NPD: Behind the Numbers, July 2011

Gamasutra analyst Matt Matthews breaks down sales figures for July -- the new "lowest month since October 2006" at U.S. physical video game retail -- examining trends in software and hardware, including in-depth information on 3DS, Kinect and PlayStation 3.

[Gamasutra analyst Matt Matthews breaks down sales figures for July -- the new "lowest month since October 2006" at U.S. physical video game retail -- examining trends in software and hardware, including in-depth information on 3DS, Kinect and PlayStation 3.]

One could be forgiven for thinking that the industry was passing through some sort of lowest point when retail video game sales for May 2011 were reported as “the lowest month since October 2006” according to NPD Group analyst Anita Frazier. And yet the miserable results for July 2011 were worse, with Frazier crowning it the new “lowest month since October 2006.”

Indeed, the U.S. retail estimates published by the NPD Group last week have only tiny bits of good news hidden among all the gloom. Software, hardware, and accessories: all of these were down, year-over-year, and the the prospects for August are similarly grim.

Below we'll try to explain some of the currents underneath the turbulent surface of the top-line figures and point out some expectations for the coming weeks and months. The software segment, in particular, requires some of our attention as does the effect of hardware pricing for the four newest systems on the market today.

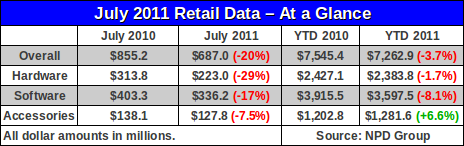

The Numbers, At a Glance

No segment of the retail video game market was spared in July 2011. Even the accessories segment, which had been positive for much of the year, showed an 8% decline in retail dollar sales over the figures from July 2010.

And here we must make a quick aside to point out that the NPD Group revised its total July 2010 figures slightly from the results reported in August of last year. The combined retail sales for console and handheld hardware, software, and accessories was revised upward from $846.4 million to $855.3 million, a difference of nearly $9 million. Such revisions regularly occur, and we let them pass without comment, but this adjustment seemed significant enough to warrant a bit of elaboration.

The $9 million increase came entirely from a revision of the accessories segment. That pushed the July 2010 results from -0.5% to +0.5% year-over-year (compared to 2009). A subtle change, to be sure, but without that revision to the 2010 figure the July 2011 accessory sales figure would have come in at only -1% instead of -8%.

The hardware segment was particularly strongly affected by the downturn in July, with an estimated 25% drop in hardware unit sales compounded by a 6% drop in average selling prices for that hardware. The result was a staggering 29% drop in hardware revenue.

Software also saw a decline in both unit sales and prices. The average price for software in July 2011 fell below $34, the lowest we have seen in the years for which we have records. The nearest comparable month we know is April 2009, when the ASP for software was again around $34. However, in that month nearly 15 million units of software were sold, while the total in July 2011 actually appears to have fallen below 10 million.

The key revenue estimates published by the NPD Group are gathered below for ease of reference.

The NPD Group highlights to the media that the data above represent retail revenue figures, and that there are separate estimates for video game content sold through other means. They are providing quarterly estimates of those extra-retail sales, including mobile games, downloadable content, and casual games, along with other segments. Our latest analysis of the full market figures released by the NPD Group was given in last month's overview.

These extra-retail sales are becoming more important, and analyst Anita Frazier of the NPD Group commented that “growth in these areas, combined with a flat to modest decline in new physical sales should result in 2011 showing growth over 2010.”

We remain dubious on both counts, but are willing to be convinced. Retail sales for video games were down in July of this year, a month in which preliminary estimates by the U.S. government appear to show growth in general retail sales (but not video games). Moreover, we are waiting for more publishers and platform holders (including players like Facebook and Google) to show confidence in the NPD Group's estimates for the extra-retail segments before assigning them the same respect we have for the retail estimates.

For his part, Wedbush analyst Michael Pachter believes that “overall sales are up this year,” adding that downloadable content “is becoming big business.” Publishers like EA and Activision are increasingly focusing on using such means to increase the profit margin they can realize from a single sale at retail.

Software Collapse

With the right mix of software releases, July could have been a month of growth for the packaged video game industry. However, a dearth of new releases and the collapse of titles from previous months drove July to a mere $336.2 million in revenue, a drop of nearly 17% from the $403.3 million figure for July 2010.

During the last historical peak in video game sales three years ago, the industry experienced its best July showing ever, with software sales of $592.2 million in July 2008. The results of July 2011 represent 43% decline – or over a quarter of a billion dollars – in software revenue from that record.

Looking back at the available sales charts for earlier in 2011 as well as July in the years 2008, 2009, and 2010 provides some helpful context for understanding what happened in July of this year.

First, at least three titles which had been key to sales this summer did not perform well last month. Sony's PS3-exclusive InFamous 2, which had launched as the third best-selling game in June and sales of over 350,000 units, did not make the top 10 chart at all for July. Moreover, L.A. Noire and Duke Nukem Forever, the #1 and #2 games in June, respectively, also dropped out of the top 10 in July.

According to Anita Frazier, analyst for the NPD Group, only eight games had sales of 100,000 units or more in July 2011. In this case, Frazier is speaking of sales after combining all versions of a game across all platforms (as shown on the chart below), so the aforementioned titles which fell off the top 10 chart each had sales of less than 100,000 units. Even accounting for the difference in the number of weeks (June is a 5-week month for NPD Group data, while July has only four weeks), that means the decline in sales of those key games was significant.

Looking back at 2008 and 2009, one gets a sense of what is missing in 2011: first-party Nintendo games and music games. During July 2008, the top-selling game was NCAA Football 09 on the Xbox 360, but half of the top 10 was dominated by software for Nintendo platforms: Wii Fit, Wii Play, Mario Kart Wii, and Rock Band for the Wii and Guitar Hero: On Tour for the Nintendo DS.

(Note that at that time the NPD Group was providing charts that did not combine titles across platforms, as the chart above for July 2011 does. So, for example, if the July 2008 chart were remade in the format used today by the NPD Group, it would combine Rock Band across all platforms and not provide a separate entry for Rock Band for the Wii.)

In July 2009, NCAA Football 10 for the Xbox 360 wasn't even the top-selling title (again, without combining versions). Rather, Wii Sports Resort ranked first for the month with sales of over 500,000 units. That month six of the top 10 titles were for Nintendo platforms, including Wii Fit, Mario Kart Wii, Mario Kart DS, Pokémon Platinum (DS), and New Super Mario Bros. DS.

Other than New Super Mario Bros. DS, which launched more than five years ago in May 2006, not a single Nintendo first-party title broke into the top 10 in July 2011.

This isn't to say that Nintendo Wii software isn't selling. In fact, several titles in the top 10 this month are probably there precisely because they sell well on the Wii and the Nintendo DS. That includes licensed titles like Cars 2 and LEGO Pirates of the Caribbean as well as Just Dance 2 – the current trend in music-based games – and Zumba Fitness.

As we have stated before, we believe that Wii software sales are driven primarily by the enthusiasm of new owners (consumers who have picked up a console within the last six months). We believe this is especially true for Nintendo's first-party titles, and so sales of games like Mario Kart Wii have simply fallen in tandem with Wii hardware sales. The sales of the third-party titles here is possibly the baseline support that the huge installed base of Wii owners can provide, along with some contribution from some new owners.

The lack of big new releases in July isn't new, but it did compound the problem this year. Back in 2008 the biggest new title for the month (other than NCAA Football 09) was Soul Calibur IV for the Xbox 360 and PlayStation 3, and combined that title sold fewer than 400,000 units. Other than Wii Sports Resort, no new release made the top 10 in July 2009, and the biggest new release fin July 2010 was Crackdown 2 for the Xbox 360, which sold just over 200,000 units. (If we combine versions as the NPD Group does now, the top new release would have been LEGO Harry Potter: Years 1 – 4, which sold over 270,000 units combined on the Wii and Nintendo DS.

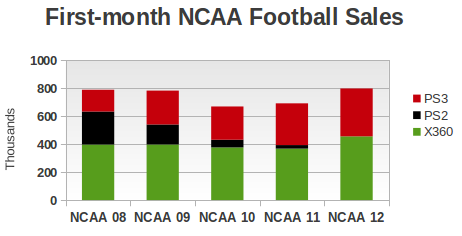

Before moving on, we would like to note at least one bit of good news for EA's NCAA Football franchise. With the end of the PlayStation 2 and PSP as a key platforms, the seminal college football title has moved to just the PlayStation 3 and Xbox 360. (We'll decline to opine upon the aborted All-Play experiment for the Wii.)

Despite consolidation on two platforms, NCAA Football 2012 has shown 15% growth in sales over last year. The figure below shows historical data for NCAA Football on the three main platforms.

NPD Group analyst Liam Callahan noted that “while unit sales of NCAA Football 12 favored the 360 in absolute numbers, the ratio of PS3 to 360 units was higher than the ratio of the current PS3 install base to the 360 install base.” He added that this result was “consistent with NCAA Football 11 which had the same 0.8 ratio of PS3 to 360 unit sales, also higher than the PS3 to 360 install base ratio last July.”

For Nintendo, Pricing is Key

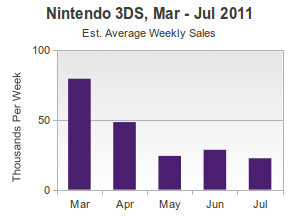

There were only three days left in the NPD Group reporting period when Nintendo announced it would cut the price of the Nintendo 3DS handheld from $250 to $170, effective on 12 August 2011. Consequently, the announcement's effect on July sales was probably negligible and we can look at July sales as entirely the result of the handheld's launch price and software.

According to official NPD Group data provided to us, the average selling price (ASP) of the 3DS during the month of July 2011 was $248, confirming that the system was not seeing much in the way of retail discounting through the end of July. Moreover, based on that ASP and the other ASPs for other hardware platforms, comments made by Anita Frazier, and the figures revealed by Microsoft and Nintendo in their respective press releases, we estimate that the Nintendo 3DS sold around 90,000 – 95,000 units during the month.

That would mark a 20% decline from June 2011 results, based on average weekly sales, and a 7% decline from the rate in May. The figure below shows the average weekly sales rates for the 3DS since launch.

As a result of these figures, the Nintendo 3DS had still not sold a million units in the U.S. by the time Nintendo announced the price cut. (Our estimate puts it somewhere between 915,000 and 940,000 on 30 July 2011.)

For comparison, during the first five months of its life, Sony's PlayStation Portable (PSP) sold just over 1.7 million units.

The 3DS is now priced the same as the Nintendo DSi XL and only $20 more than the Nintendo DSi, which should make it far more attractive to consumers considering the other Nintendo handhelds. However, price alone won't overcome the lack of 3DS software, and Nintendo knows that. Since the price cut, the company has repeatedly mentioned that a Super Mario 3D Land and Mario Kart 7, both for the 3D handheld, will be available later this year.

We will see in August's figures, and perhaps more clearly in September's data, just how important that price drop will be, since Nintendo's key new software still won't have arrived.

During that period consumers will have a choice of four Nintendo handhelds: the Nintendo DS Lite, the DSi, the DSi XL, and the 3DS. The DS Lite was priced at $100 starting in June 2011, and has been increasingly difficult to find at retailers and online. However, in July the average price of across the three DS models (i.e. not including the 3DS) was $130, according to NPD Group estimates, and that means that a significant number, about 30-40%, of these consumers are opting for the cheapest model.

That suggests to us that the surge in sales the Nintendo DS line saw during June and July, from 50,000 units per week in May to over 75,000 units per week, was largely driven by the Nintendo DS Lite price drop. If the DS Lite disappears (and we expect it won't be available much longer) then so will those consumers, and the price of getting a Nintendo handheld will have moved up to $150.

As a consequence, Nintendo's current pricing will encourage some potential Nintendo DSi and DSi XL consumers to select the 3DS instead, but that population is limited. When the September numbers arrive in mid-October, we may well be talking about 150,000 – 180,000 units per month for the 3DS. An improvement, surely, but Nintendo certainly wants stronger figures.

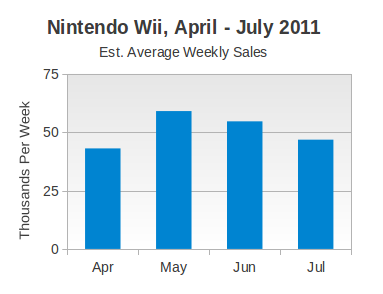

The market for the Wii is also showing a sharp sensitivity to price, as the effects of the price cut to $150 in mid-May are already appearing to dissipate. Sales shot up to nearly 60,000 units per week during May, but fell back slightly in June and then returned to nearly the same level seen in April, near 45,000 units per week. (See the figure just below.)

Two months ago we suggested that Wii sales could follow precisely this kind of trajectory, citing the recent PSP price drop as a precedent. Should Wii sales erode further (below, say, 150,000 units per month) it will be interesting to see how, or even if, Nintendo chooses to respond. It is conceivable that consumers waiting for the system be priced less than $200 bought it during one of the many retailer specials (e.g. with a gift card), bought it used, or adopted another system. As a result, the next large group of consumers to which Nintendo could appeal are waiting for a system below $150.

Pricing the HD Consoles

Using robust sales as a metric, the system which currently best exemplifies a balance of features and price is Microsoft's Xbox 360, especially with its Kinect peripheral. Broadly speaking, Microsoft offers the Xbox 360 at three prices: $200 for the entry-level model, $300 for a top-level model or entry-level with Kinect, and $400 for a top-level model with Kinect.

According to the NPD Group, the average price for Xbox 360 systems sold in July 2011 was $280. That's up from the $268 average price in May, but down from the $306 in January. The current ASP suggests that approximately half of Xbox 360 consumers are choosing the least-expensive model while the rest are spending $300 or $400 on their system.

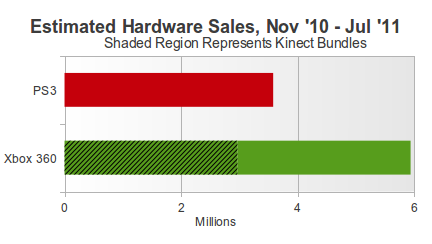

When asked for elaboration, NPD Group analyst Liam Callahan added that the “Xbox 360 hardware ASP is up 13% YTD, driven by the higher priced Kinect bundles.” And as to how the sales of the more expensive Kinect bundles compare to non-Kinect bundles, he added that they “represent 52% of Xbox 360 hardware unit sales since they were introduced in November 2010.”

That figure, 52% of systems sold since November 2010, is astonishing. It would appear that nearly 3 million Kinect-bundled Xbox 360 systems have been sold in just nine months. (Without additional information on the Kinect as an accessory, data which is typically closely held by the NPD Group, we cannot know how many additional Xbox 360 systems may have Kinect sensors.)

For a sense of scale, during the period in which nearly 3 million Kinect bundles have been sold, the PlayStation 3 has sold just under 3.6 million systems.

Globally, Sony has estimated that it will ship as many PlayStation 3 systems this fiscal year (ending on 31 March 2012) as it did during the last fiscal year. Because a system's price must traditionally be decreased to maintain sales, and the last price drop was two years ago in August 2009 with the introduction of the PS3 Slim model, we believe that the company has been preparing for a price drop before Christmas of this year.

For us the questions are not so much whether Sony will drop the price, but rather when and by how much.

Speaking just about the U.S., the average price for the PlayStation 3 currently sits at around $312, according to official NPD Group figures for July 2011. That means that the system sells for $32 more than the Xbox 360, on average.

Were the ASP to translate directly with any price drop, a $50 price cut to the PS3 would put its below the Xbox 360's current ASP. Such a cut would also fit with Sony's view of the PS3 as a long-term, profitable platform. Even with recent tweaks to the PS3 internals, we believe that a $100 cut would incur a loss for each system sold.

As for the timing, we favor a cut sooner rather than later, and Gamescom this coming week would be an ideal platform for that announcement, two years after the last cut and major hardware revision.

However, Sony has shown tremendous patience this entire generation, enduring endless calls for price cuts as it has trimmed the $600 launch system down to the leaner $300 system it is hawking today. It held its ground on pricing from November 2007 until August 2009, and it could potentially hold out much longer this time.

In speaking with Wedbush Securities analyst Michael Pachter on the issue of PS3 pricing, he said that “Sony most likely [will wait] for Microsoft to cut before they react.” Were a new, reduced-cost model waiting for launch, however, he believes they might cut the PS3 price first.

Prior to the introduction of the PS3 Slim, there were numerous unsubstantiated rumors and even photographs of the new model. There appear to be no such leaks about a new model this year, even though this is merely suggestive rather than dispositive.

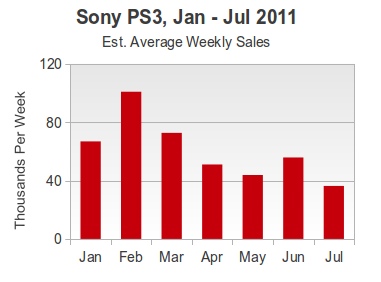

Even if Sony does not announce a price cut in the coming week, we believe it will do so by the end of the year. With all the effort Sony has put into its system, pushing exclusives like Killzone 3 and InFamous 2, the system did not break 150,000 units in July, by our estimates. (The above figure shows weekly rate estimates for the year.) Should sales continue at that rate through August and into September, Sony will probably feel pressured into cutting the price prior to the end of October, just as holiday sales are beginning.

Unfortunately, the effect of a $50 price cut may be quite modest. If consumers are continuing to purchase Microsoft's Xbox 360 because of Kinect or for Xbox Live or for system exclusives like Halo or Gears of War, then it will take more than just a $250 entry-level price to get them to consider the Sony's machine.

[As always, many thanks to the NPD Group for its monthly release of the video game industry data, with a special thanks to David Riley. Thank you in particular to NPD Group analyst Anita Frazier for her monthly analysis notes, and to Liam Callahan for his added insight and coöperation.

Additional credit is due to Michael Pachter, analyst for Wedbush Securities, for his perspective, instrucive conversations, and entertaining anecdotes. We also drew on the comments of Doug Creutz of Cowen and Company, and wish to thank him for his perspective.

Finally, many thanks to colleagues at Gamasutra and particularly regular commenters on NeoGAF for many helpful discussions.]

Read more about:

FeaturesAbout the Author(s)

You May Also Like

.jpeg?width=700&auto=webp&quality=80&disable=upscale)