Earnings report roundup: Game industry winners and losers in Q1 2017

Jon Jordan offers a rundown of info gleaned from game company quarterly reports for Q1 2017. Who overperformed and underperformed, and why?

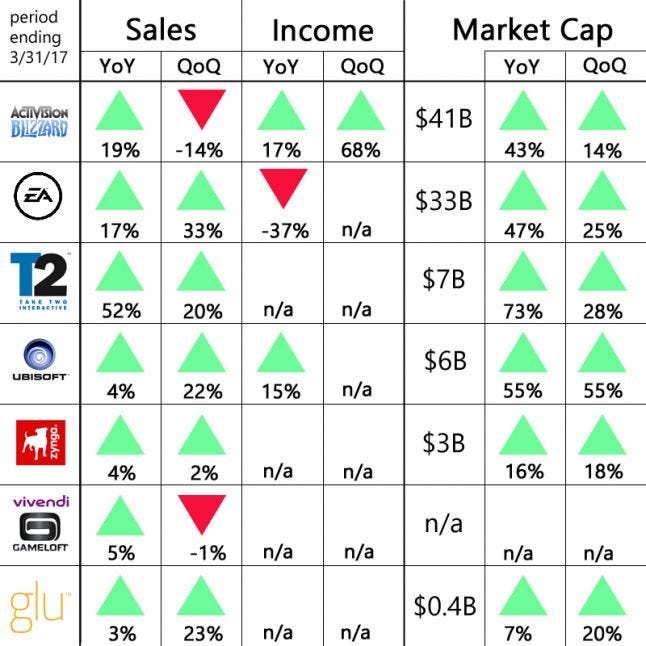

Given the scale of financial information and the range of complex numbers generated every three months by dozens of game companies, we’ve been considering a simpler way of presentation.

Welcome to our quarterly summary of game company financials.

Starting with the key Western companies but expanding globally in future, this is your cheat sheet of who’s currently up and down.

Ranked in terms of a company’s market capitalization, you can simply read along a row to see if a company beat (or not) its previous sales and income figures on a year-on-year and quarter-on-quarter basis.

Note, we’re not detailing the actual sales and income figures, just the short and long term trends.

Of course, a company is/was loss-making in quarter, we can’t calculate this, hence the “n/a”. Further issues are created for Gameloft, which is now part of Vivendi so no specific income or market capitalization data can be generated for it.

One key trend to note in this period - the three months from 1 January to 31 March 2017 - is that all Western game companies experienced growth in their share price, both on a YoY and QoQ basis. If nothing else, it was a good quarter to be an investor.

You can read a more detailed per company summary below.

Activision Blizzard

It was another good quarter for Activision Blizzard, with the continuing strong performance of Blizzard’s Overwatch and World of Warcraft overcoming the relative weakness of Call of Duty: Infinite Warfare (compared to 2015’s Black Ops III.) Year-on-year performance was also improved, as this was the first quarter to include full three months of revenues from its acquistion King, makers of Candy Crush. Its shares continue to rise. Sales were down quarterly because of the comparison to Call of Duty in the previous quarter. [See our previous coverage here.]

EA

Thanks to FIFA: Ultimate Team and a “strong contribution” from The Sims 4 expansion pack, EA saw Q4 revenues rise year-on-year and quarter-on-quarter. Profits were down year-on-year, however, in part due to Mass Effect Andromeda’s underperformance and comparison with 2015’s Star Wars Battlefront. Its share hit an all-high, however. [See our previous coverage here.]

Take-Two

Thanks to digital revenues from Grand Theft Auto V, Grand Theft Auto Online and NBA 2K17, Take-Two experienced very strong Q4 sales. It was also profitable, which compares to comparative loss three months and 12 months ago. And despite pushing Red Dead Redemption 2 in FY18, Take-Two share rose to a new all-time high. [See our previous coverage here.]

Ubisoft

A solid quarter from Ubisoft saw Q4 sales up 4 percent year-on-year as its Tom Clancy series of games continue to gain audience. Debts rose, however, due in part to the acquisitions of mobile companies Ketchapp (2048) and Growtopia. Still, investors are looking forward to further growth in FY18 thanks to the new Assassin's Creed and Far Cry games. [See our previous coverage here.]

Zynga

It’s still loss-making, but Zynga shares popped strongly despite sales only rising a small amount. Zynga Poker and CSR Racing where the company’s best performers, but advertising revenue was down heavily. Nevertheless, a decline in first quarter losses holds the promise of profits in FY17.

Gameloft

Thanks to the strong performance of back catalog games such as Asphalt Airborne, Disney Magic Kingdoms and Modern Combat 5, Vivendi-owned Gameloft recorded its second best quarter of sales ever.

Glu Mobile

The surprising success of interior design game Design Home signals better times to comes for loss-making outfit Glu Mobile. On the back on strong quarter-on-quarter sales growth, it’s increased full year guidance and has been rewarded with its shares breaking the $2.50 barrier.

About the Author(s)

You May Also Like