Why Chinese mobile game companies are rushing to overseas markets?

A brief post on the sticks and carrots that drive Chinese game developers to shift their focus towards overseas markets.

Globalization is prevalent across all industries, and the mobile games market is no exception. Recently, one of the hottest new mobile game in China, Onmyouji (阴阳师), has officially launched globally by opening up its international APP download service. After making waves in the Chinese market, NetEase is beginning to expand this game in overseas markets, hoping to ride the wave that "Onmyouji" has created in China.

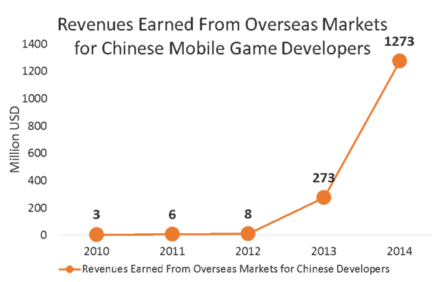

Apart from "Onmyouji", an increasing number of mobile game developers have been trying to publish their top performing games overseas since 2013, gaining experience in these unexplored markets and hoping to increase their influence abroad.

Recently, Lilith CEO Wang Xinwen to announced that 2/3 of its target portfolio will be focused on game publishing with the main focus on global distribution. One of its highest grossing games, "Heroes Tactics" had not been made available in the domestic market yet, but it was already earning upwards of 10 Mn RMB monthly in overseas markets.

Companies ranging from big to small are increasingly shifting their eyes on the global market, but what are the forces that are driving so many companies to expand overseas?

Part 1: The Stick

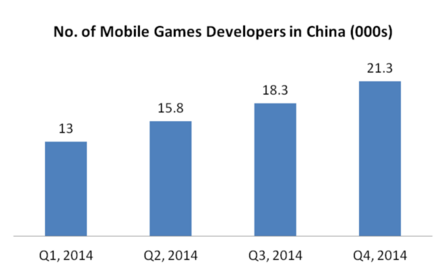

1.Competition is intense and resources dominated by large companies. In a crowded mobile game market, users have a huge number of games to choose from. As a result huge companies compete fiercely to acquire long-term users, spending significant amount of money into promotion, attempting to reach its potential users across several channels. Some companies even invest another huge sum of money into acquiring higher ranking in the app store charts, all of which equals a huge amount of sunk costs before the game can generate any significant return. In comparison to large companies, the small and medium companies have even higher acquisition costs as they do not have the brand names and existing player base like big companies do, and even if they have the capital to invest in acquiring a huge number of players, there is no guarantee on the user quality.

2. High market concentration. In terms of mobile games revenue by company in China, Tencent and NetEase combined accounted for nearly 70% of the domestic mobile game market revenue, while none of the other remaining firms have more than 5% market share.

In the first half of 2016, 102 National Equities Exchange and Quotations (NEEQ) listed game company net profit came to a combined 1.126 Bn RMB, which was less than one-tenth of Tencent's net profit over the same period. In addition, in the above mentioned 102 companies, 38% of these had a loss. (Note: NEEQ is basically a stock exchange with lower requirements that allow medium sized companies to acquire financing from the public market)

3.High Channel Distribution Costs. In the pursuit of rapid cash flow generation, the games given the highest exposure are usually the ones that have the potential to generate the fastest return, those without IP or new products that do not employ a proven successful game model are likely to be cut off before it can even make onto the shortlist. Thus potentially fun innovative products have limited opportunity to enter the market and gain broad exposure via a large platform, much less achieve significant success.

4.Domestic content provider revenue split is low. Realistically, there is no other factor that domestic content providers are more dissatisfied with than the limited return they get by cooperating with large distribution platforms. Compared with foreign countries, domestic game developers not only get a low revenue split, but also have to bear costs such as issuance fees, taxes, payment channel fees, event sharing fees etc. which further restricts their profit margins.

Part 2: The Carrots

In terms of the pull factors, there are a few that entice Chinese game developers to look overseas:

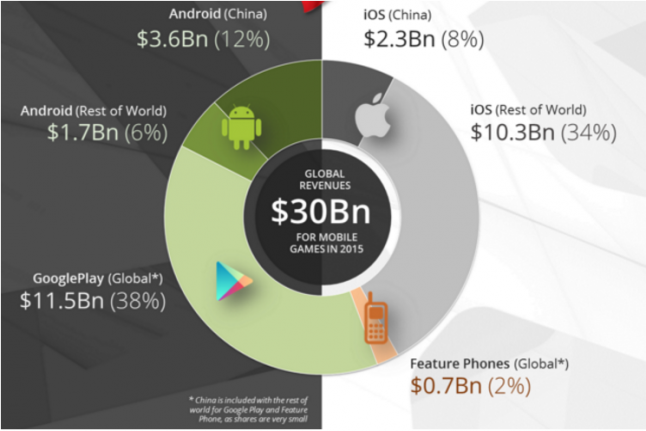

1. Google Play and iOS store are the two key distribution platforms in many overseas markets and have a standardized submission process, the game does not need to be submitted to various segmented app stores and undergo intense examination and auditing procedures that can drag out the process.

2. There are varying types of gamers in every market, if a game achieved significant results in China, a little cost in localization can expand the game into several other markets with brand new potential. Even if the game did not achieve significant success in China, it does not mean that it is guaranteed to not succeed elsewhere.

3. Increase brand in China. Though a bit of a stretch, if a game is able to perform well and accumulate a sizable number of users in overseas markets, this could even help with the game's growth in the China market, as Chinese Gamers have often looked to the West for the next hot and innovative game. Some Chinese game developers have even launched overseas first before opting to launch in China.

4. More ethical competition. Fake ranking, false recharge, etc. are common occurrences in China and extremely hard to control. Although this also exists in foreign markets, but it is considerably less frequent compared to the Chinese market.

5. More than one market. Although China is one of the biggest mobile game market in the world at $6.5 Bn (roughly 22% of the global mobile games revenue) in 2015, it is still just one market, there is still 78% of potential revenue to be earned.

Part 3: Final Thoughts

Although the overseas game market is not a utopia filled with endless milk and honey, but from the domestic developers perspective, compared to the domestic market where there are thousands of games battling it out in the complex market across several app stores, it definitely sounds like an attractive market worth looking into.

For any game developer looking to enter a foreign market, whether into China or to other regions, attention to the local gaming culture and its respective regulation is of utmost importance for long-term success. We have seen in recent years the rise of some Chinese-made games, such as "Clash of Kings (COK)", "Bouncing Church" and other games achieve relative success in overseas markets, though its been noted that the R&D team for COK actually has a sizable number of staff that are more culturally affiliated with the overseas markets and an in-depth knowledge of their target market.

All-in-all, shifting the focus overseas will not guarantee these developers success, but it does give them more options in their long-term development. In the end, regardless of the domestic or overseas markets, excellent game quality will continue to be the key to long-term success in any market!

A good additional note from one of the commentors:

The thing that the Chinese developers need also to consider is to succeed abroad, localizing a successful Chinese game is not enough or an error. Foreign gamers and Chinese gamers have sensible different taste . The next step for Chinese developers and I think the foreign companies already realized that is to create and think games global from the beginning . Only making games for one country and then localize it to release it to another one is already a strategy from the past. Japanese developers understood that and that's how Square-Enix became great again for example .

Data and charts from ‘the stories in online games social circle’ article, GMGC, Newzoo, Talking Data and various other google search

_________________________________________________

If the China mobile gaming market may be something of interest to you, whether you are a developer, in operations, marketing etc. join the LinkedIn Group "Mobile Gaming - China" for more relevant posts in the future

Read more about:

BlogsAbout the Author(s)

You May Also Like

.jpeg?width=700&auto=webp&quality=80&disable=upscale)