Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Gamasutra's comprehensive breakdown of NPD Group's U.S. physical video game retail sales estimates for September exhibit how Xbox 360 hardware is "defying gravity" with a higher price and higher sales than competition, and how Madden and Gears of War 3 saved the month.

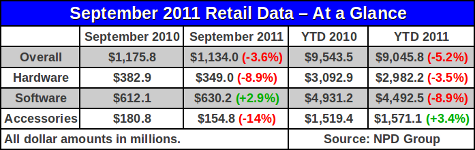

On Thursday of last week the retail-tracking firm, the NPD Group, released its estimates of new U.S. physical retail video game sales for the month of September 2011. With EA Sports' Madden NFL 12 pushed into the September retail calendar, and the release of Microsoft and Epic's Gears of War 3, it was no surprise that software sales were up 3% compared to last year.

However, that modest growth was outweighed by 9% and 14% declines in the hardware and accessory segment revenue, leaving the retail video game industry down by a full 4% relative to September 2010.

Below we will break down the figures into a bit more detail, including a detailed examination of console hardware sales in terms of both units and average prices. We also look into some specifics of the software segment, including a three-year view of the changing share of software dollars among the leading consoles.

Finally, we look beyond retail and into the NPD Group's Games Industry: Total Consumer Spend report, which attempts to produce a more comprehensive view of consumer spending on video game content from a variety of outlets. We express some skepticism and ask some questions about the report's figures, and get a response directly from the president of the NPD's Games Group, David McQuillan.

After an extremely disappointing July and August, it was refreshing to see some positive figures in the September report. In particular, software revenue was up $18 million over September 2010, an increase of approximately 2.9%. Software units were up an even healthier 4.4% to 14.5 million units, although the average price of the software sold did drop by 1.6%.

To put those software figures in context of the weak summer months: software revenue increased 90% from August to September, on a weekly average basis, while software units increased 30% and software prices jumped 37%.

We estimate that hardware unit sales were around 1.55 million units for the month, a modest drop from the 1.62 million in September of last year.

A year ago Sony launched its PlayStation Move system for the PS3, and it is possible that some of the decline in the accessory segment this year stems from a comparison to that launch.

Below are the key revenue figures for September 2011, according to the NPD Group's report.

The NPD Group highlights to the media that the data above represent physical retail revenue figures, and that there are separate estimates for video game content sold through other means. They are providing quarterly estimates of those extra-retail sales, including mobile games, downloadable content, and casual games, along with other segments.

We examine the latest of those quarterly estimates, with some historical context and comments from the NPD Group itself, in the final segment of this article.

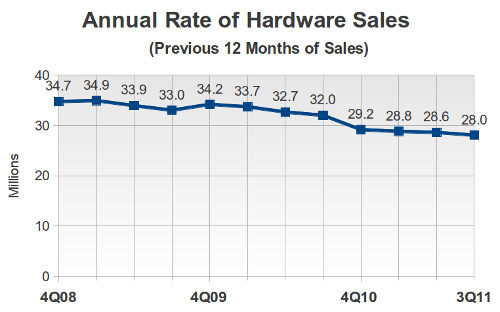

Looking at the industry as a whole, hardware sales rates have been declining since about the end of 2009. At that point, the annualized sales rate (the sum of the previous 12 months of sales) peaked briefly around 34.2 million systems per year, but were already down from their historical high of 35.4 million systems per year at the end of February 2009. As of the end of September 2011, the annualized rate fell to 28 million systems, a decline of 20% from the peak.

This matters most because building the installed hardware base is a prerequisite for increasing the sales of software. As users become inactive – lose interest over time or have the systems break – the overall software-purchasing population will decline, at least at retail. In an environment where new physical software sales are declining, the last thing publishers and developers want is a shrinking audience.

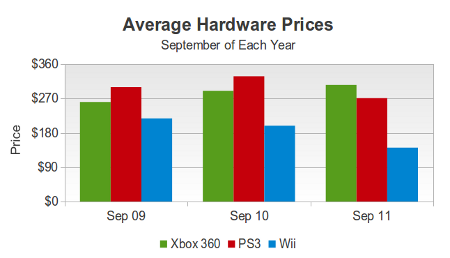

On top of the declining unit sales, hardware prices on many systems have been cut. Except for the most expensive systems, like the PlayStation 3 and the Xbox 360, those cuts have not resuscitated flagging unit sales.

As we have discussed before in these columns, a decline in prices can compound a contemporaneous decline in unit sales, for a breathtaking cut in revenue. While the effect on hardware has been modest (hardware prices were $228 on average in 1Q 2009 and are only $215 now, a loss of 6%) it is still there.

Before moving onto some specific trends for the systems underlying these industry-wide totals, let us look at a visualization of that annualized hardware unit sales rate described above. Below the rate is given for hardware sales for the U.S., measured each quarter since the last quarter of 2008. Note the peaks in the first and last quarters of 2009, with consistent declines since that time.

This decline in hardware sales is not, however, uniformly distributed across the available systems. Nintendo's systems, with the exception of the 3DS which launched a few months ago, have seen sharp declines over the past couple of years. By comparison Microsoft's console and Sony's lead console have either held their ground or grown modestly – enough to claim significant ground in annual sales, but not enough to shift the balance of power as measured by install base sizes.

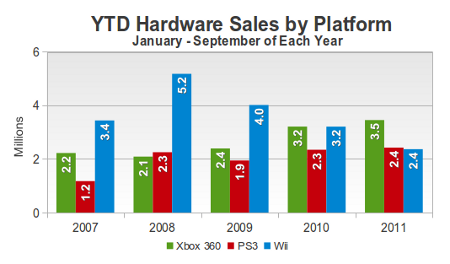

For example, the following figure shows the January – September hardware sales figures for the big three consoles. As a caveat, we note up front that Nintendo's sales in the last quarter of the year are often very strong compared to the competition. So while this is an interesting view, it does not tell the full story for annual sales.

While Microsoft has grown its console's sales over a matter of several years (its first full year, 2006, is not shown in this graph), Nintendo's Wii shot to 5.2 million units in 2008, its second full calendar year on the market. From that peak its 3rd quarter YTD sales figures have declined by 20-25% each successive year.

Sony's sales show the company plodding on from price cut to price cut, continually trying to live down the burden of its exorbitant launch price. Its sales jumped from 2007 to 2008 based on the November 2007 introduction of the 40GB PS3 system with its $400 price, but then stagnated from 2008 to 2009. From 2009 to 2010 its sales edged up again as the PS3 Slim ushered in a more streamlined system at a $300 price. We think it unlikely that the $50 price cut the system received in August of this year will have a significant effect on PS3 sales through the first three quarters of 2012.

By contrast to the fortunes of the other systems, Nintendo cut the price of the Wii from $200 to $150 in May of this year, and the system's sales dropped nearly 9% in the subsequent quarter. The company's focus appears to be on maintaining some semblance of life for the system while the Wii U is prepared for launch in 2012.

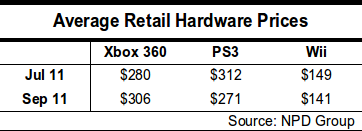

We find the average price of each system each month to be of particular interest. By average price, we mean the total hardware revenue sales for a month divided by the number of systems sold in that particular month. For example, if 70 systems are sold at $200 and 30 systems are sold at $300, then the average price will be $230 per system.

Just since July there have been some dramatic shifts in this picture. Consider the table below, which gives the average prices for the Xbox 360, PlayStation 3, and Wii in July 2011 and then again in September 2011.

Between these two months the PS3 received its $50 price drop and retailers began offering some versions of the Nintendo Wii for approximately $135. As a result each of those systems saw its average price drop, by about $40 in the former case and $8 in the latter. (Consumers are now spending more on Nintendo DSi and DSi XL systems, on average, than they are on Wii systems.)

During the same period, the Xbox 360 saw its price increase by approximately $25. While the NPD Group won't speak to the specifics of a change like this, we suspect that part of the price increase may be related to the end of the Xbox 360 and Windows PC promotion that ran throughout the summer of this year.

Last month we hinted this role reversal could happen. At the time, we said “If consumers think that the Xbox 360 offers a better value, then the $50 PS3 price cut could bring the PS3's average price below that of the Xbox 360 without actually driving PS3 sales higher than Xbox 360 sales.”

That's precisely what happened in September 2011. Compared to its closest competitor, Microsoft is selling 12,000 more systems per week and at a $35 higher price.

From our experience, this is likely the first time that the Xbox 360 has exceeded the PS3 on average price. Going forward, the dynamic between the two consoles could change if price becomes a stronger determining factor in consumer choice.

In a communication to us about September sales, Wedbush analyst Michael Pachter described Xbox 360 sales as “defying gravity”, a turn of phrase we feel captures precisely the dynamics of the current market. While everyone else is treading water or eking out modest gains on hard-fought price cuts, Microsoft's sales are strong and its system prices are going up.

To get a longer view of how console prices have changed, we offer the following graph. Keep in mind that there is a lot of variation from month to month in the average price of a system, especially as that price can be tied to cross-promotions with other products, but the figures below give a general feeling for how average hardware prices have changed over the past two years.

October is the first month of the video game industry's most energetic season, and each system has a chance to cap its year with very strong sales. For the Xbox 360, absent a price cut, we think it will hit just under its record sales of 2010. Pachter, who has far more information than we, believes that Microsoft has “a huge Kinect television promotion planned for holiday” and is “focused on increasing the adoption of Xbox TV.” To achieve these ends, he says Microsoft may cut its price on Xbox 360 systems bundled with Kinect, especially if Sony begins to highlight its $250 system against Microsoft's more expensive Kinect systems.

Sony has made its move – that was the August price cut – and it's locked in for the ride into 2012. It should end the year slightly up over 2010 – and therefore a new record calendar year – and on track to achieve its profitability and sales goals for the fiscal year ending in March 2012.

The Wii appears to be nearly out of gas. If it can't outsell either of the other main systems, each of which costs twice as much on average, and it has only the currently announced software slate to power it through the end of the year, then we could see sales like the system saw at the end of 2007 – a full four years ago.

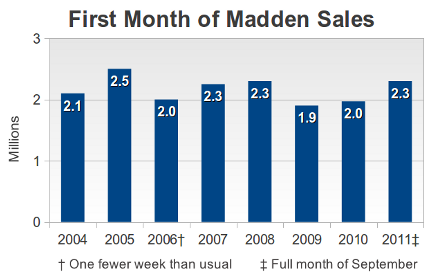

When Electronic Arts pushed the release of its Madden NFL 12 to August 30, 2011, that forced the title out of the NPD Group's August reporting period (four weeks ending August 27) and into the September period (five weeks ending October 1).

So in addition to the general lack of new releases in August of this year, the biggest title of the month had its sales recorded for the subsequent month. That led the retail industry to record its worst month of software sales since the beginning of the latest hardware generation, a month of older releases leading sales.

By contrast seven of the top 10 titles on the all-formats chart for September were new releases, and Madden NFL 12 led at #1.

According to notes from analyst Doug Creutz of Cowen and Company, Madden's total across all platforms came in over 2.3 million units for the 33 days it was on sale during the NPD Group's reporting period.

When asked for comment on Madden sales, analyst Michael Pachter of Wedbush Securities noted that purchases during the initial five weeks this year were “just under sales in the first eight weeks last year”. He elaborated that that means during Madden NFL 12's first eight weeks in 2011, EA will see “overall sales [...] up at least 5 - 10% for the comparable first eight weeks” of 2010.

In a nutshell, it appears that the late launch didn't affect sales of Madden NFL 12 and EA can expect another year of growth.

Because of the differential in release times, a direct comparison to any previous year is difficult, but we provide the following chart of Madden release sales for historical context.

Previously we have been able to provide a platform breakdown of Madden NFL sales, but such information was regrettably unavailable this year. When asked to elaborate on the platform breakdown, Liam Callahan, an analyst for the NPD Group, pointed out that “unit sales of Madden NFL 11 were split fairly evenly across the 360 and PS3 in Aug 2010” and that “when adding the PS2 they favored the Sony consoles.” On the subject of this year's release, he explained that “with the launch of Madden NFL 12 in September 2011, unit sales leaned towards the 360.”

That is an interesting shift, and one that highlights just how consistently Microsoft has built its platform and consumer base to sell huge quantities of software. Not only did Xbox 360 owners purchase nearly a million units of Madden NFL 12, but they also found the money to buy 2 million copies of Epic's Gears of War 3.

Put a bit more simply, one out of every five units of software sold during September 2011 were either a copy of Madden or a copy of Gears for the Xbox 360.

Now add the Xbox 360's share of Dead Island and FIFA 12 sales and it becomes clear just how well Microsoft has executed on its plan to make its platform the dominant platform for HD-class games. (According to Cowen and Company's Creutz, those titles moved nearly 1 million and over 400,000 units, respectively, across all platforms.)

The net effect is that Microsoft has started its hot holiday sales streak a month earlier this year than everyone else, to paraphrase a comment made by a colleague about the launch of Halo 3 back in September 2007.

Regardless of how one feels about a game like Insomniac's Resistance 3, a PlayStation 3 exclusive which also launched in September of this year, its inability to strike a chord with the PS3 audience is indicative of Sony's failure so far to catch lightning in a bottle this generation the way its main rival has. According to comments that the NPD Group's Anita Frazier made to Eurogamer, Resistance 3 sales came in at around 180,000 units.

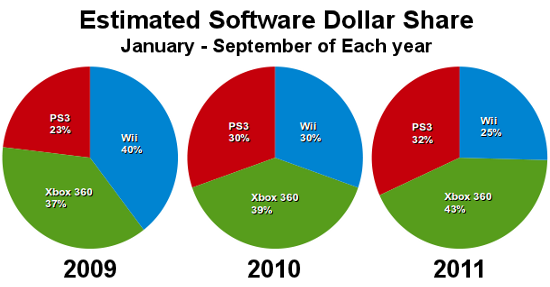

Based on comments made by analysts, and our own estimations, we have pieced together a picture of what we feel is a reasonable view of the software sales picture on the three main consoles over the past three years. In the following we only consider software revenue during the first nine months of each year. This neglects several factors, including some hit titles whose sales are concentrated during the last two months of each year, and the price differential among Xbox 360, PlayStation 3, and Wii software.

This graph reminds us of the comments made, half-seriously and half in jest, during and after the launch of the original Xbox from Microsoft. At the time people who had long watched Microsoft cautioned that it wasn't the first iteration of a Microsoft product that was a threat, but rather successive iterations in which the company had learned from experience and honed its strategy.

Looking at the picture above, we see Microsoft besting the winner of the last two generations of console hardware (Sony) and then outlasting the ostensible winner of this generation (Nintendo, as measured by installed hardware base, for example).

What we cannot see in these pictures is the additional revenue that Microsoft and Sony and Nintendo generate from sales through their online console services. The NPD Group is attempting to capture that data in its new Total Consumer Spend report, and we wish to examine that data next.

As the American retail video game industry has struggled through several spare and troubling months in 2011, more attention has been paid to the other segments of the market which are more independent of the traditional retail channel. Among these are full digital game downloads, social network games, downloadable content, and games for non-traditional mobile platforms like smartphones and tablets.

The basic question: When all monetization methods are considered, is the video game market growing, contracting, or maintaining its previous size?

Just looking at retail, content sales for consoles and traditional handhelds (like the Nintendo DS) have shrunk significantly. Through September 2011, those segments of the market have contracted over 5% from the same point in 2010 and almost 24% from the same point in 2008. In absolute terms, year-to-date retail content sales are down approximately $1.6 billion from the peak three years ago.

According to a recent video posted by the NPD Group to its YouTube channel, the decline in retail has coincided with the proliferation of alternative means for consumers to find gaming content. In the video Anita Frazier, an analyst for the NPD Group, goes on to say that the company has “seen through [its] expanded coverage of the market that the sales to consumers of content through these other ways of acquiring content is actually making up for the decline in retail sales.”

While it isn't an absolute statement – Frazier doesn't say specifically that the other segments are completely making up for losses at retail – hers is as informed an opinion as one is likely to see on the growth of the market. If the industry appears to be contracting, then at the very least new sources of revenue are stepping into the breach.

The NPD Group produces a quarterly report entitled Games Industry: Total Consumer Spend which outlines the company's estimates for the entire video game content market. In addition to the segments already mentioned, the company also estimates sales of used video games, for example by GameStop, and video game rentals.

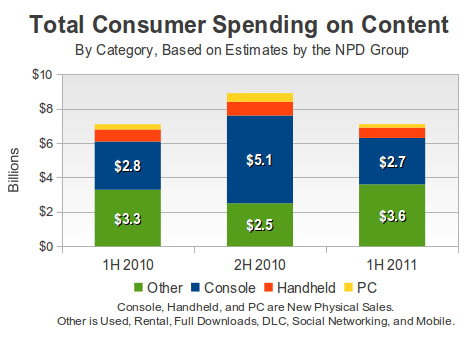

In its latest public release about consumer content purchases during the second quarter of 2011, the company stated that $1.44 billion was spent on traditional new content (console, handheld, and PC games at retail) while $1.74 billion was spent on all other channels combined. That follows an earlier report that $2.03 billion was spent at retail on traditional content during the first quarter of 2011 while $1.85 billion was spent on content through other means.

While the NPD Group is well-positioned to measure these markets as well as any other company, a longer view of these figures – and figures from earlier Total Consumer Spend reports – shows that the metrics are still not perfect.

Two quick examples should make that point:

In October 2010 the NPD Group announced that total content sales in the U.S. for the first half of 2010, across all channels, were estimated at $2.6 – 2.9 billion. But based on the year-over-year growth rates given for the 1Q and 2Q figures for 2011, it now appears that the 1H 2010 figure was closer to $3.3 billion, an increase of nearly $400 million.

Judging from comments made by Anita Frazier in a note to the press in April of this year, all other forms of video game content sales in 2010 except for traditional new retail content accounted for $5.8 billion. Given the previous bullet point, we can estimate that all those other forms of content sales broke up into $3.3 billion in the first half of 2010 and $2.5 billion in the latter half of 2010, a decline of 24%.

See the graph below for a visualization of just the decline in the Other category that we're highlighting.

There is at least one reason to be skeptical of that decline in the second half of 2010: used video game sales at GameStop. According to that company's filings with the Securities and Exchange Commission, used product sales (which includes used hardware and accessories) see an increase of approximately 50% during the last quarter of each year. We estimate that GameStop's used video game content sales account for around a quarter of the revenue that the NPD Group is measuring outside of traditional new content sales.

If used game sales spike during the last quarter of each year but total revenue outside of traditional retail declines, then all those other content sales – social network games, mobile platform games, and so on – would have to take quite a hit. That may very well be what the NPD Group's measurements are saying, but at the very least one should be surprised at the conclusion.

After the latest NPD Group results for retail sales last week, we asked Wedbush analyst Michael Pachter his outlook on the Total Consumer Spend report, and he wrote back that it is “too early” for him to have a fully-formed opinion about the figures. He says he won't subscribe to the service “till I see if it is relevant.”

Early last week we voiced our skepticism to the NPD Group directly, laying out the ways in which these estimates lacked consistency over time and didn't jibe well with what we believed were solidly established trends in used game sales.

We had a productive discussion about the report and its methodology. As a result of those conversations, the President of the Games Division at the NPD Group, David McQuillan, was kind enough to field some questions we had about the Total Consumer Spend report.

With content reaching consumers through so many different channels, the job of measuring what consumers are really spending seems quite challenging. Can you tell us a bit about how the data is collected for the Total Consumer Spend research?

David McQuillan: Our methodology for developing the Games Industry: Total Consumer Spend estimate leverages many sources, including but not limited to, point-of-sale (POS) data, multiple syndicated NPD consumer trackers covering games and gaming-capable devices, data sourcing from multiple calibration partners, and more.

While it’s a different methodology than what people are used to seeing from POS sales data, it is based on a large number of consumer reported transactions and calibrated using sound market research methodology.

I think it’s just so different from what people are used to in the games industry that it takes some getting used to, but our clients are getting more and more comfortable with how it can be used to help them with their business decisions. As a point of reference, there are many industries, such as the toy industry, which is solely tracked through consumer reported purchases and does not have a POS component to it. It’s not unusual at all.

How often are you producing estimates for customers, and how does that compare to the frequency of data collection for the report? Can you elaborate on that process?

DM: We currently report the information on a quarterly basis. The frequency of data collection varies from weekly or quarterly depending on the primary consumer data source. We synthesize the various sources as they become available and issue our estimate at that time. Our first priority is reducing the turnaround time of our quarterly estimates and our next priority is to increase the frequency of reporting the bigger picture.

We haven't noticed any industry stakeholders – publishers, hardware companies, and retailers – commenting on the Total Consumer Spend estimates. What response are you seeing from them?

DM: We have many clients purchasing the service including retailers, publishers and the financial community. As an indicator of client interest in the information - expanding our tracking of the games industry beyond the physical format - we have been encouraged by many of our current clients to expand this market sizing estimations into Europe and Asia.

[Ed. note: According to the latest press release, coverage of the UK, France, and Germany will begin in early 2012.]

Of course, our clients would like to have the data at a more granular, more frequent level – a goal that we share. This is a first step on what we expect will be a dynamic journey that will require a flexible methodology, which we have developed. The industry and business models are changing too rapidly to not remain nimble.

In our earlier conversations, we noted what appear to be some discrepancies and revision of earlier consumer spending figures for content. What are the factors driving the refinement of those figures?

DM: We are continually expanding our market coverage. One recent example is the expansion of our mobile coverage to expand beyond smart phones to also include deck phones. We are also making refinements to our methodology either in terms of the approach or as the sources of data are improved upon or expanded.

Our goal is to provide the best estimates of the market based on what we know today and the information available to us. We are very candid with our clients that these estimates don’t provide the same level of precision at POS data, but it still provides the best market estimate using widely accepted market research best practices.

In August the NPD Group announced that it had worked with many video game industry players to develop a coherent taxonomy for classifying video game content monetization methods. For example, the sale of content can now be classified by the delivery channel (e.g. brick & mortar store or online retail) or segment (e.g. console or mobile phone), as well as several other categories. How does that figure into how the Total Consumer Spend estimates are produced and reported?

DM: The Games Industry Taxonomy provides the industry with a framework for discussing the rapidly changing market. We will use this taxonomy, which we will revisit and modify as needed due to market changes, to help inform additional areas of spend that need to be captured through whatever data source is best suited to it.

In the details of the report we do refer to the taxonomy to help facilitate the adoption of a common language with which to reference the state of the industry.

Back to those restatements of revenue – will there continue to be restatements of earlier public revenue estimates from the Total Consumer Spend report?

DM: It’s likely.

For example, right now we don’t report on revenues generated by “gaming in the cloud”. As we collect more information we will add that to our estimate as well, and using trend data we may adjust previously reported periods.

We only will do that if there is a client benefit to doing so. Our first priority is to make sure our clients have the best information currently available to inform their business decisions, and we also make a portion of that available to the public, like media outlets, to the extent it helps inform their reporting.

We note that, without those public releases, practically every conversation about video game sales trends would be reduced to hand-waving and back-of-the-envelope estimates based on SEC filings and the stray publisher press release. It's clear that the NPD Group is working hard to produce solid estimates of video game content sales, and it's also clear that there are still some areas in which it can improve its measurements of sales outside of traditional retail.

The industry has hit a rough patch, especially as consumers have cut back on spending on games delivered on discs and cartridges. The NPD Group believes that that lost revenue is getting replaced through other channels – and for now we have little choice but to believe it.

[As always, many thanks to the NPD Group for its monthly release of the video game industry data, with a special thanks to David McQuillan for his coöperation. Thank you in particular to NPD Group analyst Anita Frazier for her monthly analysis notes, Liam Callahan for his added insights, and David Riley for personally making it all work.

Additional credit is due to Michael Pachter, analyst for Wedbush Securities, for his perspective, instrucive conversations, and entertaining anecdotes. We also drew on the comments of Doug Creutz of Cowen and Company, and wish to thank him for his perspective.

Finally, many thanks to colleagues at Gamasutra and particularly regular commenters on NeoGAF for many helpful discussions.]

Read more about:

FeaturesYou May Also Like