple angles.

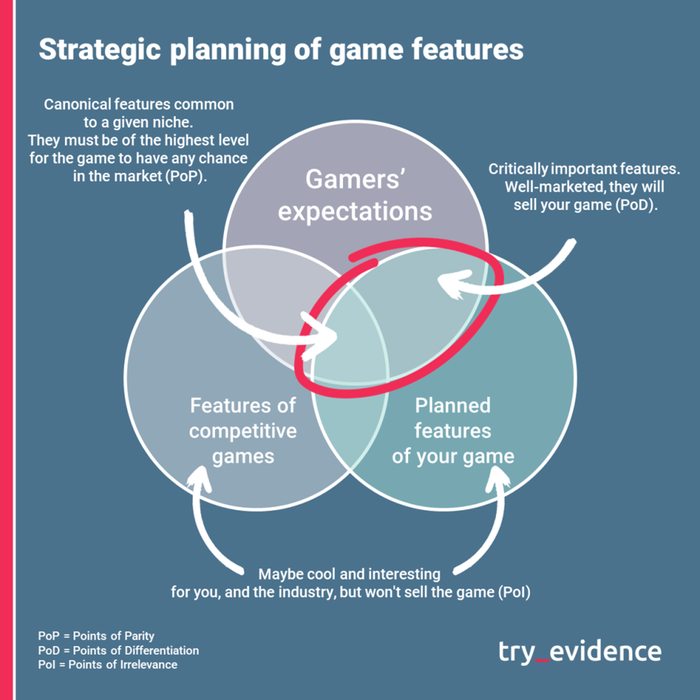

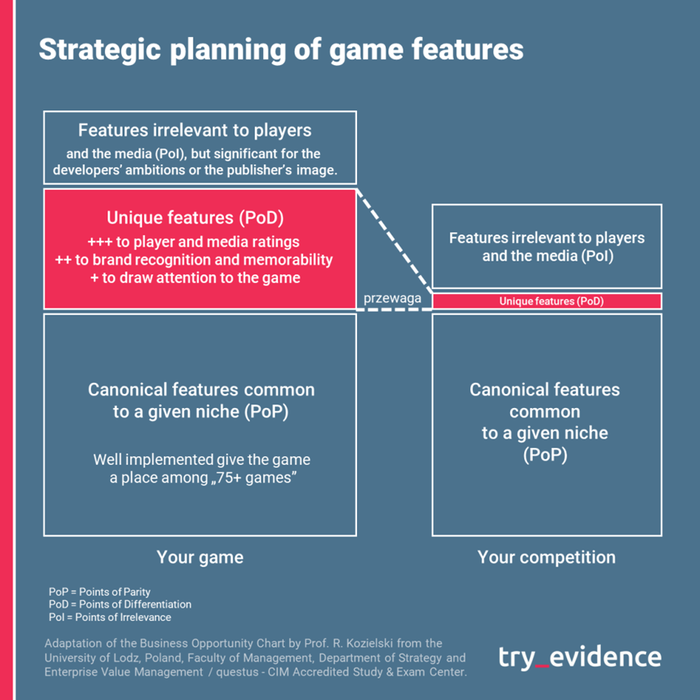

Adaptation of The Business Opportunity Chart by Prof. R. Kozielski from the University of Lodz, Poland, Faculty of Management, Department of Strategy and Enterprise Value Management / questus - CIM Accredited Study & Exam Center by Michał Dębek / Try Evidence CC BY-ND

Let's face it—crafting innovative and capricious games is a formidable task.

The key to success lies in discerning market voids and player necessities to deliver unique Points of Difference (PODs) and compelling Unique Selling Propositions (USPs) that elicit enthusiastic responses from players, media, and influencers alike.

This endeavor begins with rigorous research, a staple in traditional marketing sectors.

As my esteemed mentor in strategic marketing, Prof. Robert Kozielski often remarked:

"Business opportunities are born from the chasm between demand and supply."

While this may seem self-evident, its application in game development still requires broader adoption.

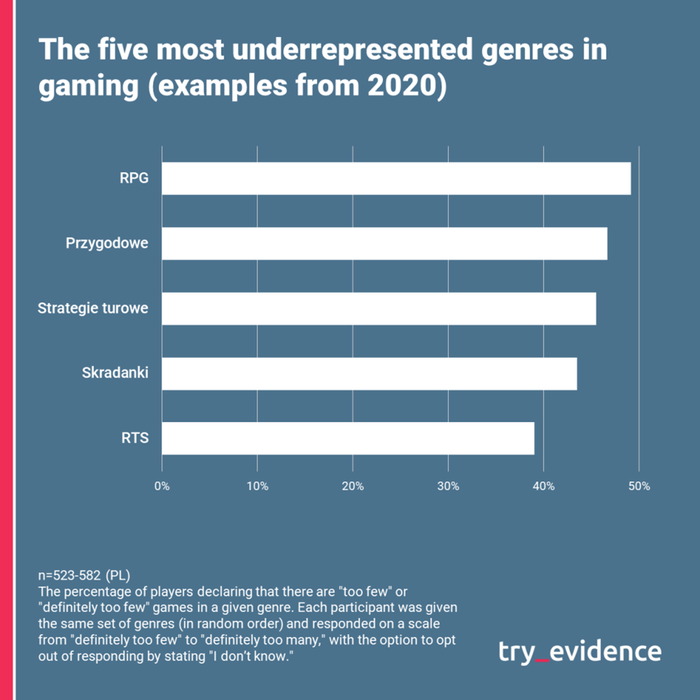

I conduct extensive research for various clients in Try Evidence, safeguarding the results as they confer a direct competitive edge. Nonetheless, we occasionally share insights at industry events. For instance, in late 2020 and early 2021, we surveyed over 2,000 players from the US, Russia, Poland, and Germany, probing their market perceptions and specific needs regarding games. The survey revealed the five most underrepresented genres at the time, reflecting the demand-side elements in the upper echelon of our previous chart (see above).

by Michał Dębek / Try Evidence CC BY-ND

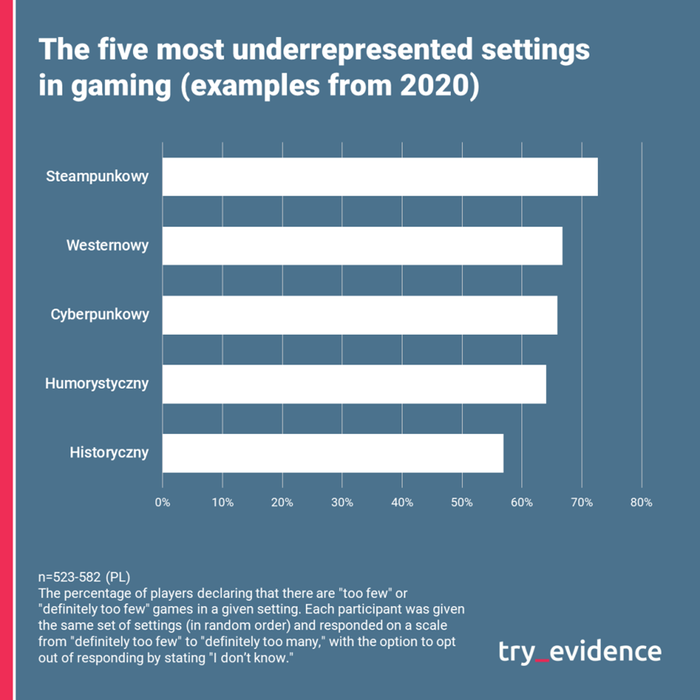

by Michał Dębek / Try Evidence CC BY-ND

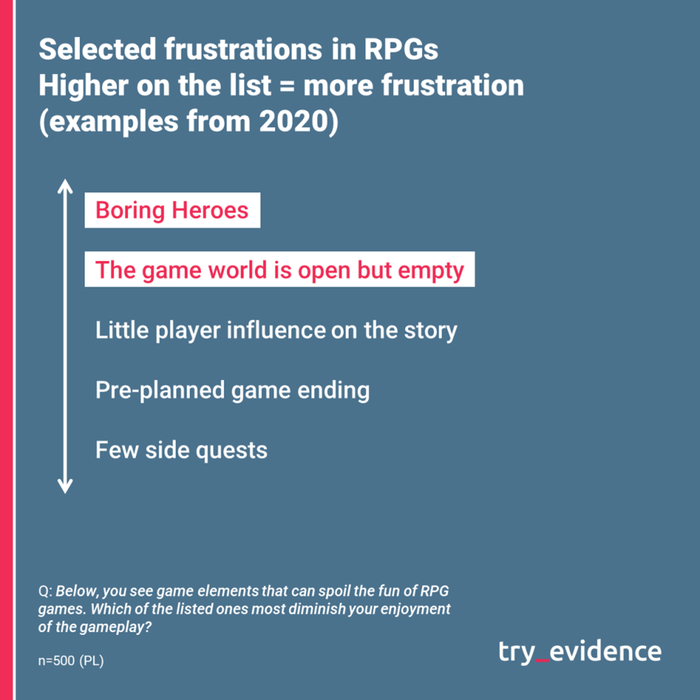

Preceding the large-scale global surveys, in-depth interviews with gamers allowed us to sketch out a vast landscape of expectations and frustrations, gaining insights into their gaming psyche. These discussions informed the categories for a subsequent quantitative study, enabling us to gauge the true magnitude of these phenomena.

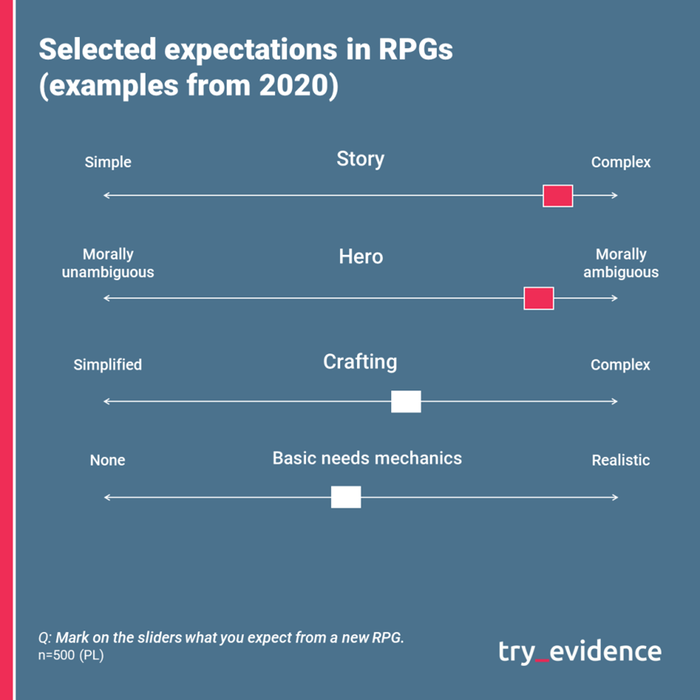

by Michał Dębek / Try Evidence CC BY-ND

by Michał Dębek / Try Evidence CC BY-ND

Developers and publishers aiming to dominate a genre or to capture a player segment must use this foundational knowledge.

Qualitative research further enriches such data, leading to genuine insights—deep understandings of player needs, behaviors, and emotions.

Insights from gamers represent a comprehensive amalgamation of data regarding their tastes, challenges, and aspirations. Such valuable perspectives are exclusively derived from the players themselves and cannot be fabricated by developers or marketers (which is not as obvious as it may seem).

It's crucial to note that, alongside player research, many publishers now also benefit from journalist research. 'Mock reviews,' journalist & designer critiques during various production stages, once scarce, now frequently guide publishers, particularly in navigating the complex and evolving market. Budgets for such analyses are increasingly allocated from the onset of production, even in smaller studios, recognizing the unparalleled value of an unbiased external perspective and the ability to see what can go wrong before it does. These insights facilitate classic SWOT analysis or media reception planning and, if conducted early enough, can inform pivotal project adjustments, saving substantial resources.

It's all about the risk mitigation.

In pursuing unique differentiators and insights, it's crucial not to overlook the Points of Parity (POPs)—those attributes universally recognized by players within a particular genre or niche. Their significance is well-known, and their importance is widely acknowledged. Yet, mastery over them is not standard. As I've previously highlighted, refining these traits to perfection is essential—the saturated market swiftly weeds out any product that falls short. Consider this: a game that flawlessly executes on genre-specific POPs might garner a score of "merely" 75/100 from rating aggregators in today's landscape. To surpass this threshold—and in today's competitive environment, it's imperative to succeed—a game must exhibit substantial Points of Difference (POD) besides being perfect at POPs.

by Michał Dębek / Try Evidence CC BY-ND

Despite the industry's advancements, numerous manufacturers and publishers often showcase, at best, a meticulously designed Point of Parity (POP). More frequently, however, they introduce an array of Points of Indifference—features that, while potentially inconsequential from the players' or industry media's viewpoint, hold paramount importance for game developers.

Adapted from Prof. R. Kozielski from the University of Lodz, Poland, Faculty of Management, Department of Strategy and Enterprise Value Management / questus - CIM Accredited Study & Exam Center by Michał Dębek / Try Evidence CC BY-ND

This tendency frequently leads to the excessive allocation of financial and temporal resources in crafting parts of the game that may ultimately be superfluous.

*

In the volatile, uncertain, complex, and ambiguous gaming industry and markets, the triumph of smaller developers and publishers will increasingly hinge on their agility to navigate and adapt to swift market changes. This agility includes rewards for innovation, fiscal understanding, and the ability to effectively engage with players and the media. Success will favor those who ground their development and publishing strategies in robust analytics and a profound, qualitative grasp of the gamer psyche. Paramount to this success is the early recognition that the principles of free-market economics, marketing savvy, and consumer psychology apply to the gaming industry and any other sector.

Game developers and publishers are not Olympic gods; they cannot manipulate the fabric of reality or economic principles or magically enchant gamers. Ultimately, they are catering to ordinary consumers seeking the highest utilitarian value.

Those who excel in their roles as marketers and producers will prevail. Conversely, those who linger in fantasy and excessive bravado will meet their downfall, much like Icarus in his ascent toward the sun.

You May Also Like