A summary of proposed tax breaks for the gaming industry

Back in September 2013, UK ISP Plusnet wrote about the proposed tax breaks for the gaming industry that are currently being discussed in parliament (or being held up by red tape, depending on your preferred wording).

Back in September 2013, UK ISP Plusnet wrote about the proposed tax breaks for the gaming industry that are currently being discussed in parliament (or being held up by red tape, depending on your preferred wording).

Plusnet's post was my first encounter with the proposed tax breaks, and they sparked my interest in the inner workings of the gaming industry. Beforehand my only experience with the industry beyond playing games was nursing the same dream every teenager has of being a game designer, and having the school career advisor summarily crush this dream. Here I attempt to provide a summary of the tax breaks and their current status, partly to build on what Mike Rose has written previously, and partly to introduce the concept to people who may not have come across it yet

The proposed tax breaks for the gaming industry would see tax breaks of 25% for companies who spend at least 80% of their game’s development budget in the UK. This spend includes all aspects of the process from designing and development through to testing, so it’s quite a commitment. The allocation in the budget to similar tax relief schemes is quite large – Develop Online said in a recent article that “some £15 million will be spent on UK tax breaks in the financial year 2013-14, with another £35 million budgeted for the following year.”

Tax relief for creative industries exists already, as mentioned above. The HMRC website says that “Film Tax Relief was introduced in April 2007 and two additional reliefs were introduced in April 2013. These are Animation Tax Relief, High-end Television Tax Relief”, and that “a fourth relief for Video Games Development will be introduced after state aid approval.” The legislation is currently pending review to ensure it complies with state aid guidelines, which exist to ensure that no company is given unfair advantage over another through allocation of taxpayer funded resources (examples are tax credits and lottery funding). A full description of state aid is also available at the HMRC website, here, if you’re curious.

The Telegraph wrote about this recently in an article about the possible closure of The Blast Furnace, which is a mobile focused studio associated with Activision. The article demonstrates the importance of these measures for games companies, who often operate within extremely tight budgets. The article laments the fact that “[the] tax incentives are currently wrapped up in red tape at the European commission”, alluding to the state aid compliance review that was detailed previously.

The Blast Furnace – at risk of closure

Games are likely to be subject to a ‘cultural test’ to ensure they are relevant to Britain and the European Economic Area (EEA). This test, outlined in a recent Huffington Post article, includes such criteria as how much is set in the UK or EEA state (4 points for 75% down to 1 point for 25%), whether the a UK or EEA state based story is portrayed (up to 4 points), and so on. The test has drawn criticism on twitter and led to the rather amusing #UKTaxExemptGames hashtag. Some highlights:

Call of Due Tea (@Jogosity)

Grimsby Fandango (@Danthat)

Coronation Street Fighter (@CelsiusGS)

Need for Speed Cameras (@KeefJudge)

The Woking Dead (@BritishGaming)

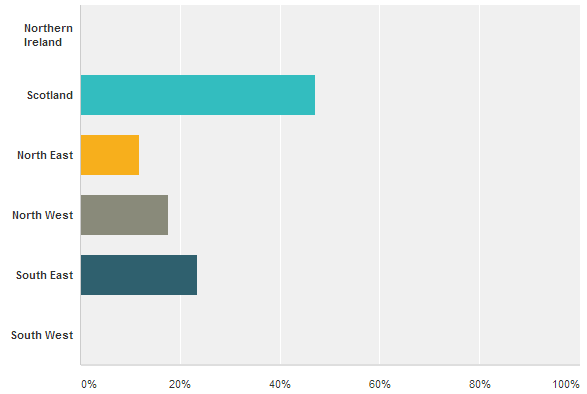

In Plusnet’s post that was mentioned at the start, they asked staff at 17 game design companies here in the UK for their thoughts on a range of questions. The majority of the respondents were based in Scotland:

When asked whether they think the proposed Games Tax Relief will encourage more gaming start-ups in the UK, the responses were unexpectedly varied, hinting at some confusion within the field. Some of the responses were positive (“The relief will make it easier to attract finance (investment or otherwise) into the UK to make games”), some negative (“a small change in the profitability of individual titles won't be enough to change the fundamentals of starting a new studio - that they have to succeed in making hit games very quickly or die”), and others were concerned about the way the scheme would be implemented:

“It is aimed at large and very large developers and projects - with budgets of six, seven and even eight figures. Smaller and medium sized developers and all start-ups (other than UK branches over non-UK multi-nationals) will not qualify for Games Tax Relief. For small and medium sized developers and all start-ups, the proposed Games Tax Relief will cause them to be DIS-ADVANTAGED compared to their larger UK and overseas competitors”

This range of views was summarised nicely by the question “how much difference would the tax break make to your company on a scale of 1-10?” – the two most popular responses were 1/10 (17.65%) and 10/10 (29.41%).

This discrepancy in views suggests that more clarification is needed on who exactly will benefit from the proposed tax breaks. There is concern among smaller companies that they will be left in the dust if only larger companies are able to reap the benefits, which is fully understandable. Hopefully the delay surrounding these tax breaks will be resolved soon so that discussion can continue and we can begin to see and understand the benefits. C'mon David!

Read more about:

BlogsAbout the Author

You May Also Like