Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Gamasutra analyst Matt Matthews examines yet another underwhelming month at U.S. physical video game retail, delving into price cuts for PlayStation 3 and 3DS, and pointing out that the absence of Madden isn't the only reason for August declines.

[Gamasutra analyst Matt Matthews examines yet another underwhelming month at U.S. physical video game retail, delving into price cuts for PlayStation 3 and 3DS, and pointing out that the absence of Madden isn't the only reason for August declines.]

One could be forgiven for thinking that a month with two major hardware price cuts would be a time for celebration of higher packaged good sales in the video game industry, but August 2011 just didn't work out that way. While the Nintendo 3DS dropped from $250 to $170 and Sony's PlayStation 3 shed another $50 to $250, consumers largely kept their wallets closed according to the latest NPD Group estimates of retail sales.

Truly, the price cuts had their immediate intended effect – the 3DS sold 235,000 systems and the PlayStation 3 moved over 215,000 – but software and accessory sales did not immediately follow.

In part, this can be attributed to the absence of Madden NFL 12 from the August software list, but Wedbush Securities analyst Michael Pachter noted that using last year's Madden sales as a proxy demonstrates that software revenue still would have been down this year.

This month we'll examine the hardware price cuts in detail, and ask both what they mean for the immediate market and where they are likely to head going into the end of 2011.

We'll also look at just how beleaguered the physical software market was in August, and how it is getting more and more difficult to argue that the packaged gaming industry is just in a temporary slump.

Before we dive in, however, we take our monthly run through the top-line figures and take stock of the industry's revenues so far in 2011.

Looking back over the transition from July to August at retail, it isn't uncommon to see hardware revenue decline while console software revenue is either flat or grows about $10 – $40 million. The summer months typically have slower retail sales, regardless.

August 2011, by these expectations, was turned completely on its head. Hardware revenue was up $26 million from July, due in part to stronger PlayStation 3 sales and much improved Nintendo 3DS sales. However, console software went the other direction, dropping nearly $68 million from July's figures.

The drop in software revenue, as we've seen many times before, came from a combination of lower unit sales (here from about 10 million units in July to just 8.4 million in August) and a decline in software prices (from an average of $34 to under $32).

For its part, the accessory segment maintained its strength, with sales flat year-over-year and actually up slightly from July.

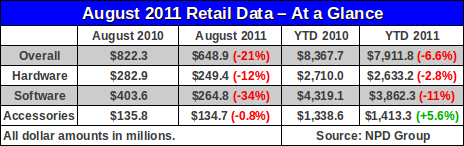

The chart below shows the monthly and year-to-date revenue figures, for easy reference.

The NPD Group highlights to the media that the data above represent retail revenue figures, and that there are separate estimates for video game content sold through other means. They are providing quarterly estimates of those extra-retail sales, including mobile games, downloadable content, and casual games, along with other segments.

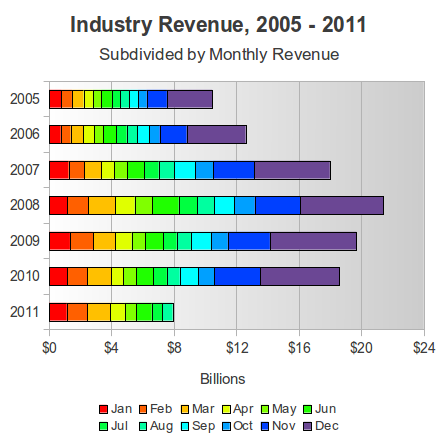

Earlier this year we held out hopes that the industry would pull out a year with retail revenues similar to 2010, around $18.6 billion. However, as that chart above makes abundantly clear, the revenue picture for 2011 looks quite grim compared to last year. If retail sales are flat for the remainder of the year, then total retail sales will come in around $18.1 billion in 2011.

We think that's unreasonably optimistic. All the great software releases are piled up from September through Christmas, and nothing in the past few months gives hope that the American consumer is about to buy games with utter abandon. Instead, we expect that many notable games will go ignored at retail by consumers while the biggest names (like Call of Duty and Just Dance) soak up the money that consumers are likely to spend.

That need not mean lower overall sales, but in this case we believe that to be the case. Call of Duty: Modern Warfare 3 could be bigger than Black Ops was last year, but it likely can't be large enough to make up for the games that will be left on shelves as a result.

Here's the year-to-date “rainbow graph” we've often brought out for taking stock of the annual revenue. We're currently tied with 2007 for revenue, and this year the industry won't have tremendous Wii hardware and software sales to save it.

On August 16, 2011 at Gamescom 2011 in Cologne, Germany, Sony issued a global price cut for its PlayStation 3 system, including a $50 price cut in the United States, almost exactly as we suggested last month. With the price of entry now at $250 for a 160GB PlayStation 3 system, many anticipated that the system would see a resurgence in sales throughout August, a surge that could continue throughout the remainder of 2011.

It had been a full two years since Sony issued an actual price cut to its flagship console. With the introduction of the PS3 Slim model back in August 2009, the price of the system went from $400 to $300. As the company focused on profitability, it has stubbornly stuck to that price and one gets the impression that the current $50 cut was given only grudgingly.

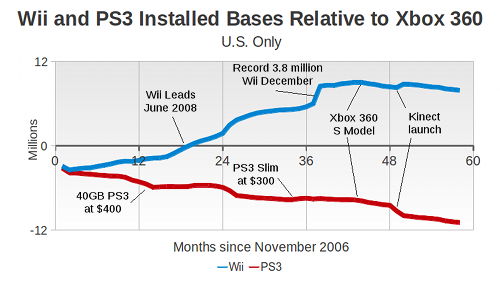

The reality is that the PS3 is the third-place console for this generation in the United States and will likely remain there for the rest of this hardware cycle.

If Microsoft were to cease Xbox 360 sales today and PlayStation 3 sales were to continue at their current annual rate for two years (an unlikely occurrence in any case), Sony's platform would still not have caught up.

Fortunately for Sony, it has reached enough of an installed base in the U.S. – 17.5 million systems by our estimates – that it cannot be ignored by publishers. Taken as a whole, the high-definition console space in the U.S. is split about 40/60 between Sony and Microsoft.

The figure below shows the PlayStation 3 and Wii installed base sizes relative to the Xbox 360 installed base.

This shows just how far Sony has gotten behind its two rivals, the rapid growth and slowdown of the Wii, and the release of several key hardware models. It also shows the net effect of Sony's price cuts: far from helping Sony gain ground, they have merely slowed the rate at which the PS3's base has fallen behind.

Last month we said that the key questions were when Sony would cut its price and by how much. With those satisfactorily answered, we move now to how the price cut will accelerate sales, and for how long.

As to the former, we begin with the actual sales figures themselves. We estimate, based on comments made in Nintendo and Microsoft press releases, that the Sony PlayStation 3 sold between 215,000 and 220,000 units in the United States in August 2011. For the NPD Group, that 4-week sales period included 12 days during which the PS3 was available at a reduced price.

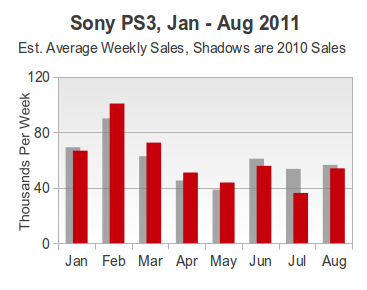

The figure below shows the estimated average weekly sales rates for the PS3 for each month this year. The shadowed bars are the same figures but for 2010.

By this measure the price cut appears to have increased sales for the month by about 50%. However, the fact that the price cut was active for only 12 days means that the effect on the weekly rate was certainly quite a bit more pronounced.

If we assume that the rate from July (about 36,000 units per week) continued for the beginning of August, then Sony sold approximately 130,000 PS3 units after the price cut. That's approximately 78,000 units per week – or over twice the rate seen in July.

The actual change is likely somewhere between these extremes, and that's good news for the present, since 60,000 – 70,000 units per week outside of the holidays is a very solid rate of sales. In effect, the PS3 has been restored to the relatively strong sales it saw earlier this year.

How its price cut plays when the holidays arrive is another matter.

The $300 PS3 Slim was considered a good value by consumers in late 2009, but Microsoft has made a lot of progress tipping the value proposition in their favor. The Xbox 360 S Model and heavy Kinect promotion have combined with the platform's existing strengths (name brands like Halo and Xbox Live's feature set) to make its $200 entry-level price very popular with consumers.

In July, the PlayStation 3 sold for about $310 on average while the Xbox 360 sold for about $280. If consumers think that the Xbox 360 offers a better value, then the $50 PS3 price cut could bring the PS3's average price below that of the Xbox 360 without actually driving PS3 sales higher than Xbox 360 sales.

Except for Blu-ray playback and Sony-exclusive software, the Xbox 360 will likely look like a good alternative to the PS3 this holiday season. That will likely cap the rate of PS3 below what we saw in the last four months of 2009 (when the PS3 Slim did exceptionally well) and keep the PS3 below 5 million systems for the year. (Worldwide, Sony expects to sell 15 million PS3 systems between 1 April 2011 and 31 March 2012, a quantity equal to the previous fiscal year's sales.)

Truly, that 5 million will be their best calendar year ever in the U.S. but it will still likely put them behind both the Xbox 360 and the Wii for 2011.

When we discussed the July 2011 sales estimates released by the NPD Group, Nintendo had already announced its intention to price the Nintendo 3DS at $170 as of August 12. Because the announcement came right at the end of the July sales period, it could only have affected three days of sales out of 28.

According to Nintendo's press release after the August 2011 sales estimates were published, they saw sales 260% higher during the 19 days following the price cut compared to the analogous period in July. (This suggests that Nintendo is relying on its own sales tracking system, since that period extends beyond that covered by the NPD Group's estimates.)

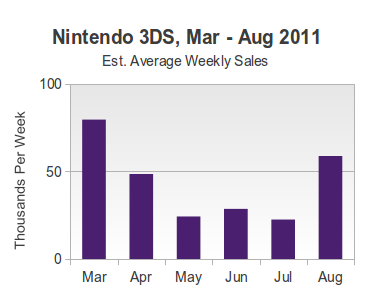

As a result of the price drop, the Nintendo 3DS saw sales increase from about 22,500 units per week in July to over nearly 59,000 units per week in August.

Sales of the Nintendo DS systems (Lite, DSi, and DSi XL) dropped 45% month-over-month while total sales of Nintendo handhelds (3DS plus DS) were flat from July to August.

Together, these facts suggest that consumer demand for Nintendo handhelds remained relatively flat and those shoppers largely opted for the 3DS over one of the older models.

As the figure below shows, that sales rate puts it above every month except March 2011 (the system's launch). Moreover, we still haven't seen a full month of sales figures for the system at its new $170 price, so there is the possibility that its weekly rate will rise again in September.

Given the preliminary readings, it would appear that the Nintendo 3DS will exceed 300,000 units in September (a five-week month for the NPD Group's purposes), which is clearly a strong push going into the holidays.

Let us turn to where the 3DS will go from here, since it is likely to stay entrenched at its current $170 price for a very long time.

Supplies of the $100 Nintendo DS Lite appear to be drying up at retail, leaving the $150 Nintendo DSi and the $170 Nintendo DSi XL as the only two alternatives to the $170 Nintendo 3DS. We expect Nintendo to announce new pricing for the older models in the coming months, perhaps putting the DSi at $130 and the DSi XL at $150.

Even with its own older brethren competing at lower prices, the Nintendo 3DS should be well-positioned for the holidays, since Nintendo has made it clear that 3DS software will be its primary handheld focus going forward. The company is betting that Super Mario 3D Land and Mario Kart 7 will draw enough fans to the system to keep sales fueled into next year when, hopefully, more third-party software will begin to arrive.

After a slow start, the last four months of 2011 are the window during which the Nintendo 3DS will have its second chance to establish itself as a major platform. As the older DS line recedes in importance, Sony's PSP continues its slow decline, and the PlayStation Vita remains unavailable in the U.S., Nintendo will have the dedicated handheld market all to itself.

If it executes well, the company and current management could reap the benefits of a big turnaround, akin to the revival the Nintendo DS saw with the introduction of the DS Lite in mid-2006.

Should it fail, and that possibility should not yet be ruled out, then the consequences will not only be dire for Nintendo. The industry at large is struggling with an ongoing image of weakness, and headlines inside and outside the video game press will likely portray Nintendo's stumbling as another indication that the iPhone and iPad app markets have irrevocably changed the economic landscape for games. In particular, we believe that that will be the storyline – whether it is true or not.

The retail software figures for August are alarming by just about any measure. In terms of units, or dollars, or prices – we have not seen anything like this for a very long time.

Certainly, the delay of Madden NFL 12 by EA Sports left a large hole in August sales, but even that is not enough to explain away all of the decline. The NPD Group reported that software revenue for August 2010 was $403.5 million and that declined by over $138 million (or 34%) to $264.8 million for August of this year.

According to Wedbush analyst Michael Pachter, EA's Madden accounted for over $100 million in software sales last August, and had it done as well this year it would have brought the decline in software to only 6% (or about $24 million).

However, Cowen & Company analyst Doug Creutz noted last year that 1.97 million units of Madden NFL 11 were sold during the game's launch month, and that is almost exactly the decline in software units from August 2010 to August 2011.

That is, had Madden NFL 12 actually launched as usual and sold as well as it did last year, software unit sales would have been about flat (down less than 3%) but actual software revenue dollars would have declined at over twice that rate.

As usual, this situation signals a dramatic decline in the average price of software, and in fact that is what happened in August. You may recall that, in July, we noted that the average price of software fell below $34 for the month, and that that was the lowest average for a month in our records going back several years.

In August that average fell below $32, more than $2 lower than the rate we found alarming just a month ago. As Pachter noted to us in an email, the very low ASP tells us that software sales in August were “all catalog,” i.e. older releases and licensed games.

Indeed, as the August 2011 top 10 list released by the NPD Group shows, only two new releases (highlighted in blue) made the cut, Deus Ex: Human Revolution and Phineas and Ferb: Across the 2nd Dimension.

Three titles, highlighted in red above, were from 2010. The remaining titles are all from May, June, and July of this year. Moreover, the titles themselves are more casual, licensed, and family-oriented than what the industry has come to expect recently. August's list contains a college sports license, two animated cartoon licenses, two licensed dance games, and a licensed fitness game.

One can hope that the lull during the summer has just been a calm before the storm, and that industry will pull of a strong finish during the remainder of the year with both its core and casual titles. Because the focus has shifted away from the Nintendo Wii, and the Nintendo 3DS still has a relatively small installed base (just over 1.1 million systems), most of the sales will have to come from titles on Microsoft's Xbox 360 and Sony's PlayStation 3.

September alone will have Madden NFL 12, a big cross-platform title, and the platform-exclusive Gears of War 3 (Xbox 360) and Resistance 3 (PS3). Another wave of games will drop in October with RAGE, Batman: Arkham City, and Battlefield 3 fighting for action game dollars while Just Dance 3 takes that hot casual franchise into multiplatform territory for the first time.

Finally, the year will finish with Call of Duty: Modern Warfare 3 in November, for all major platforms, Uncharted 3: Drake's Deception on the PlayStation 3, and Halo: Combat Evolved Anniversary on the Xbox 360.

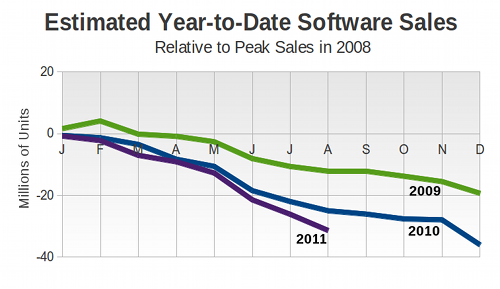

The following figure shows just how much ground the retail industry will have to make up in order to finish the year flat – or even just down a small amount – compared to 2010. It shows year-to-date software unit sales for the past three years using the record high software sales of 2008 for comparison. (That is, each curve below shows year-to-date sales for each year after the comparable figure from 2008 has been subtracted. Because every year has come in lower than 2008, the curves are largely at negative values.)

Except for the first two months of 2009, the retail industry has been far behind its peak in 2008, and it now appears headed for another down year.

In the past few years, the retail industry has sold approximately half of its annual software units prior to the end of August, and the other half from September through December. If we take that general rule of thumb and apply it to this year, we arrive at an estimate of 215 – 220 million software units for all of 2011. That would put 2011 sales at around 10-15 million units below 2010's total.

Even if August 2011 was just a fluke – the kind of slow sales month that comes once every decade – the fact remains that 2011 has been yet another weak year at retail. At some point the industry will have to make the case that it is not undergoing a “secular decline”, to use the words Michael Pachter famously used to characterize investor pessimism about the the video game business.

Larger publishers like Electronic Arts, and more recently Activision Blizzard, have begun to embrace a future which integrates online digital delivery and services with retail products and services. Smaller companies have long been plying their wares online – as direct sales, as services, and as free-to-play venues which sell virtual goods. Unfortunately, the metrics used in those online areas are still so ill-defined and so different from traditional metrics, that the overall health of the video game industry remains difficult to discern.

In cooperation with the NPD Group, publishers and platform holders, have agreed on some definitions for transaction classifications. The next step is regular, transparent reporting of revenues using those definitions, both by publishers and the NPD Group itself. Perhaps then we can say whether software sales growing, flat, or truly down $500 million as the retail estimates suggest.

[As always, many thanks to the NPD Group for its monthly release of the video game industry data, with a special thanks to David Riley. Thank you in particular to NPD Group analyst Anita Frazier for her monthly analysis notes, and to Liam Callahan for his added insight and coöperation.

Additional credit is due to Michael Pachter, analyst for Wedbush Securities, for his perspective, instrucive conversations, and entertaining anecdotes. We also drew on the comments of Doug Creutz of Cowen and Company, and wish to thank him for his perspective.

Finally, many thanks to colleagues at Gamasutra and particularly regular commenters on NeoGAF for many helpful discussions.]

Read more about:

FeaturesYou May Also Like