How to Prepare for a Financing or Acquisition: Diligence

Diligence is the process by which a prospective buyer or investor looks at a company in order to decide whether or not to invest or buy. Here is an example diligence request list.

Diligence is the process by which a prospective buyer or investor looks at a company in order to decide whether or not to invest or buy. It’s really that simple.

Diligence can be very scant or it can be very involved. A wise investor or acquirer will lean toward more aggressive diligence. That means looking closely at financial statements, questioning assumptions in those statements or any projections for the future, reviewing all significant contracts and generally determining whether the business is as sound as its leadership thinks.

How can a company prepare for this? It’s also really simple: organization.

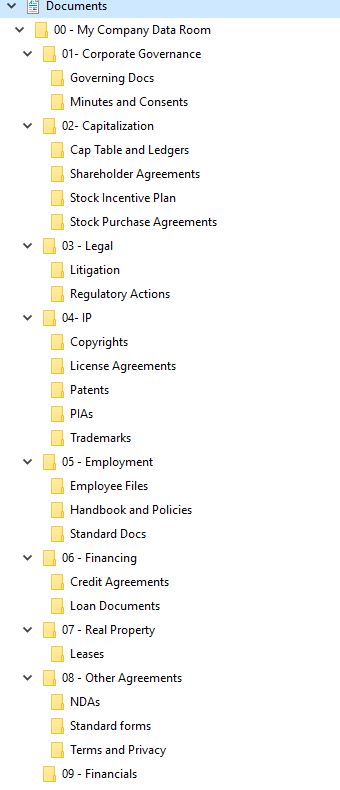

Here is an example diligence request list – this is not a complete or perfect list and any list for a particular situation will likely be different than this list:

Corporate Governance Information

The Company’s current charter and any amendments

The Company’s current bylaws

List of all board members including contact information

All shareholder actions and minutes

All board actions and minutes

Capitalization

Current shareholder, option holder, warrant holder lists including issuance dates and issuance prices

Summary of all vesting schedules (if any)

All purchase, sale or issuance documentation for all outstanding or repurchased stock

All voting agreements

All preemptive rights information (like rights of first refusal in any documents)

Other shareholder agreements

Documentation of qualification under federal and state securities laws for prior issuances of securities

Legal / Regulatory

All documents related to any actual or potential litigation

All consent decrees, judgments, settlement agreements, etc.

Documents related to any regulatory investigations

Any correspondence with (relevant regulatory group) regarding any investigation, potential investigation or compliance issues

Intellectual Property

Form of Proprietary Information and Invention Assignment Agreements signed by employees or consultants. All documents related to technology transfer

Copies of the PIAs signed by key employees

A list of all employees or consultants that have not signed the form PIA and copies of their agreements.

Copies of any nonstandard PIAs

Any inbound license or agreement with respect to any patent, copyright, trade secret or trademark other than an “off the shelf” standard product license

A list of all patents, trademarks and copyrights including dates of any upcoming deadlines and the status and jurisdiction of each

Employment and Management

Any agreements with any employee/officer/director or affiliate thereof (including loans, indemnifications, guarantees or otherwise)

Consulting agreements

Employee benefit and profit sharing plans

Stock incentive plans

List of all officers, directors and employees including name, title, salary, PTO (accrued and entitled)

Copies of all employment offer letters

Copies of all handbooks and policies

Copies of any EEOC or similar complaints

An org chart showing the structure of reporting within the company

Financing

All debt and credit agreements, including lease financing

Any guarantees

Real Property

A list of all leased or owned property

Copies of all leases

Any known environmental liabilities

List of all known local permitting requirements to continue the business

Other Agreements

All capital leases

All standard form agreements

All joint venture, partnership or similar agreements

Management, service and marketing contracts

Nondisclosure Agreements

Agreements requiring consent or approval for the transaction at issue (e.g., a non-assignment provision in a sale)

Agreements containing any noncompete or nonsolicit obligation on the company

Other material agreements (this could be tied to a dollar amount, time frame, specific issues at the company, etc.)

Financials & Business

Most recent financial statements

Most recent audited financial statements

Most recent business plan

Most recent budgets, projections and prior versions of the same

Copies of any valuation or report on the company

The best way to prepare for this is organization from the beginning. Create a data room on day one of the company. Then add information to it as it becomes relevant:

If a company has bad record-keeping habits, two things happen. First, there is a crunch to respond to diligence requests when they happen. This means a bigger distraction from the work of the business in order to get the transaction through. It also generally means higher legal and accounting fees as documents are located and organized. Second, the potential investor or acquirer sees this chaos. It could affect their interest.

Read more about:

BlogsAbout the Author(s)

You May Also Like