Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Indie developer Lars Doucet takes us back for another look at how his game has performed now that it's received a massive update and, in the process, landed on stores like Steam and GOG, detailing both his gross revenue and what, on the developer's end, goes into generating those numbers.

February 20, 2013

Author: by Lars Doucet

This article is being highlighted as one of Gamasutra's top stories of 2013.

Last January, we launched the initial version of our Tower Defense / RPG Hybrid Defender's Quest: Valley of the Forgotten. We sold the game directly from our own website, using a browser-based demo distributed via flash portals to drive traffic and sales.

It was a solid niche hit, receiving both critical acclaim and financial success (by our standards).

Three months later, we detailed the initial sales results in a featured Gamasutra article, Defender's Quest: By the Numbers. At the time, we had sold 13,846 copies and made $70,716 gross in revenue.

Since then, we've massively improved the game, with new graphics, bugfixes, balance tweaks, and an enormous update to both story and gameplay content with "New-Game+" mode.

As hoped, our big update and promising sales numbers were able to attract the attention of Steam, GOG, Impulse, Desura, and GamersGate. We launched on all five services on October 30th. Afterwards, we took part in every sales promotion we could, going with whatever discount rate the platform holder suggested.

It's now been three months, and it's time to report on the results!

Lifetime revenue stats for Defender's Quest: Valley of the Forgotten, across all sales platforms, are:

NOTE: These numbers do not include figures from GamersGate, who requested we not disclose sales or revenue data from them.

That's a lot of money up there -- over a quarter of a million dollars in gross revenue -- but let's take a step back. First of all, we don't get to keep all of that,. Each store takes a cut. I can't give net figures this time around, since NDAs forbid me from revealing several platforms' percentage take, but I can say this: our direct sales payment provider FastSpring takes 8 percent, while Kongregate takes 30 percent of all Kreds revenue. Steam, GOG, and the others take undisclosed percentages. (The silver lining is that sales tax, VAT, chargebacks, etc., are all covered by the stores' cuts).

Next, we get to account for expenses! I don't want to get too specific, so I'll just say total expenses were somewhere between $30-40K. And after that's subtracted, the pie gets shared out between the core team members, who have been working on this for about two years.

It works out to a decent living for doing something we love -- a tremendous privilege in and of itself -- but this isn't anywhere close to Minecraft, Limbo, or Super Meat Boy levels of money.

With that out of the way, let's look at where the money came from.

Everyone knows you can make a lot of money on Steam. But how, much, exactly? And what about other platforms? Let's break it down:

Steam, unsurprisingly, is the lion's share of the market. However, over 40 percent of our revenue came from other sources -- and direct sales are still our number 2 source of overall revenue.

If you combine direct revenue + Kongregate Kreds, 32.6 percent of all revenue was earned outside of the major portals.

The first thing this chart tells me is that you should sell your game direct! Not only is it a big piece of the pie, you also get to keep most of the money (92 percent!), and build a direct relationship with those customers that no platform holder can yank away from you.

Besides, we would have never gotten on Steam and GOG had we not built up a base of direct sales to convince them with first.

But don't take it from me, take it from Cliffski of Positech games, developer of Kudos, Democracy, and Gratuitous Space Battles. Once you're done reading that, head on over to Pixel Prospector's big list of Payment Processors to set yourself up.

As for the major portals, GOG's star is clearly rising. Even under direct competition, GOG generated 14.5 percent as much revenue as Steam.

If Defender's Quest had not also been available on Steam, I suspect GOG revenue would have been even higher. Steam enjoys a captive market of ardent loyalists, but GOG is swiftly becoming an attractive alternative and gaining loyalists of its own, especially in the anti-DRM crowd.

I should note that GOGers are a passionate bunch. Since our background is in Flash games, we implemented basic gameplay metric tracking without a second thought -- it's just something you do in that world. Shortly after, GOG players started complaining about the game "phoning home." The fans convinced us that it should be removed or at least switched to opt-out, and we put out a quick patch to disable the tracking. Although we stumbled at first, responding promptly to fan feedback turned things around for us and won us a lot of support in that community.

Kongregate also brought in a large amount of revenue, not only as a large portion of our direct sales, but also through Kreds transactions. Our browser-based demo was our ticket out of obscurity, and flash game portals drove lots of sales. Even after flash portal traffic died down, the browser demo continued to be our secret weapon.

This is because of the "EXE barrier." To install a downloadable demo, a player has to click a link, download a file, navigate to whatever stupid folder their browser saved it to, double click it, be warned that the file will destroy their computer, install it, wait for it to install, and then run the game.

As I've said in my article Piracy and the Four Currencies, even if something is free in terms of money, it can still cost people time and pain-in-the-butt. A browser-based demo is one click and you're playing. No money, minimal time, minimal pain-in-the-butt.

This has obvious benefits in terms of demo-to-sales conversions, but it doesn't stop there. Journalists, bloggers, Steam/GOG reviewers, and other gatekeepers will play that demo, too, and the EXE barrier affects them all.

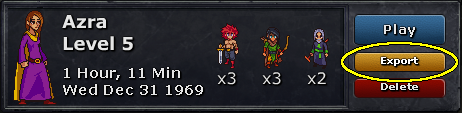

So, if there's one thing you take away from this article, it's this: make a browser demo. Then, cap off the player's positive demo experience by letting them export their save progress. Remember -- time is more important to some people than money. Some players might be happy to give you $15, but not if it means losing the two hours they sunk into your demo.

Browser games have traditionally been Flash-based, but today there are more options than ever before. Unity, Java, HTML5, and Haxe are all great alternatives, and Kongregate supports all of them. Plus, Unity and Haxe can export directly to Flash, so you can have your Flash-based cake and natively-compile it too.

Remember that little game called Minecraft? A chief key to its viral success is that its demo can be played in a browser.

Seriously, I'm going to keep saying this until I'm blue in the face.

The pie chart alone isn't a fair comparison, however, because we've been selling direct for much longer than we've been on Steam, et al. Therefore, we need a chart of sales over time.

Direct sales peaked early, then trailed off. The only spikes after the initial launch came from Rock, Paper, Shotgun articles, being featured on Kongregate, and participating in the Because We May sale. We saw another small spike when Gold Edition came out, after which sales ticked up marginally, but that was it.

Without new sales channels, Defender's Quest's run would have finished.

The Steam Launch was huge. We launched at 33 percent off the final price of $14.99 for the first week, and later participated in the Autumn sale, but the best was yet to come. When Defender's Quest was selected for the Steam Daily Deal, we made nearly half of the game's entire pre-Steam revenue in a single day.

The daily deal spike is actually slightly under-represented, because the 24-hour sales period was spread out over two data points -- the total take being nearly $34,800.

GOG gave us a similar one-day promotion, a "GOG Gem" feature, on January 23, for 60 percent off, which was another nice, single-day treat.

GOG was overshadowed by Steam, but still a major source of revenue and matched our take from Kongregate Kreds in a fraction of the time. Shortly after launch, GOG embedded the browser demo in the game's news page, driving further sales.

Even better, Steam and GOG continue to have healthy long tails. A year from now we expect Steam and GOG to account for over 75 percent of Defender's Quest's lifetime revenues, especially if we get to participate in future sales.

Desura and Impulse barely register on the above charts, and their combined total was under $1000. Had players not been able to buy the game on GOG or Steam instead, I suspect sales on these platforms would have been higher. I know some developers have made good sales with these platforms, so I wouldn't write them off entirely, but our experience wasn't particularly lucrative.

When we initially released the game on January 19, 2012, the price was $6.99. We raised this to $9.99 when Gold Edition came out, and settled at $14.99 as the final price for the Steam/GOG release. We raised the price because we knew we would make most of our money during sales periods, and we needed to give ourselves room to go down. All previous owners of the game received free updates at no additional cost.

As expected, the majority of revenue from GOG and Steam came during sales periods. Note that this effect is not just due to the discount, however, but the combined effect of the discount along with featured promotion leading to a temporary boost in visibility.

We used fairly steep discounts (33, 50, and 66 percent off), and did so early in the game's release. We're not sure if that was the wisest move, and feel we might have underpriced ourselves during these sales periods. For our next title we'll likely use shallower discounts to see if there's any major difference in revenue.

Steam provides the most detailed stats of any of our platforms, so let's look at some interesting data from there.

This stat means that over 1/3 of all people who have ever played the Steam demo go on to buy the full game. This speaks well of not only our demo, but also the Steam platform itself. Installing and playing a demo on Steam is often just as easy as playing a browser demo on the web -- the player clicks one button, waits for the game to download, and then she's ready to play.

To give that number some perspective, our conversion rate of Kongregate players (202,610 unique) to Kongregate purchasers (3,524 Kreds transactions + 4,977 Direct Sales by Kongregate referal) is 4.2 percent, which is considered very high for that platform.

Also, here are our playtime stats from our steam page (re-formatted to fit this page, and with emphases added).

Fully half of all people who have ever opened their copy of Defender's Quest on Steam have played for at least 10 hours, and over a quarter have played for 20!

According to the achievement data, 40 percent have beaten the regular game, 8 percent have beaten new-game+, and about 2 percent have beaten the ridiculously hard "Hero Mode++" challenge, which asks you to earn 180 gold stars without any generic recruits.

I'm very humbled by these numbers. In an era when gamers have dozens or even hundreds of titles in their Steam Libraries, most of which they've barely even played, I'm extremely grateful that people find our game worthy of their time.

As we wind down, let's talk about the power that press coverage has on a game's fortunes. I used to think that getting featured by popular game sites was our ticket to success, and without the help of journalists our game would be doomed.

So far, that hasn't been our experience. To be sure, we've received far more coverage than we ever expected, but it's still modest compared to top-tier "Indie Superstars" like Braid, Limbo, Super Meat Boy, Spelunky, FTL, Hotline Miami, Legend of Grimrock, etc.

As of today, we don't even have a single review that counts towards our Metacritic score. By comparison, as of this writing, Offspring Fling has managed to garner the required four and Incredipede is almost there with three. (I don't give much credence to meta-scores in valuing games, but they're still a useful metric of your game's media impact).

Our biggest coups so far were multiple features in Rock, Paper, Shotgun, a Destructoid review prior to the release of Gold Edition, a glowing review on JayIsGames, and a brief nod on GameSpot's Free Play Friday.

As you can see on the graph (better details in the previous article), good press resulted in clear sales spikes. However, press is a single shot of traffic, with no tail. In order to really drive knock-on effects, I suspect we need coordinated press attention across all the major game sites, or at least our relevant niche, for the duration of the news cycle.

Still, I think we're a good example of a "sleeper hit" whose sales were mostly driven by forces other than direct, sustained, media attention.

I should note that as 2012 wound to a close, we started to pick up a little more attention before everyone moved on to the next batch of games:

#1 Best Indie Game of 2012 - Dealspwn (Beating Torchlight 2, Hotline Miami)

#2 Indie Strategy Game of 2012 - IndieGames.com (#3: Awesomenauts, #1: FTL)

#3 Indie Strategy/RPG Game of 2012 - JayIsGames (#4: Torchlight 2, #1: FTL)

#3 Best RPG of 2012 - Gamezebo (#4: Diablo 3, #1: Legend of Grimrock)

Making good games is hard. Selling good games is even harder. So many factors are outside of your control, and even if you do everything right success may still elude you.

I used to believe that if I worked really hard and made something great, an audience would magically find me and we'd make a lot of money. Reality is quite different.

Sales basically comes down to a simple formula:

Eyeballs * Conversion_Rate = Sales

You can't directly control the ebb and flow of the fickle eyeballs of the internet. You can, however, control how many you capture when they show up.

So make your pitch. Tell them what you're about. Give them a free sample. Repeat nice things others have said, and if you're so inclined, tell them if it's okay for their kids. Learn all about what Tadhg Kelly calls the Marketing Story. Be human, be humble, be open, and if fortune is on your side, good things can happen.

And when you're done, come back and share your data with the world! It's scary out there, and the more information we share, the easier it is for the next developers to chart their path.

Read more about:

FeaturesYou May Also Like