Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs.

App Stores, Steam, and Indie poverty: the Web as an alternative.

This article offers insights about Indie poverty in the app stores and Steam platforms. I have also make some analysis of sales and revenue of best and worst selling games in Steam based on Steam Spy data. Finally I propose the Web as an alternative.

This article is going to try to prove with data how difficult it is to make a living as an Indie video game developer in some areas. We’ll be showing data from app stores and Steam to point out how complicated it is to enter into those markets with scarce resources. Finally, we’ll look at Web-based games as a possible alternative for Indie developers who want to get started in the world of video games with a minimal resources to build a sustainable business.

App Stores: a highly unequal ecosystem.

At a pace of more than 1,000 new apps per day just in the Apple App Store, everybody knows that the main game stores for mobiles are saturated; the Apple App Store and Google Play mostly, but also, in smaller measure, the Windows Phone, Amazon, or Tizen stores, for example.

This led, in 2014, to the use of a new term, the “App Poverty line”, based on reports like those from Vision Mobile. These analyses showed that up to 24% of developers didn’t earn anything, 23% made less than $100 a month, and 22% less than $1,000 a month.

They even came up with a number for the “App Poverty line”: revenue below $500 a month, which means up to 64% of Android developers are poor, and 50% of iOS developers. After that, a middle class that makes between $500 and $25,000 a month, with 30% for Android and 39% for iOS. Finally, an upper class of developers who make more than $25,000 a month, with 6% for Android and 11% for iOS. Finally, there’s a super elite of developers who make up just 1.6% of developers who earn more than $500,000 a month, and several (unspecified) times more than the other 98.4%.

With these data, we must keep in mind that all types of apps are being analyzed, not just games, which is usually the category with the best earnings. In their 2014 third-quarter report, Developer Economics showed data specific to video game developers.

In this case, the poverty line is different, and varies quite a bit depending on the number of games published per developer. So we can see that of the companies that have only published between 1 and 3 games, the percentage under the poverty line (less than $500 a month per game) reaches 64% while the upper class is 3%. On the opposite side, among companies that have published more than 50 games, we can see that only 21% are poor, while 27% are rich.

These data have been widely shared among the developer community, and have helped create several myths around app stores and indie developers. For example: only a few make millions of dollars, and they are the ones taking almost all the revenue, and anyone outside that privileged class is in poverty.

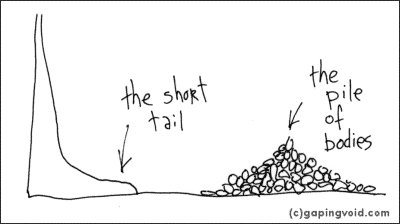

According to the data we’ve just seen, these myths have weighty arguments behind them. Even so, some try to show the opposite, arguing that there are, for example, 1,260 iOS publishers who make more than $1 million. In any case, these 1,260 lucky ones represent only 0.26% of the 477,000 iOS publishers in the US store. Another myth that’s making the rounds is the one about sustaining oneself thanks to the long tail. This refers to the idea of being able to make your games profitable without having to be among the bestsellers thanks to the wide user base and niche markets that digital distribution platforms provide. I think the following image from Gaping Void illustrates the reality of this model in a rather funny way.

Visibility problems on Steam

Steam is another big open market for independent videogame developers. Already in 2014 we began to hear comments about the growing rate of publication of new games. Just in the first 20 weeks of 2014, as many games were published as in all of 2013. In the end, 1,814 games were published in 2014.

In July of 2015, more comments were made about the fact that Valve by then had already published 1,592 new games to Steam, and finished the year with 3,109. By February 8, 2016, 318 new games had already been published (according to Steam Spy). For the following graphs, I’ve used data provided by Steam Spy. It’d be a good idea to look at their page to see the margins of error for these data.

In any case, in this table, we can see the average sales per game and the sales median per game as well as the number of games published.

At first, especially between 2009 and 2013, there was a time when the titles published to Steam enjoyed less competition and good sales per game, both in the average sales per game and the median. But after 2013, there is a sharp decline in each game’s sales. In 2015, developers began commenting that the main barrier to Steam is the visibility of your games in such a competitive and saturated market.

If we look at Google Trends’ data on people’s interest in the term “Steam”, we can see that it parallels the rise in games published on Steam. Undoubtedly, Steam’s success among the wider public is at its best moment; in December 2015 it hit a new record, and everything points to it beating that by June 2016.

Steam’s success, just like app stores, is undeniable. But, who gets a piece of Steam’s success? Let’s analyze the revenue from Premium games on Steam.

Revenue from Premium games on Steam.

To get the data on revenue from Steam, we’ll again use Steam Spy. We have to keep in mind that these sales data are the result of multiplying the number of copies owned (Owners) by the price of each game. This method is not 100% reliable for several reasons discussed on Steam Spy, but I believe they serve to reflect the proportional relationships between different games. The data obtained by this method are the following:

Game | Price | Owners | Revenue | % of revenue |

Grand Theft Auto V | $40,19 | 3.960.076,00 | $159.155.454,44 | 17,34% |

Fallout 4 | $40,19 | 2.878.007,00 | $115.667.101,33 | 12,60% |

Dying Light | $59,99 | 1.286.951,00 | $77.204.190,49 | 8,41% |

ARK: Survival Evolved | $20,09 | 2.518.525,00 | $50.597.167,25 | 5,51% |

The Witcher 3: Wild Hunt | $29,99 | 1.362.977,00 | $40.875.680,23 | 4,45% |

H1Z1 | $14,99 | 2.312.033,00 | $34.657.374,67 | 3,78% |

Rocket League | $12,99 | 2.539.040,00 | $32.982.129,60 | 3,59% |

Cities: Skylines | $11,99 | 1.998.408,00 | $23.960.911,92 | 2,61% |

Prison Architect | $14,99 | 1.552.842,00 | $23.277.101,58 | 2,54% |

DiRT 3 Complete Edition | $7,49 | 1.128.998,00 | $8.456.195,02 | 0,92% |

Total top 10 |

|

| $566.833.306,53 | 61,75% |

Total Non top 10 game |

|

| $351.090.449,45 | 38,25% |

All games |

|

| $917.923.755,98 | 100,00% |

As we can see, the Top 10, that is, 0.33%, generates more than 60% of total revenue, a highly concentrated and unequal situation.

Now we’re going to try to analyze what other games that are not so well positioned are making. Again using data from Steam Spy, we’ll separate the number of games into different sections depending on the revenue they made in 2015 for those games published that year.

We can see that 51.4% of games made less that $6,000 last year (the $500 monthly that we��’ve defined as the poverty line), and 66% less than $25,000. On the other hand, 2.7% made more than a million dollars, even while generating no more and no less than 78.8% of revenue, according to the following table:

Revenue | Number of games | % of all games | Revenue | % of revenue |

> $ 1MM | 83 | 2,74% | $723.668.188,80 | 78,84% |

> $ 500K & < $ 1MM | 100 | 3,31% | $70.802.809,19 | 7,71% |

> $ 100K & < $ 500K | 386 | 12,76% | $102.527.966,01 | 11,17% |

> $ 50K & < $ 100K | 103 | 3,41% | $7.678.150,76 | 0,84% |

> $ 25K & < $ 50K | 136 | 4,50% | $4.729.464,18 | 0,52% |

> $ 6K & < $ 25K | 442 | 14,62% | $5.267.737,60 | 0,57% |

< $ 6K | 1555 | 51,42% | $3.249.439,44 | 0,35% |

Free | 219 | 7,24% | 0 | 0,00% |

Total games | 3024 | 100,00% | $917.923.755,98 | 100,00% |

This is a highly unequal ecosystem. The richest 2.7% of games generate 78.8% of all revenue. And the poorest part, 66% of games generate just 0.92% of revenue. With these data, it’s hard to believe that Steam is a means by which any indie videogame developer could generate enough revenue to make a living.

We’ve seen the revenue per game reality of app stores and Steam. In summary, on mobile 57% of developers make less than $500 a month per game. And on Steam, 51% sell less than $6,000 a year.

Concentrated, saturated, and unequal markets.

Such unequal ecosystems like these remind me of Thomas Piketty’s reflections in his wonderful essay on the history of economic inequality, Capital in the Twenty-First Century. On the one hand, there are ethical considerations about whether it is fair or not that there is such concentration of income in such a tiny percentage. These issues aside, it would also be a good idea to consider if this scene is appropriate or not for a sector, or a society in general, that believes in meritocracy. Many talented indie developers are starting to believe that accessing the market with a product is more a question of having money than any merit. This can be a brake on innovation, creativity, and the renewal of the sector.

When a market begins to be saturated with products, it’s normal for a developer to have to turn to different strategies to make their product stand out from the rest. Some of these strategies include creating a product that is really different thanks to its quality, theme, innovation, or any other reason. But much more often, developers turn to marketing, communication, and public relations techniques.

Using marketing and communication in supply-saturated markets makes some products finally stand out from the others, or makes them more easily discovered by the buyer. To reach these objectives of creating visibility, one usually needs to have at hand a marketing and communications budget to pay for a team dedicated to these tasks, or at least to subcontract specialized agencies. On the other hand, many turn to purchasing ad space in different media. In any case it’s not normal to find a dedicated marketing budget in many indie development studios. This means that this is an insurmountable barrier for many developers, meaning they can’t make a living doing what they enjoy most.

The Web as an open market

With such a complex situation for indie developers, the term ‘Indiepocalypse’ began to be heard, and to generate debate in very interesting articles such as this one or this one on the Indie panorama in 2015.

Some of the authors of these articles defend the idea that the window of opportunity for indie studios has already passed. The current panorama is much more complicated in many ways; you only have to look at the data above for app stores and Steam. They’re saying that there was an Indie bubble and it burst a few years ago.

In any case, here at WiMi5, we believe that there are still possibilities for indie developers. We believe that with HTML5, an enormous range of possibilities has opened up and that now is the time to take advantage of them.

With HTML5, you can develop games for many platforms. On the one hand, you can create native games from HTML5, as we've already explained before on our blog. But, even better, you can create web games that can be played on any device that has a web browser.

The web game market is one of those with the highest growth in the next few years. According to a report from NewZoo, China passed the US as the biggest game market in 2015, with over $22 billion in revenue. China is a market dominated by PC games (representing 68% of the total). Of that 68%, 12% corresponds to webgames, and the rest (56%) to PC/MMO games. Casual webgames represent $2.6 billion and were growing at a rate of 26% in 2015.

We can see, in the graphic above on China, that webgames is similar in size to the mobile game market. But what marks the fundamental difference is that it is much more open. The main advantage of the web games market is that there are no unique stores that act as a bottleneck for the visibility of new games. It’s a much less centralized and less monopolized market in which many agents are competing amongst themselves in a much more competent fashion.

It is also true that despite what was said earlier, the web game market has had some years now in which the number of developers has fallen. This decline has been due in part to the migration of many Flash developers to other solutions, and the rise of the mobile. In any case, this article, which describes the webgame sector’s situation in the last few year very well comments that the sector’s situation seems to have stabilized since 2014. In this same article, the creator of Phaser comments that in addition to the classic online games portals, many HTML5 game developers are selling their games to telecommunications companies’ portals which have their own game catalogues for their customers. This is something we’ve been able to check directly, at least in Spain.

In any case, there are still a ton of web game portals where you can publish directly or via the syndication of content. We’ve already published lists of HTML5 game portals where publishing is affordable and where you can reach millions of gamers. But there are more resources and lists in different media that are equally valid. Some new game portals and sites, instead of simply having a homepage with 500 games listed, whether they’re downloadable or not, are also focusing more on the community of developers and of gamers. This is the case of itch.io and gamejolt.

In summary, and to finish up, I believe that indie developers can create profitable games for the web. It’s not enough to just develop the game; you also have to worry about making it visible. To do that, you have to connect with the other agents in the sector: publishers, distributors, and operators. In any case, they are easily accessible agents and there are many different alternatives. Contrasted to this are the centralized markets in which only one (or 2 or 3 at the most) distributor causes huge visibility problems for those developers who are trying to come in without huge marketing resources.

The gold rush at the app stores will continue; there are still new stories of small developers who make millions in downloads and revenue from home. The industry itself foments and creates these myths, the myth that says you can have a huge hit with a game.

Web games don’t have those myths of instant success. They’re about working day to day, making a good product, and knowing how to distribute it by creating a network of contacts, bit by bit.

Everyone can choose the one that best fits.

Read more about:

Featured BlogsAbout the Author(s)

You May Also Like