Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Gamasutra's Matt Matthews goes inside October's mixed bag of NPD U.S. video game retail results, finding signs of life for the first time in months -- and looking at the factors that'll almost surely lead to another down year.

The U.S. retail video game industry finally showed some life in October, as software sales grew nearly 6% according to the latest data released by the NPD Group on Tuesday. That made October 2010 only the third month during the past 12 in which software sales had increased year-over-year.

Regardless, there are still many areas in which the video game industry has suffered contraction during 2010, and it seems certain now that total industry sales will finish well below $19 billion for the year, a decrease from the $19.5 billion total in 2009.

In this month's examination of the latest data, we will look at just where the money has gone in the software market – from platforms to manufacturers – and also quantify the collapse of the music game market.

Then we will look at the pricing of the current consoles and follow up with some troubling observations about the Wii market in particular.

The good news about October 2010 was that software revenue saw a 5.6% year-over-year increase, while also seeing a 23% month-over-month increase (comparing average weekly rates).

This latter fact is particular laudable, because it shows that sales did not slow down after the huge launch of Halo: Reach during September.

The other bright spot was accessory sales, where 1600 points cards for the Xbox 360 continued to top the sales chart and Sony's Move controllers helped drive up revenue. The entire accessory segment is up nearly 4% for the year, and the addition of Microsoft Kinect accessories in the November data should continue that trend.

(We will mention again that Sony's Move and Microsoft's Kinect will be counted as part of hardware sales when they are packaged with a console and will be counted as an accessory when sold alone or with a bundled game.)

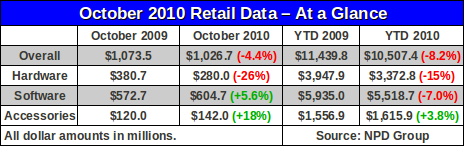

The table below shows the key figures for October 2010.

The NPD Group is now clearly labeling their media releases to indicate that the figures include only retail sales. On a quarterly basis they intend to provide estimates for extra-retail sales, including mobile games, downloadable content, and casual games, along with other segments.

While there was a modest 6% year-over-year increase in software revenue for October 2010, total software revenue so far in 2010 is still down 7%, or $400 million. To understand what's going on beneath the surface, we've broken out software revenue in a variety of ways.

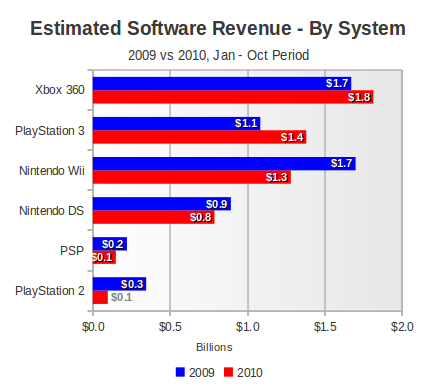

For example, one could consider the question of how much the year-to-date revenue on each system has changed.

There are currently six active systems on the market: Sony's PlayStation 2 and 3 and Portable, Nintendo's Wii and DS, and Microsoft's Xbox 360.

Considering the month-to-month (relative) changes in revenue for each system reported by analysts and comments by Microsoft and Sony about revenue for their respective platforms, we have pieced together estimates for each of these six systems.

The figure below breaks out YTD software revenue from 2009 and 2010 by platform. The systems are ranked from top to bottom by YTD software revenue in 2010.

(Note that this figure shows only the January to October period for both 2009 and 2010. Even though full-year figures are available for 2009, we're making a comparison between the same period in both years.)

Starting at the bottom, the venerable PlayStation 2 has seen its YTD software revenue drop by 70%, which is not that unexpected for a system which just completed ten years in the U.S. market.

The PSP, which has been on the market for over five and a half years, also saw a dramatic decline (over 30%) in its software revenue so far this year. Its slower fall has put it ahead of the PS2 in terms of revenue this year, but it still accounts for less than 3% of the software market, by our estimates.

Software revenue on Nintendo's DS platform, which this month begins its seventh year on the market, dropped by a somewhat more modest 12% from 2009 to 2010. Still, it accounts for nearly 1 in ever 7 software dollars spent so far this year.

The top three software revenue generators are the current-generation consoles, and here is where things get interesting. In October 2009, the Wii had generated the most software revenue of any single system on the market, just slightly ahead of the Xbox 360.

However, at this point in 2010 it is third, behind the PlayStation 3.

In contrast, the Xbox 360 has nudged its revenue up over 8%, helped in great part by sales of Halo: Reach in September and October. The PlayStation 3 has done even better, relatively speaking, with software revenue going up by over 25%.

These figure are even more striking when one considers the installed hardware bases. The Nintendo Wii has passed the 30.5 million system mark, or over 2.2 times the size of the PS3 installed base of 13.7 million systems.

With that kind of advantage, it is notable that the PS3 has moved approximately $100 million more software this year than has the Wii. Simply put, the average PS3 owner is spending significantly more money on software than is the average Wii owner.

Note, however, that this does not mean that the PS3 is selling more units of software – just that it is generating more revenue. Due to the differential in average software prices for each of the platforms, the Wii undoubtedly has moved more units of software in 2010, but more money has been spent on PS3 software.

To sum up our first look at software revenue: the three oldest systems on the market along with the Wii are all seeing declines in software revenue (down 27% or about $840 million), while the Xbox 360 and PS3 are showing increases (up 16% or about $440 million).

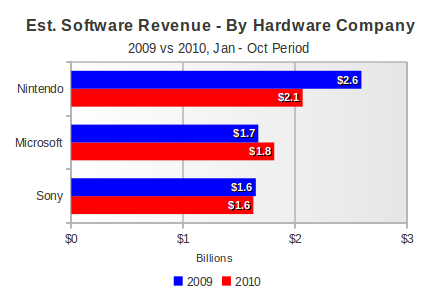

If we group platforms by manufacturer, we get another view of software revenue, shown below.

Since Microsoft has only the one platform, the Xbox 360, the story we see here is the same: over $100 million in software revenue growth.

For Sony, the so-called PlayStation family of systems has realized a small, approximately $20 million, decline in software revenue. The company has at last generated enough demand with its flagship console to overcome almost all of the software losses its is experiencing on the PS2 and PSP.

However, these systems appear to be on terminal trajectories, and if their revenues effectively go to zero in 2011 then the question becomes whether the PS3 can fill that gap – about $450 million – in Sony's revenue stream.

The larger story in the figure above, however, is the $500 million contraction in software revenue on Nintendo's platforms. Industry-wide, retail video game software revenue has fallen only $400 million, and Nintendo's systems have contributed all of that loss and more. If it weren't for strong Xbox 360 software revenue this year, the industry's hole would be even deeper.

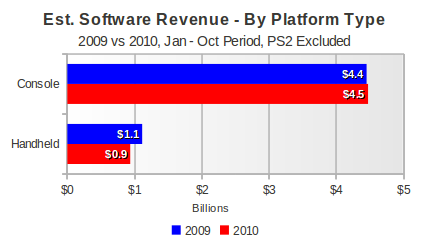

One last view of all software, just to show how the current decline has many faces. Below we pulled out the PlayStation 2 revenue, since it is both small and an anomaly in the current market. Then we considered consoles (Xbox 360, PS3, and Wii) versus handhelds (PSP and NDS).

As the figure shows, when the current-generation consoles are grouped together their YTD software revenue has actually increased slightly from 2009 to 2010. Given the other figures above, we know that this increase comes from growth on the Xbox 360 and PS3 slightly outpacing contraction on the Wii.

On the handheld side, however, the story is much different. The decline here is part of what analysts like Michael Pachter, of Wedbush Securities, point to when they say that the handheld market is under attack from other mobile forms of entertainment.

Think of it this way: The Nintendo DS, the best selling system so far this year (4.5 million units, a million more than the Xbox 360), has seen its software sales fall five points more than the industry average (-12% versus -7%). Sony's PSP has suffered even more indignity with both hardware unit sales and software revenue down by one-third so far in 2010.

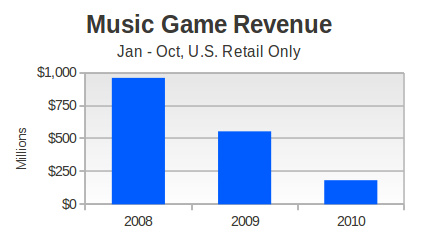

Several months ago we looked at the decline of the music game segment, and this month we revisit that area one last time. As the figure below shows, sales of music games have dropped by more than a factor of five since 2008.

While the figures above are only for the January – October period, we can at least give full-year figures for 2008 and 2009. The total haul for music games in 2008 was over $1.6 billion. That dropped to over $870 million in 2009. Short of a Christmas miracle, music games won't break $400 million for all of 2010.

The top-line figures for the retail video game industry are grim. Hardware unit sales are down (15%, or 2.7 million systems) and so are hardware dollar sales (15%, or $575 million). Likewise, software unit sales are down (about 10%, or 14 million units) and so is revenue (7%, or $400 million).

Where in these figures could the industry find a way to grow out of its current downturn?

One path is to sell more hardware, and to do so as soon as possible, and try to drive software sales on the larger installed hardware base. To drive more hardware, however, it won't be enough to continue to bundle more in the box and hold the prices constant.

Every manufacturer is doing this right now. The Wii is bundled with two software titles (Wii Sports and Wii Sports Resort) as well as a new MotionPlus controller, yet remains priced at $200.

The Xbox 360 has similarly maintained its general price structure, and is currently pushing $300 and $400 systems bundled with Kinect cameras and software. Sony continues to offer a variety of models, including a $400 bundle with a Move controller, PS Eye camera, and Sports Champions.

However, these bundles really don't do much to break into the population that wants to buy a system at $150 instead of $200 or more. As we've said in these columns before (as far back as when Sony began offering Uncharted PS3 bundles), a consumer who can't afford the cost of a $200 (or $300 or $400) console still won't be able to afford it with more stuff packed in the box.

When we asked Michael Pachter of Wedbush Securities how much consumers would respond to the drop in price for a system like the Wii, he pointed to December 2009 sales. At that time, Walmart was aggressively marketing the Wii with a gift card that effectively brought the price down to $150, and other retailers offered other deals to entice consumers to buy a Wii.

Consumers were, indeed, enticed and snapped up a staggering 3.8 million Wii systems during the final month of 2009.

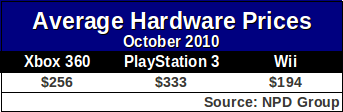

So, as a reality check, here are the average hardware prices for the main three consoles in October 2010.

Since Kinect had not launched in October, we believe that most of the Xbox 360 systems sold that month were between $200 or $300, with a smaller number of more expensive bundles available.

That consumers appear to favor the more expensive systems, or are close to evenly split, suggests that Microsoft has its system pricing and value balanced fairly well.

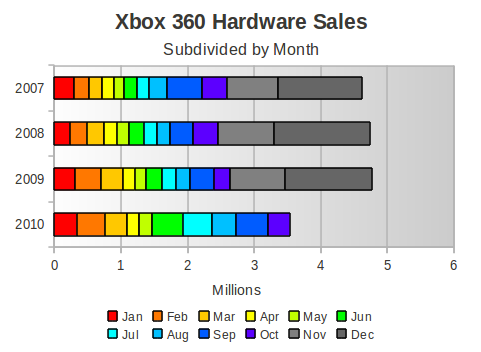

With Microsoft leading console hardware sales for six months so far this year, they won't be in any hurry to cut their price through the beginning of 2011. They could goose their sales with a price cut now, but they are probably quite pleased with the level of sales and the profit margin they have on the current hardware models.

As the graph below reveals, Microsoft is well on its way to a record year, and the effect of the Xbox 360 S launch is clearly visible in the data for 2010.

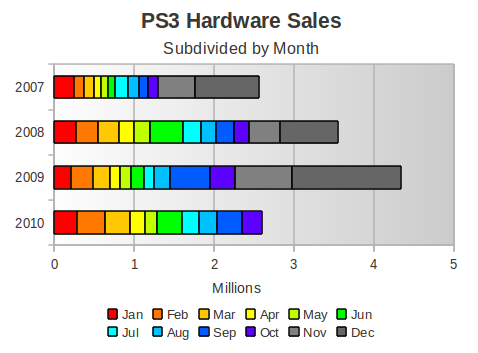

Sony's PlayStation 3 is down year-over-year, but that comparison pits today's sales against the very beginning of the $300 PS3 era. However, the $333 average price does tell us that consumers would prefer that the system be priced somewhat lower. Moreover, as the PS2 and PSP hardware sales become insignificant, it becomes more important that Sony increase its active base of consumers to continue to drive software sales.

Sales would increase significantly, we believe, if Sony were to price its low-end system at $280. This could potentially peel off consumers from the Xbox 360 column who might otherwise be considering a $300 or higher console.

To break into the real mainstream, however, Sony has to get its price much closer to $200. Sony has already dropped its price twice this generation – once in November 2007 with the introduction of the 40GB PS3 for $400 and a second time in August 2009 with the launch of the PS3 Slim at $300 – but those changes came nearly two years apart. It may take more than a year for Sony to bring its price to the $200 level.

The effects of these price drops are easily distinguished in the graph below, which shows PS3 sales in the same manner as the Xbox 360 graph above.

Without a price drop, Sony's console will still have an installed base of fewer than 20 million systems by this time next year. That's a serious handicap as their base of 46 million PS2 owners and 18 million PSP owners become obsolete.

Having already spent time dispensing with the hardware fortunes of the Xbox 360 and PS3, we now turn to Nintendo's Wii. With the hardware's $194 average price at retail clearly below the $200 MSRP, retailers are already promoting it with special deals.

If the retailer offers become more aggressive through December, that average price should drop further, and sales should increase – but to what levels? This is the key question for Nintendo through the end of 2010, and one we will explore further below.

Unfortunately for Nintendo, the Wii's days of consistently dominating the console segment appear to be over. It has not been the best-selling console since May of this year, just prior to the launch of the Xbox 360 S model.

In fact, Nintendo's console has seen its year-to-date sales decline by 24%, a change which has allowed the Xbox 360 to take the crown of best-selling console so far this year.

The current malaise in Wii hardware sales is a troubling sign, and it makes estimating sales through the end of the year difficult.

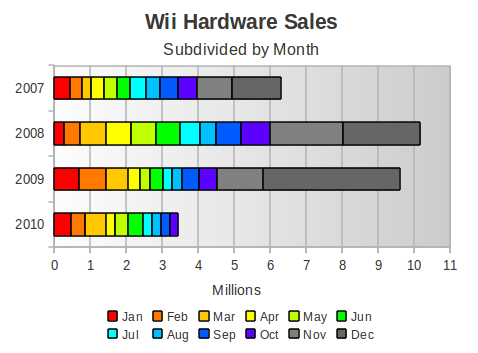

As the figure below shows, Wii hardware sales have been on the decline since peaking in 2008, but the contraction has accelerated in the past couple of months.

What is particularly interesting about Wii hardware sales for November and December of this year is that we still don't know which way the trend will break. Last year's numbers looked particularly weak until November and December more than doubled the year-to-date Wii system sales. In 2008, those two months had only accounted for 41% of Nintendo's annual console sales and in the year before that, the two holiday months were only 37% of annual Wii sales.

So which will it be this year? A more modest contribution as was experienced in 2007 and 2008? Or a near doubling of annual sales like 2009?

To at least beat the annual total for 2007, Nintendo will have to sell 2.85 million systems in the last two months of 2010 – in which case November and December would account for 45% of the system's 2010 sales. Given the stronger competition from Sony and particularly Microsoft this year, that seems unlikely to us.

Which leaves us wondering why Nintendo has maintained its $200 MSRP for the Wii. Perhaps they are waiting until 2011 and allowing the desperate retailers to cut their own margins over the holiday, reducing the effective price as happened in 2009. Perhaps they are still uncomfortable with trimming their own margins because of the unfavorable yen-to-dollar conversion rate.

Regardless, there is the issue of software sales, which in the case of the Wii appear to closely correlate with hardware sales. It is our theory that the Wii's strong software sales in past years were driven primarily by new Wii owners (those within the first six months of ownership). As the hardware sales have fallen this year, so have the software sales rates.

According to tie ratios provided to us by the NPD Group, and comparing with data released by Nintendo during its recent investor briefing, Wii software sales rates have dropped by over 50%. In particular, during the January – May period of this year, we estimate that approximately 1 million Wii software units were being sold each week, on average.

During the June – October period, that rate fell to below 500,000 Wii software units per week. Not only was that a drop compared to the rate in the first part of the year, but it does not look healthy compared to the 890,000 software units per week that the Wii averaged in the same June – October period in 2009.

We are left wondering whether Nintendo should consider a reduced-price line of software akin to the Player's Choice line used during the GameCube's lifetime. If the Wii installed base is price-sensitive enough, then those users may choose to buy very few software titles or to buy used software as often as possible.

Used software revenue is not reflected in the NPD Group's monthly figures. If the introduction of re-issued Wii software at $20 – $30 could pull in more Wii consumers and simultaneously stem the flow of some consumer dollars into the used software market, then that could at least boost the fortunes of Nintendo's platform generally and third parties specifically.

This isn't to say that third parties couldn't lower prices on their own – in fact Wii software prices are significantly below prices on the other current-generation consoles – but rather that it would mean more if Nintendo put its weight behind such a program.

When the company has had to defend its success with third parties several times during the lifetime of the Wii, it would seem a rather natural step to put some of its own marketing muscle behind a repackaging effort that could visibly aid those third parties.

[As always, many thanks to the NPD Group for its monthly release of the video game industry data, with a special thanks to David Riley for his assistance and Anita Frazier for her helpful analysis. Additional credit is due to Michael Pachter, analyst for Wedbush Securities, for his perspective and instrucive conversations.

We also wish to thank Doug Creutz of Cowen and Company for his insights. Finally, many thanks to colleagues at Gamasutra and particularly regular commenters on NeoGAF for many helpful discussions. We will single out our colleague donny2112 who has discussed at length precisely the lack of a Player's Choice line of software.]

Read more about:

FeaturesYou May Also Like