Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

In a controversial column, veteran designer Ernest Adams, himself a former Electronic Arts employee, takes a look at the history of EA, discussing whether he should dump his stock or hold on for the ride, as the world's largest publisher "changes course" in a major way.

This column is a little out of the norm for The Designer’s Notebook, because it’s mostly about business rather than design issues. Still, it reflects some of my thoughts about where the industry is going, so I think it’s within my charter.

Electronic Arts’ stock has been in the doldrums for about three years now, and every gain seems to be followed by a setback. A few weeks ago, Larry Probst, Electronic Arts’ longtime CEO, announced that he was retiring in favor of John Riccitiello, a former Chief Operating Officer who left for a few years to work in venture capital, and has now returned to take over the helm. Then a few days ago Reuters reported that “managerial changes” were in the offing, which is code for “somebody’s going to get fired” and that Riccitiello is looking for ways to “improve efficiency,” which is code for “a smaller number of people will have to do the same amount of work.”

There’s a shift in the wind; I can feel it coming. I’m not just talking about a few layoffs here. The world’s largest independent video game publisher is changing course. I worked there for eight and a half years, and in that time I accumulated a little stock myself. Most of that time it was a great earner, but lately I’ve begun to wonder: is it time to dump it? What’s next for EA?

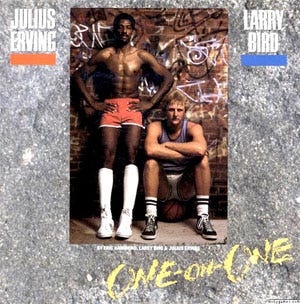

I’ve been watching Electronic Arts for a long time. The company first came to my attention when I spotted a copy of Dr. J. and Larry Bird Go One-on-One for the Commodore 64 in about 1984. At the time, I thought, “A sports-themed video game? With licensed, big-name athletes? Weird. I wonder if there’s any future in such a genre.” (There was.) It was the first indication I had seen that video games could be big business. If a game could make enough money to pay royalties to two of basketball’s most famous players, the industry had definitely moved beyond Space Invaders.

When EA was founded, it adopted several innovative principles. One was that it would treat developers like rock stars, featuring them on the covers of all the games. This worked as long as the dev teams were about the size of rock bands, but when they got up to 15 or 20 people it began to look ridiculous, and EA quietly dropped it as a marketing technique.

When EA was founded, it adopted several innovative principles. One was that it would treat developers like rock stars, featuring them on the covers of all the games. This worked as long as the dev teams were about the size of rock bands, but when they got up to 15 or 20 people it began to look ridiculous, and EA quietly dropped it as a marketing technique.

Another was that every full-time employee in the company, top to bottom, would get a stock option. Everybody could share in EA’s success. The company also had generous benefits and, once it went public, an employee stock purchase plan that let people buy at a 15% discount. If you promptly re-sold the stock at the market price, it was free money. That, combined with the stock’s excellent performance, bred a lot of loyalty.

By many accounts, however, EA wasn’t a very nice place to work in its early years. There was an aggressive, macho culture; shouting and pounding on tables in meetings was commonplace; employees who weren’t used to this kind of abuse were sometimes reduced to tears. EA also gained an unsavory reputation for taking advantage of developer naivety in business negotiations – nothing illegal or fraudulent, mind you, but they played hardball. Most game developers at the time were little more than kids, bedroom coders with no experience of negotiating contracts and, rightly or wrongly, some of them felt they got taken to the cleaners.

The first big sea-change at EA occurred when Larry Probst succeeded Trip Hawkins as CEO. Trip’s an entrepreneur: brash, charismatic, driven, and visionary. He’s good at selling a dream to venture capitalists – first with EA, then 3DO, then Digital Chocolate. Larry, by contrast, is a born executive. He can be outspoken when necessary, but for the most part his authority speaks for itself. EA moved to a quieter, more mature way of doing business. Larry took the company from being one game publisher among many to being the 400-pound gorilla of the industry.

During Larry’s long tenure, from a shareholder’s perspective the company was extraordinarily well-run, especially for such an unpredictable and fast-moving business. The stock split several times. Revenues grew from $175 million a year to $3 billion. Most importantly, the company never made a mistake that really hurt it badly. There were a number of failures – the short-lived EA Kids division, the effort to get into arcade games, Majestic, the EA.com debacle at the height of the dot-com bubble. But the company never invested more than it could afford to lose, so it was never in real danger.

EA also got quite good about picking the right technologies and getting out of them when they had run their course. It backed the Amiga, an excellent computer that later died off, and made a lot of money out of it; it backed the 3DO, a definitely not-excellent console, and made money out of it too, before the end. EA didn’t touch the Jaguar or the Dreamcast, and in the long run it was just as well. Probably the worst machine it ever tried to support, from a development standpoint, was the Sega Saturn; but again, the company didn’t commit itself to the point of danger. By refusing to be tied to one piece of hardware, it always had a fall-back position if one platform failed.

Early on, EA wisely recognized that simply publishing games wasn’t enough. Intellectual property is nice to own, but games can’t be exploited in as many ways as, say, movies can. The few attempts to exploit game IP in other media didn’t generate much revenue. A better way to lock in a solid revenue stream is to gain control of the store shelves.

Early on, EA wisely recognized that simply publishing games wasn’t enough. Intellectual property is nice to own, but games can’t be exploited in as many ways as, say, movies can. The few attempts to exploit game IP in other media didn’t generate much revenue. A better way to lock in a solid revenue stream is to gain control of the store shelves.

If you want the best, eye-level spots on the shelves, you need a distributor with the kind of muscle that can get them for you, and EA set out to be one, another of Probst’s innovations. On the strength of its relationships with retailers, EA’s distribution business remains the basis of much of its strength today.

So what about the EA Spouse debacle, and the over $30 million dollars in class-action lawsuits that EA had to settle for unpaid overtime? What about the allegations of crippling workloads and family-killing schedules? Well, when I was there, attitudes about such things varied widely from project to project, or more accurately, from producer to producer. Some were absolute slave-drivers, no question about it.

But I never got the feeling that it was a matter of corporate policy that managers should be slave-drivers; rather, the company let it go on without paying enough attention. Senior management’s sin was one of omission rather than commission – but failing to look after your people in a people-intensive business is still a sin.

I think for a long time the management assumed that EA’s “everybody gets a stock option” policy was enough to compensate for the long hours; if the company did well, it would be worth it in the end. And for a long time, it was. But with the stock price flat quarter after quarter after quarter, it doesn’t surprise me that a lot of the programmers and artists got fed up.

EA has now abandoned the option policy and has to pay cash on the barrel head for work done. That makes sense. With the development of large games becoming more and more assembly-line every day (an artist friend of mine once spent weeks doing nothing but drawing basketball players’ feet), you can’t count on passion alone to motivate people.

So that’s the past, and how EA got to where it is. What about the future – this sea-change that I see coming?

Some of it has to do with personalities. Company culture flows down from the top, and Larry was in charge for a long, long time. He was a known quantity. He could be ruthless, but he was both honest and judicious. I can’t say that I knew him well, but I knew what he was about. I knew what his priorities were and where his boundaries were – no excessive gore, nothing raunchy in the games, which helped keep EA’s name out of the headlines when Congress was investigating the industry.

Larry was a game guy – he came to EA from Activision. He got it. Riccitiello is a packaged-goods guy, not a game guy. He came to EA from being President and CEO of baked goods at Sara Lee. Before that he was at Wilson Sporting Goods, Haagen-Dazs, Pepsico, and Clorox. Does he get it? I don’t know yet. If he got it, why did he leave?

And games may be packaged goods now, but they’re not necessarily going to be packaged goods forever. Back in 1999, I predicted in a lecture at the Game Developers’ Conference that sometime in the next five to ten years, the industry would start moving to electronic distribution. I was right. Eight years later the retail model is still dominant, but thanks to the increased availability of broadband, electronic distribution is growing rapidly. Steam and Xbox Live are changing the rules.

There are still several good reasons to buy at retail – a fair number of game purchases are impulse buys – but game-only stores are under terrible pressure from discounters like Wal-Mart. That’s not a sector I would want to be in five years from now. EA never went into retail, which was wise, but if digital distribution really takes off, EA’s dominance of store shelves isn’t going to mean much.

A few years ago I heard a fascinating lecture by Jim TerKeurst, a research and business development manager at the IC CAVE at the University of Abertay Dundee. He said that at the moment the video game value chain runs: developer, publisher, distributor, retailer, consumer.

That’s a lot of middlemen. In the future it’ll be: developer, provider, consumer. The providers will be the people who own the cable that runs between the developer’s computer and the customer’s computer – or in the case of mobile entertainment, the people who own the cell-phone networks. The only publishers that will survive will be those who have development capacity. Everybody else is out of the picture, and that’s something that EA had better be planning for.

There has also been a growing chorus of complaints in recent years that the quality of EA’s games is slipping and that they don’t innovate any more. I don’t buy enough of EA’s games to have an opinion about it, but if true it’s a worrying trend. EA has some sure-fire properties: Harry Potter, The Lord of the Rings, and the NFL. A lineup like that is, in principle, a license to print money. But the company can’t afford to get sloppy; with what it takes to make a triple-A title these days, a major flop could really hurt. If I were Riccitiello, I’d worry less about efficiency and more about quality. Inefficiency hurts right now, but a reputation for poor quality will hurt for years.

As for why they don’t innovate any more, the reason for that is pretty obvious: they’re too big, and size discourages risk-taking. The Sims was innovative, but it was made over the objections of the top brass – it was Will Wright’s genius and determination, not the company’s farsightedness, that got that product out the door.

Spore is tremendously innovative, but to be honest I can’t imagine that it will do as well as The Sims. The Sims offers a chance for social play with characters that people can imagine stories around. I don’t see that happening with goofy little creatures, no matter how brilliant their on-the-fly animation algorithms are… although I would be delighted to be proven wrong. Also, part of the success of The Sims came from the add-on packs. But in Spore, supposedly the players will generate all the content. So how are you going to sell them add-ons?

The bottom line is that EA has become exactly what it set out to be: a big media company. It’s nowhere near as big as the really big media companies – Disney, Viacom, and so on – but it is by far the largest independent game publisher, and looks set to keep getting bigger. It’s not a startup any more; with over 7,000 employees worldwide, it’s not even a mid-sized company. There’s a big burn rate for salaries and, since the lawsuits, overtime as well. The latest generation of consoles costs more to develop for than ever, while the growth in sales of used games is putting a lot of pressure on the price of new ones. That’s squeezing profit margins for everybody.

The bottom line is that EA has become exactly what it set out to be: a big media company. It’s nowhere near as big as the really big media companies – Disney, Viacom, and so on – but it is by far the largest independent game publisher, and looks set to keep getting bigger. It’s not a startup any more; with over 7,000 employees worldwide, it’s not even a mid-sized company. There’s a big burn rate for salaries and, since the lawsuits, overtime as well. The latest generation of consoles costs more to develop for than ever, while the growth in sales of used games is putting a lot of pressure on the price of new ones. That’s squeezing profit margins for everybody.

EA faces some significant challenges in the years ahead. In some ways it was easier to be a smaller company than a big one. Big companies have too much inertia to change quickly; too much invested in people and properties and physical plant. What this means for investors is that EA’s stock is moving out of the aggressive growth category that it has enjoyed for most of its life, and into the category of slower-growing equities that tend to be owned by mutual funds, not by individual investors.

No, it’s not time to dump EA stock. The company’s not in trouble by any means. But it is time to diversify my portfolio a little.

Read more about:

FeaturesYou May Also Like