Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Gamasutra analyst Matt Matthews examines U.S. video game retail sales for the month of November -- the first time since March that the industry saw a rise in year-on-year sales.

Last Thursday, the gloom that has surrounded retail video game sales in the U.S. lifted – perhaps only temporarily – with the release of the November 2010 hardware, software, and accessory sales estimates from the retail-tracking NPD Group.

Not only was it the biggest November on record, but it also hosted the biggest single software launch in American history. Activision Blizzard's Call of Duty: Black Ops, developed by Treyarch, leapt to 7th on the all-time best-selling sales chart with 8.4 million units of sales in a mere 19 days on the market.

Furthermore, Microsoft also released its new Kinect camera – which permits controller-less interactions – for the Xbox 360, driving accessory sales to an astonishing $413 million dollars, the largest single-month total for that segment of the market outside of December, and a 69% year-over-year increase from 2009.

As we do every month, we'll dig into these figures and pin down just how these big events shaped the market and where they're likely to lead us from here.

In addition to the topics above, we'll examine Sony's predicament as the effects of its PS3 Slim redesign from 2009 wear thin, Move continues its modest growth, and the PlayStation 2 and PSP ride off into the sunset.

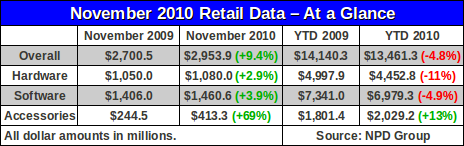

In terms of overall revenue – including hardware, software, and accessories – the industry has shown year-over-year growth in seven of the previous 24 months, and only two of those were in 2010. That's part of what makes the 9.4% growth in November so notable.

It's also important that every individual segment of the market showed growth.

Let's take the hardware segment as an example. Not only were hardware unit sales up, from 5.00 million units in November 2009 to 5.05 million for the same month this year, but hardware revenue was up, driven primarily by higher priced Xbox 360 units bundled with Kinect.

In the software segment, the same pattern holds with unit sales and revenue up about 4%, to over 33 million units and $1.46 billion, respectively.

The growth in the accessories segment was driven primarily by Microsoft's Kinect, which retails for $150 as a standalone product bundled with a game. Along with Sony's various Move accessories, including the $100 bundle (camera, controller, and game), the addition of motion controls to every current-generation console fattened the accessory category to over $400 million.

This sets the stage for a very interesting possibility in December 2010. In the past three years, the revenue from accessories in December has been between 2.5 and 3.1 times the accessory revenue in November. Assuming that Microsoft can maintain the momentum and supply for Kinect, and Sony and Nintendo continue sales of their own accessories, the accessory segment could pass $1 billion for the single month of December 2010.

That would be fully 30% beyond the record accessory sales from December 2009 and 50% of all accessory revenue in calendar 2010.

The table below lays out the latest top-line figures, as estimated by the NPD Group, for the month of November 2010.

For the record, the NPD Group is now clearly labeling their media releases to indicate that the figures include only retail sales. They are providing quarterly estimates of extra-retail sales, including mobile games, downloadable content, and casual games, along with other segments, but those figures are not included in the figures above nor are they considered directly in this analysis.

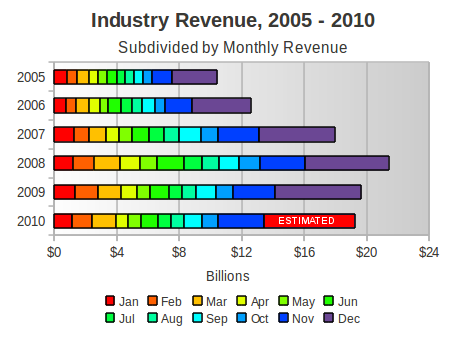

In her notes accompanying the release of the data, NPD Group analyst Anita Frazier commented that “new physical retail sales should come in between $18.8B-$19.6B” and that “gains in November offset a good portion of the year-to-date declines”. These are important points to keep in mind, especially the latter one.

Year-to-date industry revenue was down 8.5% and 8.1%, respectively, in September and October of this year. This month, as the table above shows, the industry is only down 4.8%. Would a strong December be enough to get annual revenue back the $19.7 billion recorded in 2009?

To get the industry to even the $19.6 billion level at the upper end of the range supplied by Frazier, total revenue in December 2010 will need to reach over $6 billion, or nearly 12% above the record $5.5 billion recorded in December 2009.

We're not naturally predisposed to optimism, it does seem probable that in December the industry will maintain last year's hardware and software revenue levels (although these are far from guaranteed) and that the accessory segment will reach $1 billion for December. Under those circumstances, annual revenue in 2010 would reach $19.2 billion, or a very modest 2% decline from 2009.

The figure below shows our estimate, in context with monthly and annual revenues throughout the past five years.

The growth in November 2010 U.S. retail video game sales was driven largely by Treyarch and Activision Blizzard's blockbuster shooter, Call of Duty: Black Ops.

With single-month sales of 8.4 million units across five platforms in the U.S., the title not only had the best opening month of any game in American video game sales history, but also leapt to 7th on the all-time best-selling software list.

There are a variety of notable measures by which the release of Black Ops should go down in the record books. Using exclusive data provided to us by the NPD Group, we've assembled some of them here:

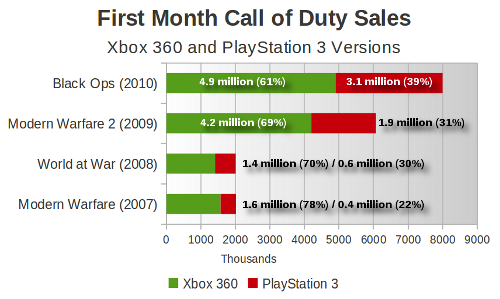

The largest launch of a game on a single platform, with a total of 4.9 million copies of all three editions (Standard, Hardened, and Prestige) sold for the Xbox 360. (The PS3 version sold 3.1 million copies across its three editions, making it that platform's biggest launch ever.)

The largest launch of a single version of a game on a single platform, with the standard version of Black Ops for the Xbox 360 selling a minimum of 4.3 million copies. (We estimate that the Prestige edition sold under 100,000 copies while the Hardened sold over 300,000.)

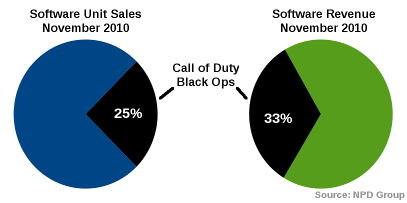

Combined unit sales across all five platforms (including the Nintendo DS, Nintendo Wii, and Windows PC) accounted for 25% of all unit software sales in November 2010, according to NPD Analyst Anita Frazier.

Combined revenue from all of the Xbox 360 and PlayStation 3 versions of Black Ops accounted for 1/3 of all software revenue in November 2010, putting the total revenue across all five platforms at over $500 million.

Put another way, out of every $14 spent at retail on video game software in the U.S. during the first 11 months of 2010, about $1 was spent on Black Ops.

If Black Ops had not outdone its predecessor, Call of Duty: Modern Warfare 2, it is quite likely that November would have recorded yet another month of year-over-year decline rather than an increase. Not only would software have been down, in both units and revenue, but overall industry revenue would likely have been lower as a result.

Looking toward the effect that Black Ops will have on sales in December, the closest comparable game is Modern Warfare 2 from 2009. Sales of the lead versions of Modern Warfare 2 dropped 55% from November to December, and if the same were to hold true for Black Ops, then those same two lead versions could move another 4.4 million units before the end of the year.

However, there is the distinct possibility that Black Ops will have its sales even more concentrated in its launch month, and as a result second-month sales will be lower. In fact, first month sales will not tell the entire story, since even 2009's Modern Warfare 2 went on to have strong sales in 2010, adding a minimum of another 200,000 units each month through the middle of the year.

The question we would pose here, amidst the obvious success of Black Ops, is whether the reign of über-blockbusters is a generally healthy phenomenon. As noted above, without the revenue and units, the industry would be in far worse shape than it is now. But the dollars spent on Black Ops are potentially sapping dollars spent on other games on other platforms.

Beyond that, simply the existence of an annual release this heavily promoted and as successful is enough to push the release schedules of other games into other months. It is far from clear whether the publishers that moved their games from November 2009 to the first quarter of 2010 really benefited from avoiding the release of Modern Warfare 2.

We don't wish to begrudge Activision Blizzard or Treyarch their success; they clearly made a product that consumers wanted to buy by the millions. However the industry as a whole has yet to sort out a means for pacing its releases out to the entire year, and as game budgets balloon and Call of Duty claims an ever bigger share of the November and December pie, it becomes more important that the release schedule problem be resolved.

Finally, we end with some historical context for the 60/40 split between the Xbox 360 and PlayStation 3 versions of Black Ops. As the figure below shows, the release of Black Ops was the best showing for Sony's flagship console out of the last four Call of Duty titles.

There are still some details below the figures that should be clarified. First, the figure for the release of Modern Warfare 2 in November 2009 does not include sales of that title that were bundled with a special edition of the Xbox 360 hardware. The NPD Group generally keeps those figures separate, since it can't be known whether the system was purchased for the game or not.

Moreover, the Xbox 360 version of World at War in November 2008 was the second major shooter available for that platform that month. Epic's exclusive third-person shooter sequel, Gears of War 2, was in fact the leading single-platform title that month, ahead of both the Xbox 360 and PlayStation 3 versions of World at War.

On 4 November 2010, Microsoft launched Kinect, its camera-based controller-less system for the Xbox 360. Consumers could obtain Kinect either as a standalone package for $150 or bundled with a 4GB or 250GB console ($300 and $400, respectively).

Along with the redesigned Xbox 360 S Model (introduced in June) and a reported $500 million promotion budget, the launch of Kinect has been likened to a relaunch of the console itself.

In fact, while Xbox 360 hardware sales in the June – October period were up a very strong 63% over 2009, Microsoft actually bested that rate in November: sales were up 68% over November 2009.

Perhaps more importantly for Microsoft, when comparing average weekly rates, November 2010 was the best month the system has ever had. The previous record was 288,000 units per week in December 2008; November's set the new high bar at 344,000 units per week.

It seems all but certain that November's record will stand until next month when the December data is released. Just maintaining the rate from November would give Microsoft its first 1.7 million system Christmas.

While Microsoft has been dominating software for most of the year (the Xbox 360 has led in software revenue every month since April), it did exceptionally well in November.

Stitching together figures and proportions provided in the comments of Michael Pachter (analyst for Wedbush Securities), Anita Frazier (analyst for the NPD Group), and in Microsoft's own press release, we have what we believe is a reasonable picture of the Xbox 360's strong showing last month.

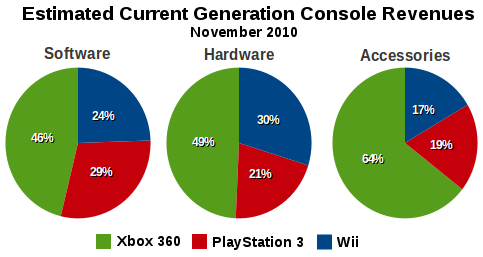

We wish to raise a few points about the details in this graph. First, note that the Xbox 360 is handily dominating each segment. In the case of hardware and accessories, this is directly attributable to the launch of Kinect.

For example, looking just at the effect of hardware bundle sales, we believe that Microsoft's average price for an Xbox 360 sold in November was around $290, which is more than $40 more than last month's average. Moreover, Wedbush's Pachter commented in his notes to investors that one half of all Xbox 360 systems sold in November were bundled with Kinect.

In the software segment, those 4.9 million copies of Call of Duty: Black Ops are the main cause for Microsoft's dominance, but it certainly did not hurt that six of the top 10 best-selling games in November were available on the Xbox 360. (In fact, as has traditionally been the case, the Xbox 360 version was probably the top-seller within each of those tiles.)

If we are on the cusp (or even past) the transition from the Wii to Xbox 360 as market leader, then 2011 will be a telling year for the market. Whereas Nintendo has had image problems and some notable failures for third-party software, Microsoft prides itself on its third-party software relations.

If Microsoft can make those third-parties successful on Kinect in ways that Nintendo has not on the Wii, then this temporary dominance for the Xbox 360 could continue well through 2011.

And, we should note, Microsoft still hasn't played its next big ace: a true price drop. They're long overdue, and we expect to see one sometime in mid-2011, especially if Xbox Kinect sales remain robust through the spring.

Except for the record-setting launch of Call of Duty: Black Ops for the PlayStation 3, there were few reasons to cheer Sony's fortunes in November. Of its three platforms – PlayStation 2, PlayStation 3, and PlayStation Portable – only the PlayStation 3 isn't moribund.

The PlayStation 3 enjoyed a good run after the PS3 Slim was launched at $300 at the end of August 2009, but as soon as the year-over-year comparisons started coming due in September, the system's sales figures have looked anemic.

Clearly the understated launch of Sony's new Move controller has not significantly moved the needle on hardware or software sales.

While the hardware bundles were modestly popular in October (when 1/3 of PS3 hardware systems were Move bundles), that popularity has waned through November with the fraction of Move bundles falling to 1/5.

According to Wedbush's Pachter, PS3 titles with “Move” in the title have sold fewer than 200,000 units collectively. (That doesn't count games that have been retrofitted for Move compatibility.)

The NPD Group provided an exclusive software listing to us, one which shows the top-selling Move-compatible games in November 2011. That table is below.

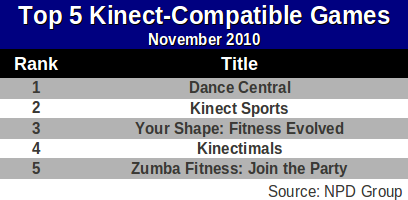

We were also provided with the top-selling Kinect titles during the same month.

In both cases, these do not include games bundled with hardware, so we are unable to speak to sales of Kinect Adventures – which is bundled with Kinect. These two charts demonstrate neatly the different strategies used by Sony and Microsoft for their new controller systems.

Whereas Sony has encouraged new Move titles (several available for download from the PlayStation Store) alongside Move-compatibility patches for games like Resident Evil 5: Gold Edition, the titles which happen to be selling best right now are of the latter category. We also can't say for sure that those sales are motivated by Move compatibility.

Microsoft, however, has required that the focus be on Kinect-only games, and the sales chart above clearly shows that they are reaching their target: music games, fitness games, and family-friendly games.

As for Sony's other systems, the PS2 and PSP, we have little to say. The PSP's hardware sales of about 288,000 units were practically flat in November compared to November 2009. At the same time, software sales have tumbled further, to about half the level seen in November last year.

It is becoming extremely difficult to explain why hardware sales continue at an extremely modest pace while software sales go to zero, outside of some explanation involving firmware hacks and illegally distributed software copies.

If consumer are buying the PSP as a media device only, they are inexplicably declining to purchase more powerful and more feature-rich devices at a similar price.

Finally, the venerable PS2 will probably be considered a dead system after this Christmas. With November sales around 80,000 units, this is the first year since its launch in October 2000 that the system has not sold more than 1 million units.

[As always, many thanks to the NPD Group for its monthly release of the video game industry data, with a special thanks to David Riley for his assistance and Anita Frazier for her helpful analysis. Additional credit is due to Michael Pachter, analyst for Wedbush Securities, for his perspective and instrucive conversations.

We also wish to thank Doug Creutz of Cowen and Company for his insights. Finally, many thanks to colleagues at Gamasutra and particularly regular commenters on NeoGAF for many helpful discussions.]

Read more about:

FeaturesYou May Also Like