Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Gamasutra's latest analysis of NPD's U.S. console retail figures examines <a href="http://www.gamasutra.com/php-bin/news_index.php?story=24470">June's 31% sales slump</a> in the context of the recent past, including exclusive data on the top-selling games of the year so far, music game trend analysis, and a look forward to the rest of the year.

[Gamasutra's latest analysis of NPD's U.S. console retail figures examines June's 31% sales slump in the context of the recent past, including exclusive data on the top-selling games of the year so far, music game trend analysis, and a look forward to the rest of the year.]

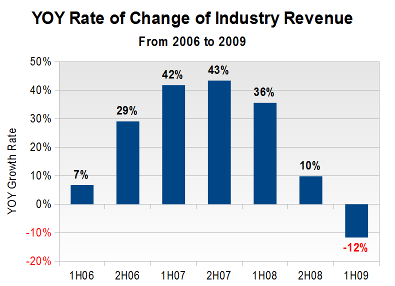

As if defying the pull of the worldwide recession, the videogame market experienced remarkable expansion throughout practically all of 2008. With annual revenue growing more than 18% in the United States, many observers felt that videogames were living up to their label of “recession-proof”.

Then in 2009 the industry slowed, posting a year-over-year loss in March and continuing through the middle of the year. June 2009 marked the fourth straight month of contraction, according to the latest figures from the NPD Group, which tracks the retail market in the U.S.

By many key measures – hardware sales, software prices, accessory sales, total revenue – the industry has seen dramatic decreases throughout the second quarter.

Below we'll survey some of these measures, and turn up a few choice bits of good news along the way. Be sure to check out our survey of the music game market in the first half of 2009, the year-to-date top 5 games on the current generation consoles, and an overview software unit sales since 2007.

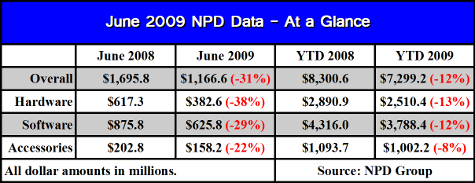

The top-line figures for June 2009 showed losses in each of the main categories for which the NPD Group provides data.

Hardware revenue for the month was only $382.6 million, down $234.7 million or 38% from the same period last year. Software dropped to $625.8 million, a decrease of $250 million or 29%. The accessory segment was hit least of all, dropping only 22% from last June.

The table below summarizes the major category data for the month of June and for the industry so far in 2009.

It is key to understand that the industry could probably never have sustained the kind of growth it experienced beginning in the second half of 2006, continuing through the end of 2008. From that perspective, the revenues being seen in 2009 could be the result of a correction in the market which will lay the foundation for more modest, healthy increases over the next year.

The following figure provides a clear illustration of the rates of growth that the industry has produced in the past 30 months.

Analysts currently expect the market to return to positive growth in the latter half of 2009, probably in August, but in terms of annual revenue, much damage has already been done.

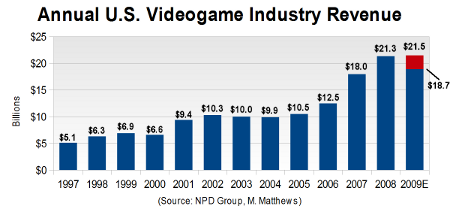

In the past four years, the industry revenue during the first half of the year has been either 34% or 39% of the full year's revenue. If 2009 follows one of those two patterns, what would the total annual revenue be for the year?

If the revenue from January to June of 2009 turns out to be 34% of the full year revenue, then total revenue in 2009 will be $21.5 billion, a 0.5% increase over 2008. This assumption would require that revenue in the back half of 2009 grow by 9% over the same period of 2008.

On the other hand, if 1H09 revenue is 39% of all revenue for 2009, then we can expect and annual total of only $18.8 billion, or a loss of 12%. In this scenario, revenue in the second half of 2009 would drop over 12%, year-on-year.

The final result, which we won't know until mid-January 2010, will probably be somewhere between these two cases. We currently lean toward a value between $20 billion and $21 billion, a modest decline from the record $21.3 billion in 2008.

Even if unit sales of hardware and software pick up, those gains will be undermined by lower software prices and hardware price cuts. That is, stronger hardware and software unit sales in the last half of the year may not actually result in proportionately higher revenues.

Here's U.S. game industry retail revenues since 1997, with the range of possible estimates for the rest of 2009 marked in red:

There are plenty of unknown changes that could impact this significantly. For example, if Nintendo were to cut the Wii's price from $250 to $200, the company would have to sell 25% more hardware just to maintain the same level of revenue. Likewise, Sony would have to sell 33% more PlayStation 3 systems to offset revenue lost in cutting the system's price from $400 to $300.

Compared to June 2008, the software market contracted a cool quarter of a billion dollars in June 2009. Year-to-date software revenue is down over $500 million from the same period last year.

Not only are fewer units of software being sold, but overall software prices have dropped as well. According to figures provided by Michael Pachter, analyst for Wedbush Morgan Securities, the average price of a game sold in the first half of 2008 was nearly $40. In the first six months of 2009, however, the average price has dropped to around $38, a decline of 5%.

At least some of this drop can be attributed to falling sales of more expensive packages like Guitar Hero and Rock Band bundles. Sales of Nintendo's Wii Fit with the included Balance Board, retailing for $90, began weakening in the second quarter and will probably lose its effect on software ASP going forward.

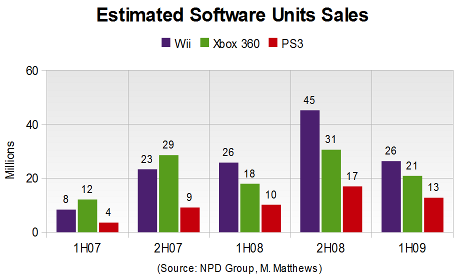

Even though software has been cheaper overall (that is, consumers are buying cheaper software, generally) software unit sales are down over 8 million from the first half of 2008.

The decline in software prices probably spans all platforms, even the Xbox 360 and PlayStation 3 where new software is often priced at $60. Consider the data for per-platform software unit sales over the past 2.5 years shown in the figure below.

As the diagram shows, Wii software sales were flat from the first half of 2008 to the first half of 2009. Even though unit sales were up on the Xbox 360 and PlayStation 3, platforms with more expensive software, the average price of software across the industry dropped. This suggests that consumers were seeking out less expensive software on those platforms, contributing to the overall decline in average software prices.

The data in the figure above also reveals the increasing importance of the current generation of consoles to the software market. Roughly speaking, the three consoles accounted for 50% of all software units sold in the first half of 2008. By our figures, the same three consoles had a 60% share of all software units during the first half of 2009.

Given that software on the Wii, Xbox 360, and PlayStation 3 is priced significantly higher than the software on the other platforms (Nintendo DS and DSi, PlayStation Portable, and PS2), the current generation consoles command an even larger share of all software dollars.

As of the end of June 2009, the Xbox 360 and Nintendo Wii were essentially tied in life-to-date software sales, each in the neighborhood of 132-133 million units. Note that the Xbox 360 has achieved those sales after 44 months on the market, compared to 32 for the Wii. PlayStation 3 software sales currently stand at 54 million units after 32 months on the market.

When the Xbox 360 was at the same point in its lifespan that the PlayStation 3 and Nintendo Wii are now (32 months on sale), American consumers had purchased around 82 million units of software for the system.

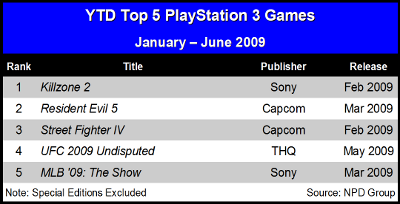

The Xbox 360, Nintendo Wii, and PlayStation 3 are currently the focus of much of the American videogame market. The NPD Group provided us with exclusive ranking data on the top five games for each platform so far in 2009. (Note: The rankings here do not include limited or collector's edition versions of each game.)

PlayStation 3 software in 2009 is led by Sony's own first-person shooter, Killzone 2, launched in February 2009. As of the end of April, sales of Killzone 2 had reached 677,000 and we estimate that it is nearing 750,000 at mid-year.

The second and third best-selling titles on the PS3 are both from Capcom: Resident Evil 5 and Street Fighter IV. The sales figures here are a bit less clear, since each of these games had a collector's edition.

However, the fourth title, THQ's UFC 2009 Undisputed, does not have a collector's edition and has had sales in excess of 500,000 since its May 2009 launch. The final title, MLB '09: The Show, is Sony's first-party baseball title and we estimate that its sales are in excess of 425,000.

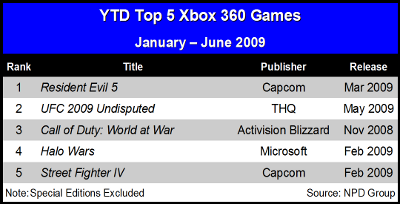

Capcom's Resident Evil 5 tops the list on Microsoft's console, and its sales are known to be in excess of a million units, including the collector's edition. THQ's UFC 2009 Undisputed ranks second on the Xbox 360 in 2009, with known sales of 1.03 million units in its two months on the market.

Activision Blizzard's Call of Duty: World at War takes #3 on the YTD chart, although its sales are difficult to estimate given its rankings this year and the fact that a collector's edition of the game is available.

The last two games, Microsoft's Halo Wars and Capcom's Street Fighter IV we estimate both have sales of 500,000 to 700,000, but again the situation is complicated by the existence of collector's editions.

The lists for the Xbox 360 and PlayStation 3 share several similarities. Both have three titles in common (although ranked differently) and both feature key first-party properties (two from Sony, one from Microsoft). Also, with the exception of World at War on the Xbox 360, all of the listed games were released in February 2009 or later.

Moreover, the sales are relatively modest compared to what we'll find on the Nintendo Wii list. On Sony's platform the five top-selling titles each have sales between 750,000 and 425,000 units. On the Xbox 360, the top five titles span the range from just over a million units down to 500,000 units.

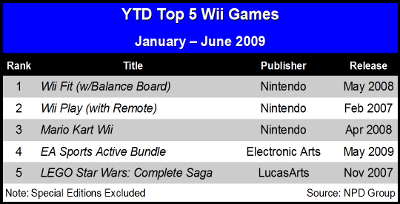

The list for the Wii is quite different, as we'll see below.

Here three first-party titles claim the first three spots: Wii Fit, Wii Play, and Mario Kart Wii. Sales of these titles are easily determined: 3.06 million, 1.5 million, and 1.4 million, respectively. All of those are clearly well above sales of the #1 title on the lists for the Xbox 360 and PlayStation 3.

It was expected that EA Sports Active would rank fourth on the Wii, given its robust sales of 630,000 units since its release two months ago. However, we were surprised to see LEGO Star Wars: The Complete Saga take the #5 spot on the Wii list.

This game ranked at the bottom of the top 20 list for the first three months of 2009, but then dropped out of view. According to the NPD Group, LEGO Star Wars: The Complete Saga for the Wii has sold over 400,000 units so far in 2009.

This means that the fifth best-selling game on the Wii in 2009 has sales on par with the fifth best-selling game on the PlayStation 3 during the same period. The difference, of course, is that MLB '09: The Show just came out in March 2009 while LEGO Star Wars: The Complete Saga has been available for 20 months as of the middle of this year.

In fact, only one game out of the five best-sellers in 2009 on the Wii, EA Sports Active, is actually from 2009. Two are from 2008 and another two from 2007.

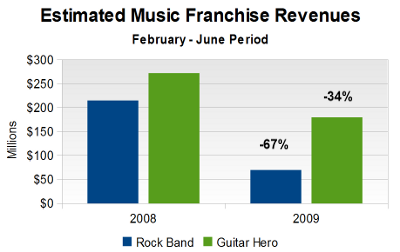

June 2009 was the second consecutive month without a Rock Band or Guitar Hero title in the top 20 software titles. The last time the software charts went two months without one of these franchises was in September and October 2007, right before the launch of Guitar Hero II on the PlayStation 2.

As we've commented before, these franchises are being guided in different ways by their respective publishers. MTV Games, the publisher of the Rock Band products, has released a sequence of Track Packs to provide new content to retail consumers. These $20 to $30 packs offer a variety of tracks or a set of themed tracks (e.g. country, classic rock).

As of this writing, there are effectively seven Rock Band titles in the console and handheld market, including the track packs and Rock Band Unplugged for the PSP. The next major game in the series, The Beatles: Rock Band, is expected in Fall 2009.

For its music game series, Activision Blizzard has also released track packs, but two could be considered more elaborate Guitar Hero expansions headlined by famous rock bands: one for Aerosmith in Summer 2008 and another for Metallica in Spring 2009. (A Van Halen package is expected in late 2009.)

These packages retail for $40 and higher, and have been bundled with guitar controllers. Activision Blizzard has also released three versions of Guitar Hero for the Nintendo DS, although those games are not compatible with the newer Nintendo DSi (which lacks the requisite Game Boy Advance slot for the extra guitar frets hardware).

To date there are over a dozen Guitar Hero titles from Activision Blizzard, from the original Guitar Hero through Guitar Hero: World Tour, and including the handheld versions along with themed/licensed expansions. Guitar Hero 5 is currently scheduled for release in Fall 2009.

The revenue, however, is not scaling up with the number of releases. Much of the initial revenue for both of these music games was generated through higher priced hardware and software bundles, including guitars, drums, and microphones. Fewer such bundles are being sold today, and consequently the average price of a piece of music software has declined.

According to data reported by Mr. Pachter of Wedbush Morgan, combined revenue from these two franchises during February – June 2009 has declined 49% from the same period in 2008. Revenue for the Guitar Hero franchise is down a more modest 34%, while revenue for the Rock Band series is down a more striking 67%.

For the year (including January) we estimate that significantly more than 3 million Guitar Hero software units have been sold for consoles and handhelds. During the same six-month period, just over a million Rock Band products have been sold (again, on consoles and handhelds).

Sales in the back half of 2009 will determine the future of the music game business. As consumers increasingly opt for software over expensive hardware bundles, the companies behind these games will see a commensurate drop in revenue.

While the publishers will probably still work with retailers to distribute music game controllers (albeit in lower volume), look for these games to shift to in-game storefronts to attract consumer dollars. The recent announcement of Rock Band Network, for example, is but one way that these games can expand their market without relying on retail sales of hardware and software.

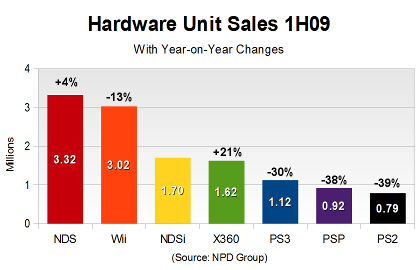

In the hardware segment, two established platforms have seen growth in 2009 while all others have lost ground with respect to sales in the first half of 2008. Given that every other part of the industry – software, accessories, online services like Xbox Live – depends on a large and growing installed hardware base, slowing hardware sales can be a key indicator of future results.

The worst news rests primarily with Sony and its PlayStation systems. The PlayStation 3 has suffered the least in 2009, with sales off 30% from the first half of 2008. In the face of two cheaper competing consoles – the Microsoft Xbox 360 and the Nintendo Wii – Sony has made little headway adding value to its system through bundling, and is under increasing pressure to cut the system's price. As we've noted before, a consumer who simply can't afford a $400 console still can't afford it when it includes a free game.

Sony's PlayStation Portable (PSP) and the PlayStation 2 are down 38% and 39%, respectively, for the first six months in 2009. Remarkably, PSP hardware sales increased from May to June (from 25,000 units per week to 32,800 units per week). It is unclear whether this bump in sales is related in any way to the announcement of the new PSP hardware model, the PSP Go, due in stores on 1 October.

The Nintendo Wii continues to underperform relative to its exceptionally strong sales in 2008. So far in 2009, Wii hardware sales are down 13%. (We saw above that Wii software unit sales were flat in the first half of 2009, but according to Mr. Pachter, software sales in the month of June were down 30%.)

For Nintendo's handheld business, things could hardly be better. Even without counting sales of the new Nintendo DSi, sales of the older Nintendo DS Lite are up 4% for the year. The Nintendo DSi, even at a $40 premium over the older model, continues to sell extremely well and could be considered the third best-selling system for the year so far.

With sales surpassing 1.7 million units since its April launch, the Nintendo DSi has had the most successful hardware opening of any system in recent history, including consoles. Even the Nintendo DS Lite didn't exceed exceed 1.8 million units until its fourth month on the market.

Meanwhile Microsoft's Xbox 360 has caught its second wind. Recall that sales slowed significantly through the first half of 2008, but the price cuts in Fall 2008 then increased the system's figures dramatically. For the year, Xbox 360 sales are up a robust 21%. September through December will be the true test for Microsoft's system, however, as it will begin to face comparison to last year's results after the price cut.

Generally speaking, several analysts expect two and possibly three of these systems to get price cuts by the end of the year.

The PlayStation 3 will likely receive the first price cut. Sony itself continues to be coy about its pricing strategy, but virtually everyone agrees that it must drop the price of the PlayStation 3 by at least $50 in the next two or three months.

Given Sony's global hardware sales target and the size of the U.S. market, we continue to favor a $100 price cut, preferably in August. Without such a cut, it seems unlikely to us that the PS3 base in the U.S. will contribute enough to help Sony reach the stated goal of a 30% increase in system sales.

The Nintendo Wii is also in line for a cut, although it is unclear how or when Nintendo will act. No other console has remained on the market at its launch price as long as the Wii, and it is likely that the system's sales would heat up significantly if its price were to drop below $200. Mr. Pachter suggests that as an alternative Nintendo could bundle the upcoming Wii Sports Resort with the system along with a MotionPlus remote while retaining the $250 system price.

Finally, Microsoft could be prompted to act if and when its competitors drop their prices, perhaps in favor of bundling high profile games while retaining its current price structure.

Throughout the remainder of 2009, we will be keeping a close eye on hardware events -- in particular price cuts -- and big software releases. We would like to see Sony drop the price of its PlayStation 3 by at least $50 around the same time that the first big software release, Madden NFL 10, is released in August.

If Nintendo was to announce a price cut, we feel that it will happen in the September - October period. Nintendo's commanding presence in the market allows them some leniency with respect to its pricing decisions, and it will not move precipitously just in response to a price cut from Sony.

The September releases of Guitar Hero 5 and The Beatles: Rock Band will probably dominate much of the industry's attention during that month, along with Halo 3: ODST on the Xbox 360.

If Microsoft is going to respond to any price cuts by competitors, either with its own cut or bundling, expect the announcement to come in October. By the time November rolls around, and with it the release of Call of Duty: Modern Warfare 2, the industry will be well into its year-end rush.

By that point, Sony will be more than halfway through its fiscal year, and we will have a better idea of whether it has any chance of hitting is PS3 sales target. By the time October's results are in, sometime in mid-November, we'll probably also have a better idea whether the industry's annual revenue will fall above or below 2008's record $21.3 billion.

[As always, many thanks to the NPD Group for its monthly release of the video game industry data, with a special thanks to David Riley for his assistance.. Additional credit is due to Michael Pachter, analyst for Wedbush Morgan Securities for his perspective and information. Finally, many thanks to colleagues at Gamasutra and commenters on NeoGAF for many helpful discussions.]

Read more about:

FeaturesYou May Also Like