Don't Roll The Dice On Your Social Casino Player

The Social Casino Games market is dominated by several large companies, but it does not prevent other developers from being successful. Understanding what drives the players to spend money is your key to success!

Social Casino is the fastest growing game genre globally. It is expected to be worth over $3 billion by the end of 2015.

But what drives the players to spend money in Social Casino Games (keeping them the top-grossing category of App Stores) when there is no chance of winning real money?

Understanding the players, their behavior and preferences is the key to success.

So let’s have a closer look at who is the player behind the screen.

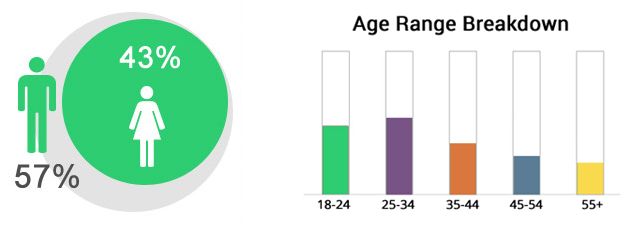

Demographics:

13% of global social gamers are Social Casino Gamers.

The Social Casino play demographic is broad and getting broader.

Player demographics differ according to game type, geography, and platform.

Facebook has 55.9M active monthly Casino Gamers. The gender share skews more to male and the average age is 34. 23% of Facebook Casino Gamers are aged 45 and above.

Social slots gamers in the US are predominantly females over the age of 40; while in Italy the audience is younger males.

Device Preferences:

63% of Social Casino Players prefer cross-platform experiences playing both on mobile and desktop. However, lifetime revenue from the mobile platform is 22% higher.

It is important to know that device preference differs in global markets. For example, mobile casinos in Japan earn 34 times more than desktop casinos; however, in Australia, gamers are still stuck on desktop and higher revenues are derived from that platform.

Session Length and Frequency of Play:

Big spenders ($20+) play 25+ hours per week.

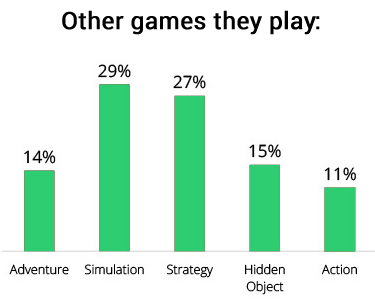

Activity Share with Other Games:

Leveraging the knowledge of what other games are played by Social Casino Gamers can help you plan your discovery strategy with more exposure and bigger ROI.

Reasons to Play and Pay:

83% of Social Casino Players visit land-based casinos at least once a year. But unlike the traditional gambling experience which blends the two strongest psychological drivers - the desire to win money and the fear of losing it; the social casino experience is pure entertainment, free of anxiety factors.

Having said that, it is important to stress though that Social Casino Gamers are still deeply incentivized and highly motivated to win and accumulate virtual currency in order to progress through the game. Consequently, Social Casino Gamers are gamers first and gamblers second.

Social factors are another powerful driver to success. Leveraging the social graph to motivate gameplay through relationships (ways to connect and compete with friends) is essential for Social Casino Games.

The biggest spenders play Social Casino Games to:

Play with other players (connect with friends, make new friends)

Compete against other players (get to the top of the leaderboard)

Experience emotions they don’t feel in the non-game world

Show off (prove they are the most skilled)

Winner Takes It All:

52% of market share, according to App Annie, is in the hands of the top companies:

Caesars Interactive

IGT

Zynga

Churchill Downs

An ultra-competitive environment and the growing appetite of players for innovations force companies to develop fresh ideas. Some companies go for multi-game suite strategies and offer meta game achievements and rewards to keep players coming back as well as lower the chances of them switching to another company’s casino game. Other companies experiment with blending different genres, e.g. Netherfire combined slots and farming.

Summary

Just like living organisms have a reasonably standard pattern of growth and development, so too do competitive markets. The Social Casino Games market is evolving and becoming more mature. Although it is dominated by several large companies, it does not prevent other developers from being successful.

It requires creative freedom and innovation to offer players a fresh experience and keep them happy. Focusing on the above, it is critical to partner with experts who understand the landscape of the industry and have in-depth knowledge of user profiles if you are to have any chance of being discovered.

At DAU-UP, we offer a dedicated team of Gamer Acquisition Strategists with profound knowledge and data-driven experience in successfully growing the world’s leading Social Casino Games from such companies as Caesars Interactive, Williams Interactive, Pacific Interactive, and many more. Learn more about our success stories or contact an expert directly to start earning more from your Social Casino Game.

Read more about:

BlogsAbout the Author(s)

You May Also Like

.jpeg?width=700&auto=webp&quality=80&disable=upscale)