Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs.

Tencent's international mobile games business eclipses NetEase for the first time

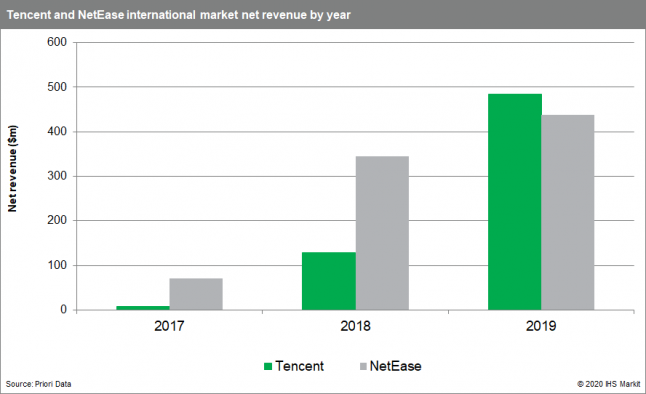

2019 saw the major Chinese companies truly establish themselves as competitors in the global market. According to Priori Data, Tencent saw international mobile games market growth of 278% in 2019, out-performing domestic rival NetEase.

2019 saw the major Chinese companies truly establish themselves as competitors in the global market. According to Priori Data, Tencent saw international mobile games market growth of 278% in 2019, out-performing domestic rival NetEase. Tencent also demonstrated an expanded portfolio, including Chess Rush. The combined international performance of both Chinese publishers almost doubled in 2019 - surging from $472m to $921m in net revenue.

NetEase builds engagement with its Japanese audience, Garena looks West

NetEase has a stronger overseas presence traditionally, and whilst it has not benefited from a stand-out title like Tencent’s PUBG Mobile, the publisher has still seen modest growth year-on-year. The Japanese market represented 89% of international mobile games revenue for NetEase in 2019, and the Chinese company is the top-ranking foreign publisher in Japan. Knives Out, Identity V and LifeAfter have seen considerable, on-going success.

Singapore-based Garena is a major distributor for Southeast Asia and Taiwan, and found huge success with the lightweight battle royale mobile title Free Fire. In January 2020, the company acquired the Canadian developer of F2P MMO Dauntless, Phoenix Labs. This indicates that Garena is also looking to explore new opportunities in the global market – mobile and otherwise.

PUBG Mobile spearheads huge growth for Tencent

Unsurprisingly, PUBG Mobile has been the main source of Tencent’s overseas success. Combined, the Android, Android Lite and iOS versions generated $471m in net revenue in 2019 – representing growth of 526% year-on-year.

The majority of this growth has emerged from the Google Play Store, reflecting the game’s popularity in Android-first markets such as Turkey and India. Newly-launched COD: Mobile looks set to be a contributor in 2020. It is developed by Tencent, but published by Activision. The South Korean version, however, is published by Tencent.

Taking mobile content overseas boosts long-term stability

Building sustainable audiences in overseas markets reduces the publishers’ reliance on China, and can offset losses stemming from the insecurity of the time-heavy, domestic approvals process. Conversely, it is still difficult for international publishers to enter the Chinese mobile games market: Tencent and NetEase remain key gatekeepers.

It was recently confirmed that Perfect World Europe – the European branch of Chinese PC MMO-focused company Perfect World – has been hit by numerous layoffs. This underlines the view that the PC games market is flattening, and cannot provide sustenance internationally.

Read more about:

Featured BlogsAbout the Author(s)

You May Also Like