Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs or learn how to Submit Your Own Blog Post

The Top 14 Predictions for China's Games Industry in 2016

2016 is shaping up to be a pivotal year for the games market in China, with revenue from PC online, mobile and console games rising to more than $26 billion. Here are Niko Partners' top 14 predictions for digital games in China for 2016.

2016 is shaping up to be a pivotal year for the games market in China, with revenue from PC online, mobile and console games rising to more than $26 billion. Here are Niko Partners' top 14 predictions for digital games in China for 2016:

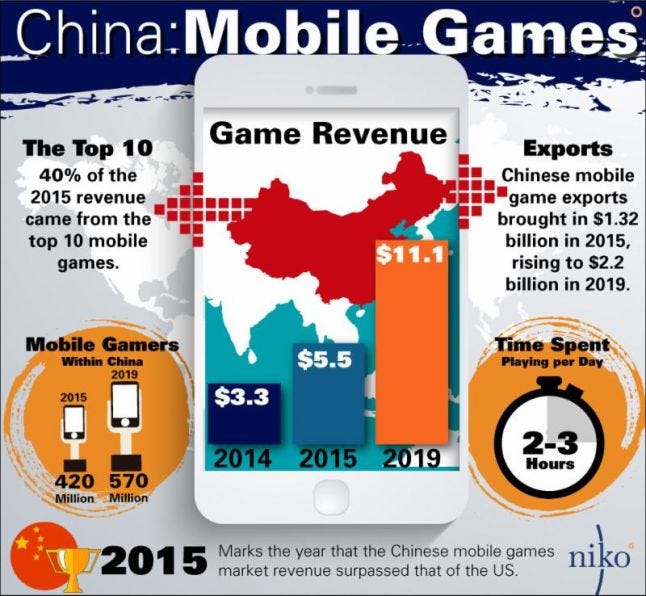

Revenue from Mobile games will continue to rise but so will the cost to acquire new gamers due to their increasingly sophisticated demand in a very crowded market. Chinese mobile game revenue of $5.5 billion generated domestically in 2015 (excludes export revenue of $1.3 billion) surpassed the US market and we forecast domestic Chinese mobile games revenue of $11.1 billion by 2019. Have we hit the peak in the growth rate of mobile games? We think so. Note: Chinese government data on mobile games revenue includes domestic revenue plus revenue from exports of Chinese mobile games, whereas Niko's reflects only revenue generated in China.

eSports- eSports- eSports. According to the Chinese Game Publishers Committee, eSports includes Massive Online Battle Arena games, Action, Shooting, Casual, Poker and Trading Card Games. We define eSports as professional or amateur tournaments and organized competitions involving specific game genres, but you may find the category widening as game developers try to latch onto the trendy moniker of "eSports". Hundreds of millions of Chinese gamers play and watch eSports already, with the popularity rising each year. Highly regarded eSports commentators earn around 10 million RMB ($1.5 million) per year as announcers during eSports tournaments.

Google Play will enter China, boosting Android game downloads, and advertising campaigns for mobile games will incorporate more foreign celebrities.

Virtual Reality games will hit the market and Chinese companies will continue to build products geared at competing against VR leaders such as Oculus and Sony. The ChinaJoy committee is already planning a special VR section at this year's annual trade show.

Investment in Internet cafés rose in 2015, including in Tiers 1, 2, 3, and 4. We expect that investment will continue, fueled by demand from games that are Multiplayer Online Battle Arena titles and other competitive games, as well as the viewing and participation in eSports.

Tencent will continue to dominate the Chinese games industry, but it will feel market pressure for the first time in a long while, from NetEase and other companies who are focused on a given market segment.

Chinese game (and game-related) companies will invest more capital in growth and market share. There are currently 171 publicly traded Chinese game companies, 136 of them are traded on local Chinese exchanges, 17 in Hong Kong, and 18 in the US. Most of the 136 traded in China are traded on the National Equities Exchange and Quotations, an over-the-counter market in China known as the third board.

The "third board" domestic stock market already has more listings than China's other two major exchanges and will continue to increase in listings since the other two exchanges have a temporary ban on IPOs. However, volume on the third board is thin and volatility is high, so we expect more regulations to be forthcoming.

Consolidation of small and mid-sized game companies in all segments, and especially among mobile game developers, because the market is crowded and consolidation is inevitable. SAPPRFT approved 750 games in 2015, including 320 mobile games, demonstrating how crowded it is and making discovery of new games a tedious concern for Chinese gamers.

The exchange rate of the Chinese Yuan Renminbi to the US Dollar is shifting to make the dollar more valuable. When we started in 2002 the exchange rate was 8.2:1, it fell to 5.8:1 a couple of years ago, and then rose to 6.7:1 at the end of 2015. The rate could increase to 7.0:1 this year, making it more expensive for Chinese game publishers to license foreign titles and IP, and for Chinese gamers to play foreign games.

Intellectual Property rights get more expensive and IP-related games become more important, yet as a result of the increase in cost, developers will be inspired to build non-IP games and we will see some strong titles hit the market. There may be an uptick in international IP entering China, for movies, TV and games.

Cross-platform play from PC to mobile will become more important. Even more interestingly, we anticipate a trans-media entertainment approach, where games turn into books and movies and TV shows, and movies and TV shows turn into books and games, and books turn into movies and TV shows and games...you get the idea.

The growth rate of PC online game revenue will continue to decline.

.........and finally........... Sales of consoles and console games will be flat, while domestic TV-based gaming boxes will see modest growth.

Read more about:

Featured BlogsAbout the Author(s)

You May Also Like

.jpeg?width=700&auto=webp&quality=80&disable=upscale)