Trending

Opinion: How will Project 2025 impact game developers?

The Heritage Foundation's manifesto for the possible next administration could do great harm to many, including large portions of the game development community.

Game developer and publisher MumboJumbo (Luxor) is one of the pioneers of taking downloadable casual games into the retail sector, and Gamasutra chats to CEO Mark Cottam about the practicalities of putting casual PC and now PSP titles on store shelves.

Game developer and publisher MumboJumbo has taken the initiative in bringing casual games from the downloadable market into the retail sector, licensing titles both internally and externally for distribution on store shelves, including Super Collapse! 3, Cubis 2, and their proprietary hit franchise, LUXOR.

Gamasutra's Frank Cifaldi sat down with MumboJumbo CEO Mark Cottam to find out how this unique venture is working out, and to detail the market segment that purchases casual games from brick and mortar stores.

Gamasutra: MumboJumbo is taking so-called "casual" games, which are typically sold exclusively through online channels, and putting them on retail shelves. Is anyone else doing that on your kind of level?

Mark Cottam: Casual games at retail grew out of the digital download world. Until recently, there was really no one else that was focused on this content, packaging it up and bringing it to retail. Obviously, the term "casual games" has become more common so we see a lot of companies looking at the category, trying to figure out what it is that works, and looking to bring content out under the casual games heading. At this point, MumboJumbo is the dominate publisher of casual content at retail. I would expect that in 2007 we'll see other companies come into this area and truly compete with us not only for shelf space, but also for licensing of titles.

GS: If I'm not mistaken, you published Myth III?

MC: Not exactly, we developed the game.

GS: That was obviously not what we consider a casual game; it's sort of a full-priced, regular game. Is that something you still do, or…?

MC: If you go back to the beginning of the company in 2000, MumboJumbo started as a developer of action, or AAA type, content working for companies like Take-Two. We specifically developed Myth III for Take-Two and they actually published it. We did work also for Electronic Arts and Dreamworks. In 2003 we saw the emergence of the casual game category. We knew we had to develop an expertise in the categroy, even though we didn't understand what exactly made a game “casual.” So in the middle of 2003 we converted our development efforts to casual games, and now all of our development resources are committed exclusively to casual games.

GS: All right. So that's just on the development side, but as far as publishing, you obviously publish – as far as retail anyway, and perhaps online also – games that were developed outside of MumboJumbo, right?

MC: We do. We've branded MumboJumbo as a developer and publisher of "premium casual games." Everything that is either developed internally or being licensed and published into retail falls into the casual game category, and a lot of our content does come form the other developers in the casual games space.

GS: I see. So let's talk about sales for a little bit. I'm kind of wondering about the sales of certain titles in their retail versus online incarnations. Are we seeing certain trends? Do certain types of casual games sell better on store shelves?

MC: As the market started to grow on the download side in 2003 and we started working that content into retail, most of what we brought into retail was the top selling games in the download community. Games like Bejeweled, Super Collapse and Jewel Quest, and our own brand, LUXOR. We were really taking the top performing products and putting them into retail. In the early stages, we saw a direct correlation between how well the title did online and how well it did at retail. And I believe in the early days that the download side, the whole kind of digital arena, created the awareness for these brands at retail. There was a lot of brute force marketing in the download space, due to sites like Yahoo!, RealArcade, MSN and Pogo, making these games very visible. As a result, I think consumers became aware of the brand, and then as they went into retail and started seeing those same brands, they began picking them up off the shelf.

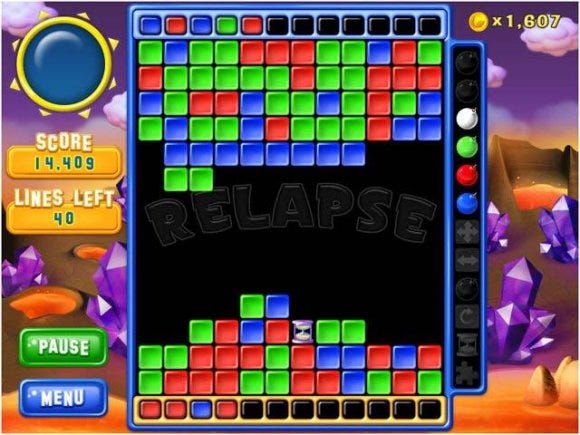

Super Collapse! 3

GS: Okay! Well, my next question was along the lines of 'How do you sell these retail games without the immediate demo exposure,' but what you're telling me is that your basis for publishing these games is based on brand recognition already existing. Is that accurate?

MC: That's correct. It certainly was how we launched the casual game category into retail, by bringing the top brands to market. And what we found was that there really were two distinct buyers. There was a buyer that was comfortable going online, downloading a file and paying for it over the Internet, and then there was another customer that was still not comfortable playing games over the Internet. The consumer may have become aware of it coming out on the Internet, or through the recommendation of a friend, but they were not really an online customer. We still get a tremendous amount of mail delivered by post; handwritten letters from customers that don’t have access to the Internet or don't know how to download a file, but who want more of the games that they've been able to find at Wal-Mart, Target or Best Buy. We still see that although the world's becoming more connected, there's a huge part of the population that is not, or doesn't feel comfortable downloading content and transacting over the Internet.

GS: So for this sort of audience, do you offer an actual printed catalogue for them to purchase games from?

MC: Yes, we produce and print a physical catalogue quarterly which we both distribute at tradeshows and mail to our customers. I think you would be surprised at the number of customers who actually purchase games through mailorder.

GS: In terms of revenue on individual products for casual games at retail versus download, how big of a hit do you take boxing these up rather than just offering them on your portal?

MC: What we've done in terms of pricing at retail has mirrored the online pricing model. The key price for a casual game on the Internet is $19.99. We've seen some products push up to $29.99, but it really seems that – at least at this point – the sweet spot is $19.99. The difference obviously is that at retail we have real hard costs. We have the cost of the packaging, fulfillment and supporting a product, snot to mention marketing to generate interest either in the category or in specific products.

So the model is very similar to what you'd see with any other retail publisher of games. Consequently, the margins aren't quite as attractive as they are in the download space, where the actual physical item is eliminated completely.

GS: So is there any kind of percentage I could quote on the marginal difference we're seeing here?

MC: There's not, really.

GS: Fair enough!

MC: People can back into it if they look into, on average, how much it costs to produce a physical good, what retail discounts look like, what the average marketing spending is, etc. It is what it is. It's more expensive to conduct business in the retail market than in the download channel.

GS: Speaking of retail channels, you had a couple PSP announcements recently, LUXOR and Platypus I believe?

MC: Yes.

GS: Is this a good time to enter the PSP market? It's not really selling as well as Sony was expecting. Is this the proper time and venue to launch these titles?

MC: We've looked at the handheld portable market for some time now. We've watched casual games go from the download arena to mobile to retail, and in every market they've done exceptionally well. We've been looking at the PSP and DS for quite some time and really trying to figure out when the right time is to come to market. We don't know that right now is the right time, but we do know that both Sony and Nintendo are interested in casual games. I think they feel that they belong on these platforms. It's just a matter of getting the right content to the platform. So we're excited about the launch of these titles onto the PSP, and we have additional products already planned for 2007. We're looking at all of the different devices and platforms and working to put casual content on each one of them.

As far as Sony, we're very bullish on the opportunity on the PSP, and we think that casual games on the PSP have tremendous growth potential. We think it's going to be a good quarter for Sony and the device. There's a lot of content coming out, and we think that that will benefit everyone in this category.

GS: Is there more of a potential market for the PSP over the DS, as far as casual games go right now? Did you specifically choose the PSP over the DS?

MC: When we started out at the beginning of the year we wanted to make games for both devices. The process of bringing the games to the PSP just moved along a little bit quicker than on the DS.

It was a decision to support our brands across the devices, as opposed to one or the other. As you know, development is not always predictable, so sometimes things occur at a faster pace on one device over another.

Magnetica on the Nintendo DS

GS: Sure, absolutely. Is Puzz Loop's [released in the United States as Magnetica] availability on the DS hindering a port of LUXOR for the system?

MC: You know, I don't think so. This is an interesting aspect of casual games. A lot of people ask me how much room there is for multiple games within a specific genre, for example, a match-three? How many different versions of say an action shooter, like a Puzz Loop versus a LUXOR, can you have? And I think that what we've experienced is that there's a huge consumer base out there for casual games, and many consumers are fans of a certain type of games. It's like in the action or hardcore arenas, you have people who will play first-person shooters, or people who will play role-playing games. We're starting to see people within the casual category flock toward a specific genre. There are people who specifically like to play word games, whowon't buy just one word game, but will buy multiple word games. The same is true with match-threes, or derivatives of match-threes.

So we think that Puzz Loop being on the DS is not a hindrance to titles like Zuma coming out on the DS. We actually think that consumers will play several games from the same, or similar, genres.

GS: So, would you call Zuma and, indeed, LUXOR, games within the same genre to Puzz Loop?

MC: I think that Puzz Loop and Zuma are more closely related, in that the shooter is in the middle of the screen and it rotates. If you look at LUXOR, it's different in that the shooter is on the bottom, and it slides back and forth, and while it may seem like a minor difference, it's significant. It changes the play, it changes the feel, it changes the way in which you shoot the ball. So I do think that the three of them are in a similar vein, but there are definitely differences between the strategy and the gameplay, the core mechanic in LUXOR versus the other two.

LUXOR 2

GS: So it's fair to say that you consider LUXOR and Zuma to be a game within a genre started by Puzz Loop, rather than you guys kind of cloning each other?

MC: I think they fall within a genre, which is "action shooter," and each one of them has differences and some variations which make them unique.

GS: Let's get sort of businessy here, as far as casual games go. Do you think there's too much VC [venture capital] coming into the casual space right now, and do you think that could adversely affect the market? We've seen an awful lot of new casual games developers and publishers lately.

MC: I personally feel that the focus on casual games, the interest in it, whether it's from the media, the investment community or the retailers, is all positive. Like any growing category, there's the risk that expectations are too high and therefore the amount of effort put into it exceeds what's really required, and therefore the results are not what people want. In this case, I feel that VC's investing in the category is a good thing.

GS: Can you elaborate on what you just said, as far as too much effort being put into it?

MC: A lot of times when there is a growing category, people rush into it looking at it as the next big opportunity. So there's a lot of effort put into it, there's a lot of money dumped into it, there's a lot of product that comes out of it, and sometimes that investment outpaces the demand, and the conclusion is, 'Well, maybe this category isn't as hot as we thought it was.' So I think that's the risk, when you get too much interest in one area and not enough growth to support it. And we've seen this before, where people speculate what the next big growth area is, and then 18 to 24 months later they back off saying, well, maybe it wasn't as big as we thought, when in reality it's a very, very healthy category or segment of the market. So I think that the only risk is that if there's too much focus, if there's too much investment, if there's too much hype, that the category itself may not live up to it. But that's not to say at all that this category won't continue to grow, that we won't continue to see more and more games come out, more and more hits, more and more consumers buying into it.

But I like what you said earlier, about not liking the term "casual games?" And that's what it's been labeled as. And we could discuss how it got that name, but I'm not sure how much that matters. We kind of look at it as games for all. On one hand, you have this category of gamers which has been called "core gamers," representing nine percent or ten percent of the population. For everyone else who doesn't want to play those games, casual games are the games that they can play. There's a saying around MumboJumbo that casual gamers don't play hardcore games, but hardcore gamers play casual games. We build games that appeal to a really broad base of consumers.

GS: I think it's fair to say that the notion of hardcore gamers being drawn to casual games is being proven in spades with Live Arcade. Have you met with Microsoft yet about a partnership in that area?

MC: I'm going to take the Fifth on that. But what I will say is that we've been looking at every kind of vehicle, every platform where casual games can go, and aggressively pursuing those markets. And certainly Live Arcade is a very desirable market. Some of the early data we've seen, and a lot of what's been reported, is that that there's a tremendous attachment rate on the casual games side. We think it's a great device for casual games, and a natural delivery mechanism to get games into consumers' hands.

GS: Stepping back a bit to when we were talking about the general state of the market, how healthy it is and how much money is going into it, is there a fear of over saturation of similar games? You said earlier that you expect people to kind of follow your path as far as boxing these things up, is there a fear that there might be an over saturation of similar games on store shelves that might confuse consumers?

MC: I think there's a fear that there is over saturation at retail as well as on the download side, and that's one of the things that we look at to determine what the next big game is. What's the next big game mechanic that people are going to be drawn to? And I think that's a challenge in the download space as well as at retail. As successful as casual games have been at retail, there's still a finite amount of shelf space, and just continuing to load it up with games of a similar genre or same gameplay mechanic with different packaging, yes, I do think that's a potential risk in the category. But at the same time, we look at what's coming out of the casual game market now in comparison to two or three years ago. At this point you've got games in the match-three, collapse, action-shooter and word genre, and games like Diner Dash that is more resource management, not to mention Virtual Villagers. We're seeing a lot of games come to market that are completely different to what we were seeing even a year ago. Those are the games that need to make it to retail, because they broaden the offering to the consumer, and they broaden the consumer's choices of what they're going to play. I would not want to see a retail assortment that had ten titles, of which, five were match-three and five were action-shooters. I don't think that's good for retail and I don't think that's good for the consumer. So obviously providing more choice is really important.

Like any market, there will be a rush to try to replicate what's successful. I think then it really becomes important for a retailer to select what content they put on shelves.

GS: I'm sorry, did you say the responsibility is on the retailer?

MC: I think it is important for the retailer to be selective and know the difference between one product and another. One of the things we've seen is that as we introduce a new game or a new style of game, there's a lift on that game as soon as it goes on the market. For example we just recently shipped a game called Cubis 2. It's been a very successful game online, and to my knowledge this is the first time it's gone to retail. The numbers on it are really, really strong, and we've seen that with other games as well. What it suggests to us is that there is a casual gamer out there that's coming into the store on a regular basis looking for new content. So when something new hits the shelf, even though it's not heavily promoted in advance, and even though it's not on preorder or pre-sale, the consumer is waiting to see what new selections are available each month.

GS: That's interesting. Who is this consumer? Do we know?

MC: From what we can tell, the interests of the consumer at retail are very similar to the interests of the online consumer. If you talk to the casual game companies, you'll find that the consumer skews more toward female, 35 and above. But I think as the category matures and becomes more popular, it will balance out. But for the time being, I do think it's more of a female audience, 35 and above. I think that explains why the success on some of the games has occurred in stores that are frequented more often by a female shopper.

GS: That's kind of what I was getting at, what retail partners are more successful with these? Is, say, Wal-Mart a better place to sell casual games than Best Buy?

MC: That's a tough question, because I wouldn't say Wal-Mart is a better place to sell casual games than Best Buy. I think those are two of the key retailers for casual games. What we have experienced is that the non-traditional computer retailers are better outlets for this type of game. Target, Best Buy and Wal-Mart are leading resellers of casual games and part of that definitely has to do with the type of consumer they attract. We've also had good success in the office superstores and with traditional computer retailers like GameStop. A lot of people are surprised to hear that..

GS: Myself included! Let's talk about your company in general. How large is MumboJumbo right now, in terms of population?

MC: We have right around fifty employees.

GS: And is a majority of that in development?

MC: We have two offices. Our main office is here in Dallas. Out of Dallas we run all of our business, sales, marketing, finance and operations, as well as a core development team. Our Dallas group is primarily focused on the LUXOR franchise. In addition, we have a studio out in Los Angeles with about twenty employees which is devoted to development. The differentiation is that our L.A. office is focused on console product as well as some original development on the PC.

GS: All right, one big final question. What is the biggest problem facing the casual games industry right now?

MC: I don't know if it's so much a problem as a challenge. I think the biggest challenge in the industry is coming up with new game mechanics and new content. At least, from the development standpoint it’s defining the next big game mechanic. And when people ask me what the next big game is, I say I don't know, but I know that it's going to be a new mechanic, it's going to reach out and do something different than what's been successful to this point.

GS: When you're looking for these new mechanics, do you kind of go old school? Do you maybe go back to your Atari and see what made those games work?

MC: We spend a lot of time looking at everything from the start of the gaming industry all the way up to today. We prototype a lot of concepts, things that have never been done previously. That is a huge part of our focus; not repeating what's already been done, but coming up with something new.

Read more about:

FeaturesYou May Also Like