Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs or learn how to Submit Your Own Blog Post

Armored Drive Post Mortem: The Hard Road of In-App Purchases

4gency's founder looks back at a first year of lessons as a mobile/tablet developer. Lesson one shows how hard it can be to make money in the arcade genre with in-app purchases.

This is Part One of a series of posts about 4gency’s first year in operation, including data on monetization, app marketing campaigns, and user acquisition. If you’re interested in learning more, contact [email protected].

This article was originally posted at 4gency.com.

It’s been a heck of a first year in operation. With two games, four platforms, three monetization models, over 60,000 users and almost a quarter-million gaming sessions logged, we’re glad to still be in one piece. Seriously, it’s tough out there. We’ve got two games to talk about – let’s start with the second one first; with only one platform and form factor (iPhone), it’s a simpler study.

Buckle up, and we’ll dig into the whole story.

Introducing Armored Drive

Originally developed for Windows Phone by Elbert Perez, a developer with 2M+ game downloads on Windows Phone

Ported to iPhone by Nick Gravelyn and Elbert Perez, published by 4gency

Built with an in-app purchase (IAP) model, in-app advertising included later

Launched worldwide on iPhone around Thanksgiving 2012

Armored Drive is a spy-car themed endless racer. Players use tilt controls on their phone to move their car left and right on the road, and touch controls to deploy weapons and gadgets to knock out other cars and get rewards. Distance and combat prowess reward the player with coins, an in-game currency, used to purchase more ammunition, gadgets, car upgrades and more. Elbert Perez, who developed the original Windows Phone game using a free-with-ads model, gave 4gency the opportunity to take the game to iPhone, going to not only a new platform, but a new revenue model as we implemented in-app purchases (IAP) in hopes of more deeply monetizing the game.

Design Considerations

We felt Armored Drive was a good candidate for IAP. An endless racer with similar traits to Jetpack Joyride, Armored Drive had upgrades to weapons, gadgets, and car appearance that would attract a variety of players. A system of ranks and challenges brought players back in and encouraged repeat plays and investment in buying more ammo and upgrades. We felt that we could implement IAP in a reasonable, non-annoying way by using real currency only as a way to more quickly attain in-game currency. By playing the game, a player could get kills, distance, and rank up for good coin rewards without having to ever buy the consumable IAP coin packs or durable IAP “coin doubler” we offered in the real-money marketplace.

There was no “end” to the game, per se – iOS leaderboards were set up to sort on maximum distance in a single run, so an expression of superiority was not simply an aggregate number of times played, but rather how effectively a player could use their tools and skills in a single effort. Designs for “in-session” drops of additional gear were considered, as a way of extending run length per session, but had to be shelved for lack of time.

Pricing Considerations

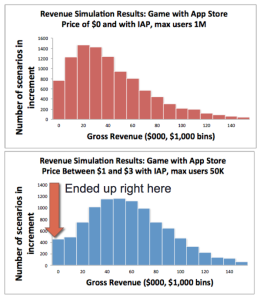

Initial designs had Armored Drive being free from Day 1. However, a Monte Carlo-style simulation run between an IAP-only and a paid-with-IAP pricing model showed paid as the probabilistic winner in a higher percentage of scenarios. I used a modified Hubbard Research model, as described in the book “How to Measure Anything” and available in Excel form on the Hubbard Research site.

And – though we didn’t know it at the time – going paid first meant we could deploy a free promotion later to take advantage of the anchoring effect, an event that we later found drove over 15,000 users to our game virally, thanks to the network of twitterbots scouring the App Store. In the end, the prediction made by the Monte Carlo simulation turned out to be right, if overoptimistic about the number of users that would find and convert on our game.

To this day, the amount of money made on $0.99 paid copies of the game outweighs the amount of money made on IAP.

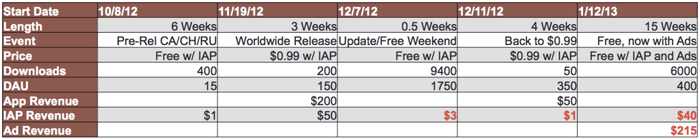

How We Did

We staged our release through a free, quiet pre-release period in Canada, Russia, and China to try out the IAP and determine depth of spend. In the test environment, we ended up with 400 downloads and $1 in revenue, so roughly one-quarter of a cent DARPU. It was discouraging at best. Regardless of how many downloads we got, the percentage of conversions was so low we’d be assured almost no return. It was at that point that we ratified going with the paid model. It wouldn’t be for several months until we saw the Big Data trend that showed us why we had very little chance of monetizing our game.

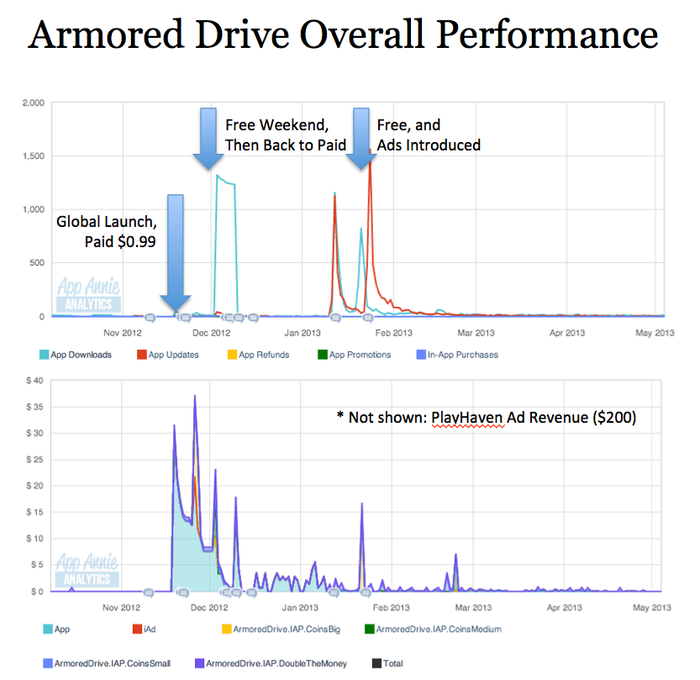

In the end, Armored Drive went through four versions, bounced between free and paid four times, and acquired about 20,000 total users. As this was a bootstrapped effort, we had no major marketing partners and worked through our own media channels to try to drive exposure and engagement in the game.

Total revenues equaled about $560 over 20,000 total users, or roughly three cents DARPU.

What Worked, What Didn’t

Armored Drive was heavily instrumented to send back metrics ; we got a good idea of how we were stacking up in a variety of ways:

Good engagement – 180 seconds per session, 2.8 sessions a month, above Action games average

Bad acquisition - less than 10% used viral “recruit” feature, less than 1% crossover with 4gency’s other game

Bad monetization - DARPU $0.03, IAP < 20% of all revenue earned on the game including ads and paid downloads

The following campaigns chart outlines how each move made to the monetization and acquisition strategy landed with our user base. Important questions are marked in red – these are the numbers that surprised or frightened us.

What we learned:

Paid and free users are different creatures: while many paid users monetized, almost no free users paid for any IAP in the initial free weekend in December 2012. At our DARPU, to even get the same amount of IAP revenue from free users that we got from paid/ads, we’d need to get 70x more, or close to 700,000 users.

Finding whales is hard: Tied to the item above, assuming average IAP spend is $14 as Flurry suggests, that’s less than 7 IAP buyers (and probably 3 of them are “whales” > $10 spend). This suggests we missed the deepest, most spend-eager market. Our ability to pivot our metrics on just the big spenders got hobbled by a wave of false events thanks to IAP hackers (see below).

Getting free users can happen almost automatically: users in the low-thousands will respond to a price-drop to free without any additional marketing – Twitter bots will pick up the change and drive traffic virally.

Ads can work well, but they need to be heavily targeted: in January, we went to ad support – targeted ads (via PlayHaven) drove 13x the revenue of non-targeted ads, and made close to the amount we made with paid downloads in just a few months.

You’ll get hacked: Just 24 hours after releasing, our metrics sent back hundreds of false “purchase completed” events for our most expensive items. 5,000 of these events were reported over several months, while only 60 legit purchases were ever made. About 50% of this traffic came from China, where 50% of our game’s total userbase was located.

Aquisition means nothing without monetization: we investigated several acquisition mechanisms, such as FreeAppADay and Flurry and PlayHaven acquisition departments – in general, user acquisition for mobile is between $2.00 and $2.50 per person – absolutely out of the question unless DARPU can rise above those levels. At our $0.03 DARPU this would be an almost suicidal waste of money.

So, What Happened?

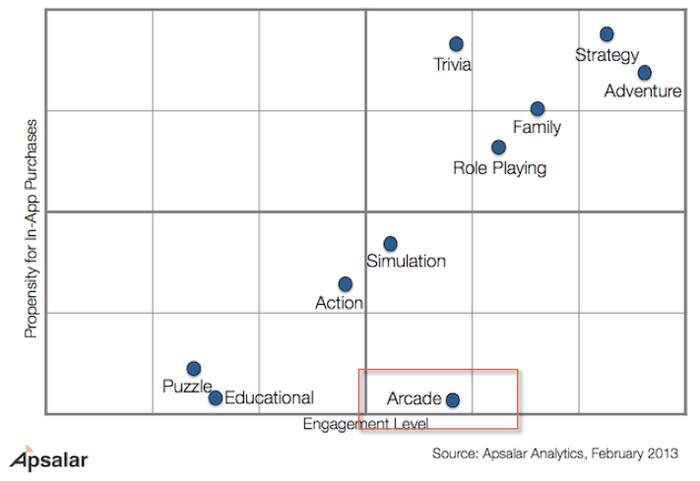

Our minds were full with the most critical question: why was monetization so low? It was only a few months ago that a potential answer came up, from Apsalar: while games of the “Arcade” genre have high engagement (as we did), they have disastrously low monetization. Many will come, few will pay:

Image Source

In the end, Armored Drive on iOS had a number of issues that kept it from overarching success, and stand as lessons we’ll use to better target and execute our next titles:

Understand the micro-market: we chased the “iOS gamer”, when we really needed to be chasing the “iOS action-arcade gamer”. This more specific market has different spending limits, hooks, and likes/dislikes from the aggregate market, and we should ensure we target it directly.

Be vocal, early: Acquisition was not something we paid for. If we wanted to get big and dig into the paying markets, we needed exposure, and that means being known. In the end, our groundswell contacts gave us very little – only two articles were ever published about Armored Drive. We needed to court media earlier, more aggressively, and with dedicated partners to help us.

Believe the test market: In the end, the test marketing effort found the problem with IAP, and we moved forward with the launch. We may not have been able to predict the genre-wide issue with IAP that all action-arcade titles had, but we might have taken the data to heart and constructed a Plan B for our game.

Conclusion

Over 125,000 sessions of Armored Drive have been played worldwide; roughly 6,000 hours of gameplay. We are proud to have brought the game onto a new platform, to a new group of players. While the game’s success suffered the familiar problems of discoverability and the less-known issue of genre-specific monetization, it is gratifying to know the game is out there for players to enjoy.

-Charles Cox

Founder/CEO, 4gency

If you’re interested in learning more about our experiences with Armored Drive, contact [email protected]. You can also download the iOS version or the original Windows Phone version of the game.

Read more about:

Featured BlogsAbout the Author

You May Also Like