11/7/2016

With 4 in a blow almost ready for soft-launch I'm curious to know how much has been changed

since the beginning of the project.

Specially when it comes to the BOS tools.

If you haven't played 4 in a blow you might want to test it first.

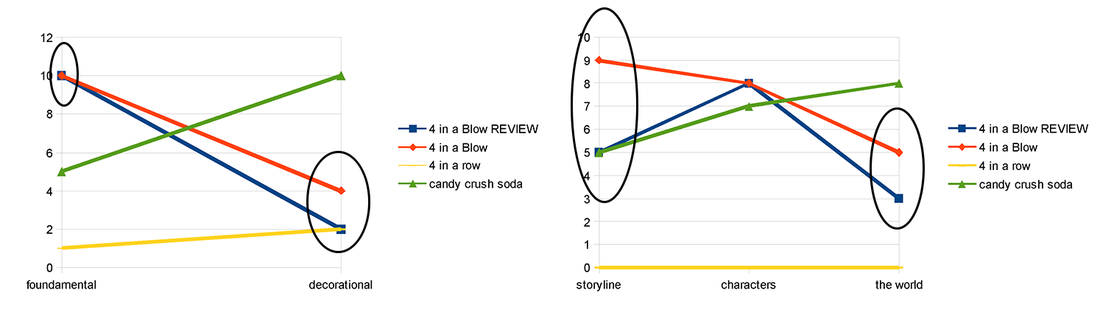

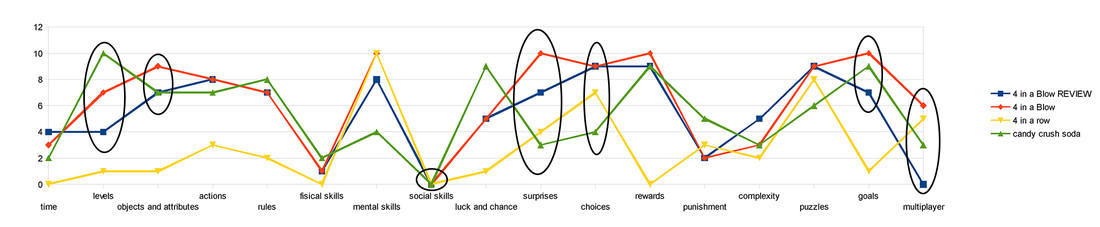

STRATEGY CANVAS

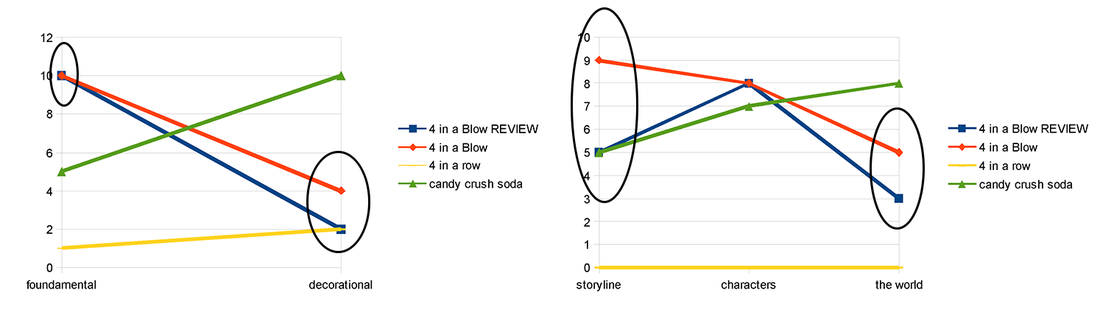

I'm glad to say that the "to be" strategy canvas isn't much different from the "as is" strategy canvas.

That means I didn't deviate much from the original concept.

Any changes to the game are due to the shortage of budget or to adapt to the needs of the players.

The shortage of budget brought the biggest changes ofcourse.

Most changes are small because of the "fine tuning" during the development proces.

The technology hardely changed. The social features and the coupons are complex.

I lowered the decorational part because of the simple pixel graphics and effects.

There was no options to get more characters, storyboards and stories into the game (budget).

And also the world and the story just aren't that original and they don't have to be original either.

The target audience is not interested in the story itself but they do care about rewards.

So the story is there just to do that.

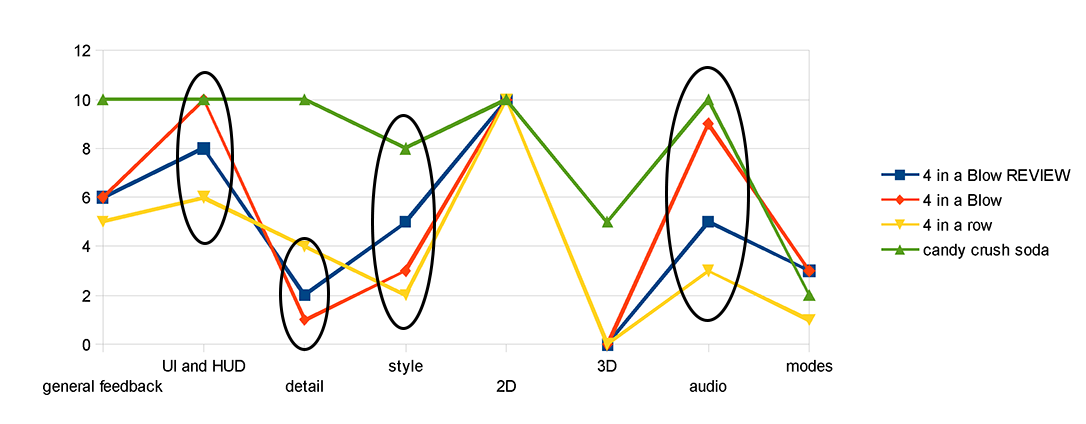

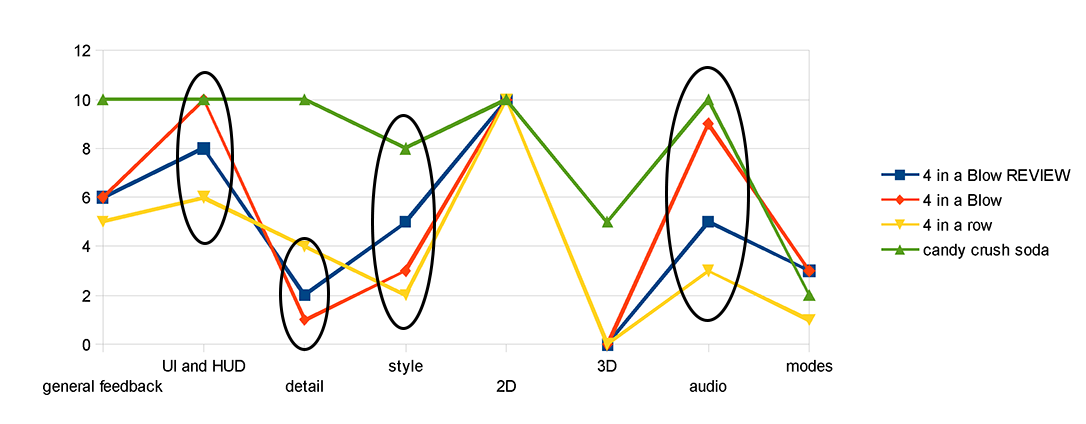

Video game audio is something tricky. I noticed that a lot of players turn of the music when they play.

Especially when the music is to loud. The logical thing would be remove all the background music from

the game right? This had a greater impact on the game experience then I predicted.

Extra investements had to be made so there would be audio feedback for the players and

a few background sounds to set the tone of the game. Even with this I still have the feeling that

the audio isn't as good as it should be.

I was also surpriced by the amount of detail and character that can be put in pixel art so

I increased that a bit.

The HUD and UI is simple. Still I'm not an expert and I think I overestimated my talent.

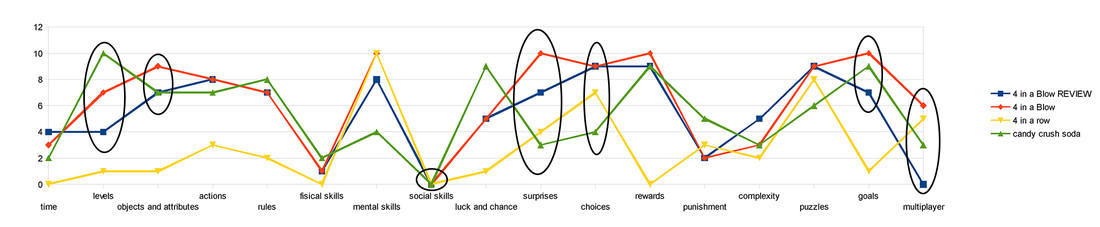

Levels, objects and attributes, goals, and multiplayer went down because of the tight budget.

Social skills are also 0 but I hope we can implement a Co-op mode later.

That would really make a difference.

There aren't as much surprices as I hope there would be but I find the surprices in 4 In a Blow more fun

then the ones in Candy Crush. I think our game has better choices because they actually matter.

Still there is some luck involved. Just enough to give the game a more casual experience then

the classic 4 in a row game.

The special items are things that I should keep an eye on. Because they will determine if the game

bends to the casual or to the strategic side.

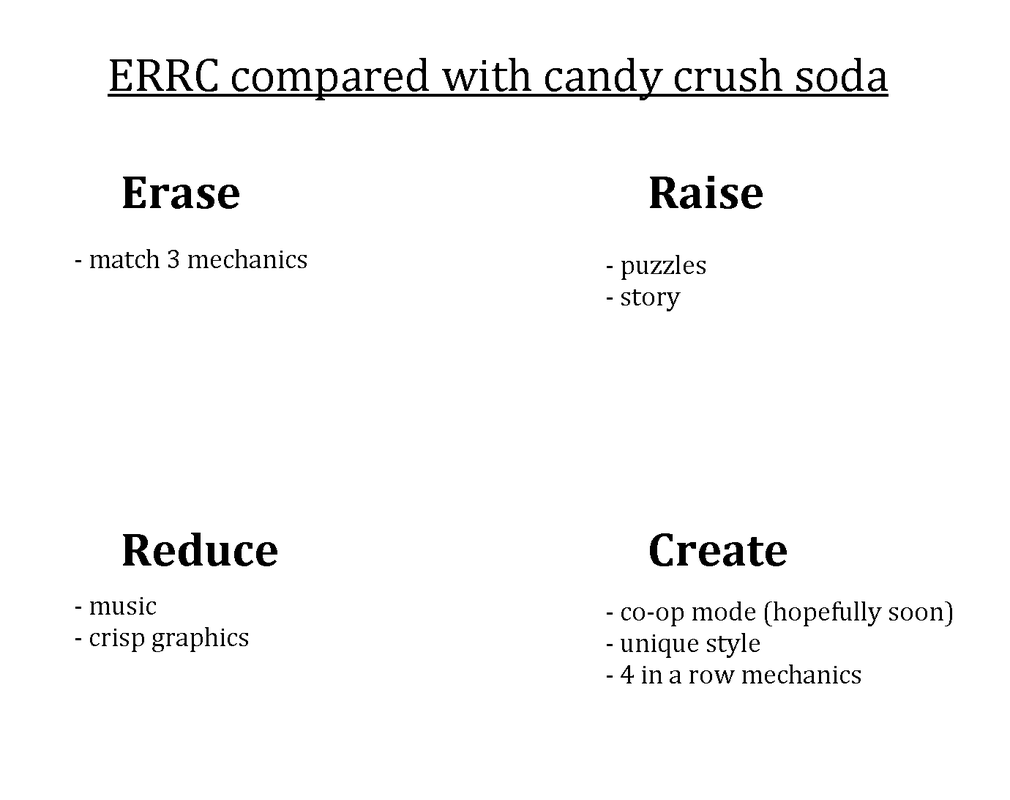

ERRC

I didn't make a ERRC grid or four action framework before we began the development.

I just checked it and went with my gut.

The ERRC grid also gives a good view of what we left out and what we created.

I really think we did something different. ERRC is easier to use then looking for nested curves in

the strategy canvas.

BUYER UTILITY MAP

This tool remains hard to fill in.

We've put far more effort into the purchase phase then I have foreseen, trying to convince

people to spend money on our game. We've spend far more efford on it then any one out there.

Hoping that the game will sell itself or making limited/special offers doesn't do the trick.

I really hope that we used the NLP techniques and CRO in the right way.

Be sure to check my next blog. (more info about NLP and CRO in the upcoming blog posts)

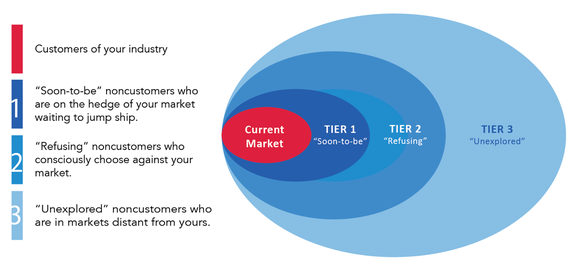

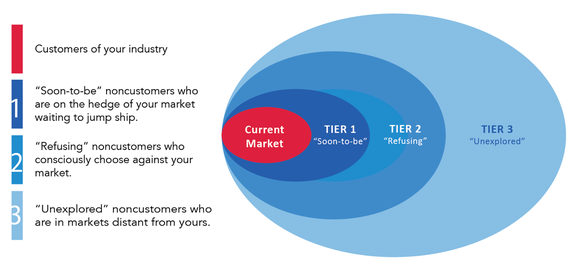

NON CUSTOMERS

This is interesting. Because of the business model we could manage to attrack more

younger gamers who don't have a credit card to pay for the game.

I didn't see this coming. Could this be tier 3 non customers?

The rest remains the same.

Tier 1 are board game lovers waiting to try a new game.

Tier 2 are the gamers who like candy crush and other puzzle/casual games.

Those gamers mostly don't like to think ahead.

Like I told in one of my previous posts, my girlfriend and I were the target audience and I used

ourselves as persona's. Not very professional I know, but it's a good start to understand our

target audience.

Quantic foundry does a great job in analysing players with their gamer motivation model.

I took the time to fill in a survey and compared that with the one of my girlfriend.

But I'm not sure if that would be enough.

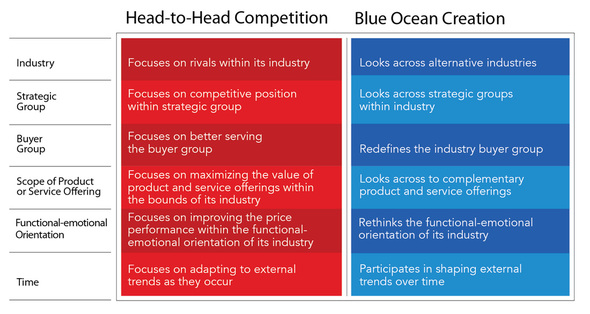

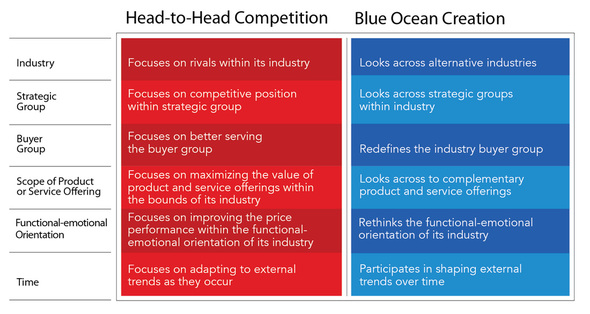

6 PATH FRAMEWORK

You can read here what I wrote a year ago about this tool.

I think that my findings from then are still correct.

The industry:

4 In a row already comes from an alternative industry, the board games.

But I'm not sure if we are still looking at that industry.

Real board games have a different venue. Bringing people together around a table is just a major part of

that industry. That is something that only a few mobile games have managed to do.

I hope we eventually can develop a co-op mode that brings the players back to the table.

I also looked at e-commerce and websites for CRO (conversion rate optimization).

Strategic group:

Yep we're still looking across different game types.

Buyer group:

The businessmodel of the game changed some things. We're focussing on influencers and buyers now.

We're not forgetting the user but the businessmodel somehow required more research and

knowledge then the game design itself.

Scope of product:

We didn't do anything with this path. I find it hard to do anything with it.

Almost everyone has a smartphone, so that's not a problem anymore.

A lot of games are small, load fast and allow shorter play sessions.

So players don't have to plan a play session.

Progress is usely saved in the cloud/server so thay can continue any time anywhere.

So what can we do more in this path?

Functional-emotional orientation:

This path is still a mystery. Creating a fun experience is all about emotions. So we can say that games

themselves are emotional orientated.

But the businessmodels are very straight forward. X$ for this, Y$ for that.

Some games offered a solution when the players failed a level, hoping that the players would buy

impulsively. And for a short time that worked. But after a while the players will know your selling tricks.

Only 3% of the player turns into payers. So we can say that the game industry still fails to deliver

a emotional orientated businessmodel.

We did another attempt to implement an emotional orientated businessmodel by using NLP and CRO.

If you use the right words, do the right things and make the right offers then people will trust you.

And trust is crucial when it comes to selling something.

Some tips for building trust:

Salesforce

Rain sales training

IMpact

Time:

Trends come and go. I don't know big (or small ) the impact of VR will be on the current market.

But I know that the kids from now will accept video games as a part of their lives. Be ready for that.

I'm also wondering how long people will tolerate the Free-to-play model and how low developers will sink

by giving their game away for free.

I'm not sure what players think of a subscription model for mobile games.

But haven't implemented a subscription model but we're taking our chances with the stagnation of

the free-to-play model.

WHAT CAN GO WRONG RIGHT?

You can playtest 4 In a Blow for yourself on testfairy.

Thinking that BOS would solve everything would be a big mistake.

You only really know if you are reaching your target audience when your project hits the market.