Mobile App Industry Benchmarks for Week Ending Aug 21

Ever wonder how your mobile game KPIs perform vs industry benchmarks? Each week we release “Mobile App Industry Benchmarks” to uncover your performance vs competitors and see KPIs like CTR, CPM, CPC, CPI, IPM, Conv%, country breakdowns, and more.

Ever wonder how your mobile game KPIs perform vs industry benchmarks? Each week we release “Mobile App Industry Benchmarks” to uncover your performance vs competitors and see KPIs like CTR, CPM, CPC, CPI, IPM, Conv%, country breakdowns, and more.

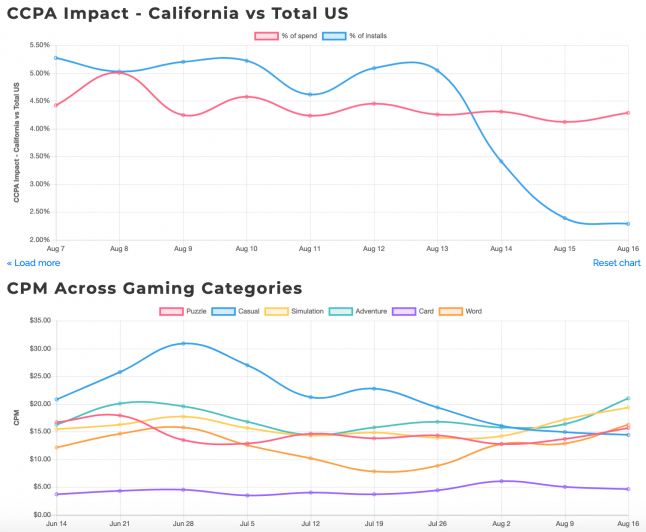

CCPA Compliance Impact

Share of CA installs from total US dropped over 50% after weeks of stability from around the 5.25% mark to just 2.5% over the past 3 days – possibly due to severe weather conditions and rolling blackouts throughout the state. However, the share of CA spend from total US has increased slightly around the same time frame, from around 4.25% to over 5.5% yesterday.

CPM

Halfway through August, CPM rates are back on the rise across most categories

CPM By Genre

Casual Games: $14.46 – down 3.1% from last week $14.92

Continued downward trend that started about 8 weeks ago, but the drop is continuing dissipate week-on-week, following several weeks of double-digit percentage drops. This may still be an indication of a longer term shift in auction market prices’ amplitude from $25 to around $20.

Simulation Games: $19.34 – up 12.3% from last week $17.22

In a break from the relative price stability of the past 8 weeks, this is a marked upwards trend toward highs not seen since Q1.

Adventure Games: $21.02 – up 28.7% from last week $16.33

In a break from the relative price stability of the past 8 weeks, this is a marked upwards trend toward highs not seen since Q1.

Word Games: $16.24 – up 25.8% from last week $12.91

In a break from the relative price stability of the past 10 weeks, this is a marked upwards trend toward highs not seen since Q1.

Puzzle Games: $15.64 – up 14.6% from last week $13.65

In a break from the relative price stability of the past 8 weeks, this is a marked upwards trend toward highs not seen since Q1.

Card Games: $4.68 – down 7.3% from last week $5.05

A continued shift in trend after a 10-week high spike just 2 weeks ago, dropping back below the $5 mark, where rates for the category have been stable throughout most of Q2-Q3.

CTR

Following on last week’s peak 6-week high of 0.85%, CTRs appear to continue to trend around a lower rate average of under 0.85%, with a marked drop this past week all the way below 0.8% – the lowest point in Q3 to date

CPI

CPI continues to climb at an exponential rate, shooting up over 151% in August, after several volatile weeks – a roaring return to pre-COVID rates not seen since Q1

Generally speaking, CPI was trending upwards in 6-8 week stretches ever since rates plummeted when quarantine measures had first been enforced throughout most of the developed world in mid-March

Pre-COVID: over $15

6 weeks between Mid-March and late-April: $8

8 weeks between early-May and early-July: $10

July: around $10.50, potentially indicating another uptick in CPI

August: Now over $25, a massive increase in rates – even beyond our most aggressive forecast for Q3

It appears that this is indeed a return in full force to pre-COVID rates, indicating a massive shift from the relatively stable rates of the past 5 months.

Read more about:

BlogsAbout the Author(s)

You May Also Like

.jpeg?width=700&auto=webp&quality=80&disable=upscale)