Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs.

Launching a game with no marketing in 2021

Yes, this is something that somebody intentionally did.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & GameDiscoverCo founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

Welcome to Monday’s newsletter! We’re going to kick off with an interesting guest section from Patrick Seibert. He’s a marketeer who also releases his own ‘0 marketing’ Steam games, and uses them to test how much ‘natural’ visibility Steam gives you if you do, well, nothing.

And he decided to ask the question, after a successful 2019 GDC talk on the subject - can we see how Steam’s baseline visibility has changed since his original 2018 experiment, by launching another ‘0 marketing’ game in 2021 and comparing the two?

Bear in mind that these games are selling modestly - GameDiscoverCo is guessing probably in the hundreds or low thousands of copies. And it’s tricky to track a) Steam improvements b) back-end changes c) the ‘more games’ effect, simultaneously. So this isn’t a ‘how to’, as much as an intriguing experiment. But hope you enjoy!

Launching on Steam with 0 marketing: 2021 vs. 2018?

- Guest written by Patrick Seibert

Hi - my name is Patrick, and I do marketing for indie games at my company Too Indie To Fail. But once every now and then I get the itch to create a game of my own. But since I already do marketing for a living, I really didn’t want to invest a huge amount of my spare time in marketing my hobby project.

So I wanted to try a little experiment, and back in 2018, I did the total opposite: released the game on Steam with ZERO marketing, and gave a talk at Game Developers Conference in 2019 about it, also comparing 2 more games launched previous to that. Seeing how games are shown to the Steam audience with no marketing at all produces some interesting baseline data on visibility and discovery.

Right after the pandemic started, I felt that itch again. One year later I released my second game - once again without any marketing. The first game was released in 2018 and the second one in 2021. A lot has changed on Steam in that time. But how did both the changes & the massive amount of new titles available evolve visibility for games? Let’s try to find out by looking at both data sets.

Comparing two games is always difficult. But at least I can say that if you played Game 1, you would most likely also be a target audience for Game 2. With the data comparison, I focused on numbers that are the least likely to be influenced by the nature of the game itself. (That means no sales, conversion rate or click-through comparisons.)

As with the original talk, the identity of the games is not revealed here. I want this to be purely about the data, and even the store page layout is minimal. But if you’re curious, by all means, it’s pretty easy to find the titles with a little bit of digging.

Debuting your Steam page: the first two weeks

This was a little difficult to compare, since back in 2018 Steam didn’t track/separate out traffic from sources such as “Direct Navigation”, “Bot Traffic” and “Other Pages”.

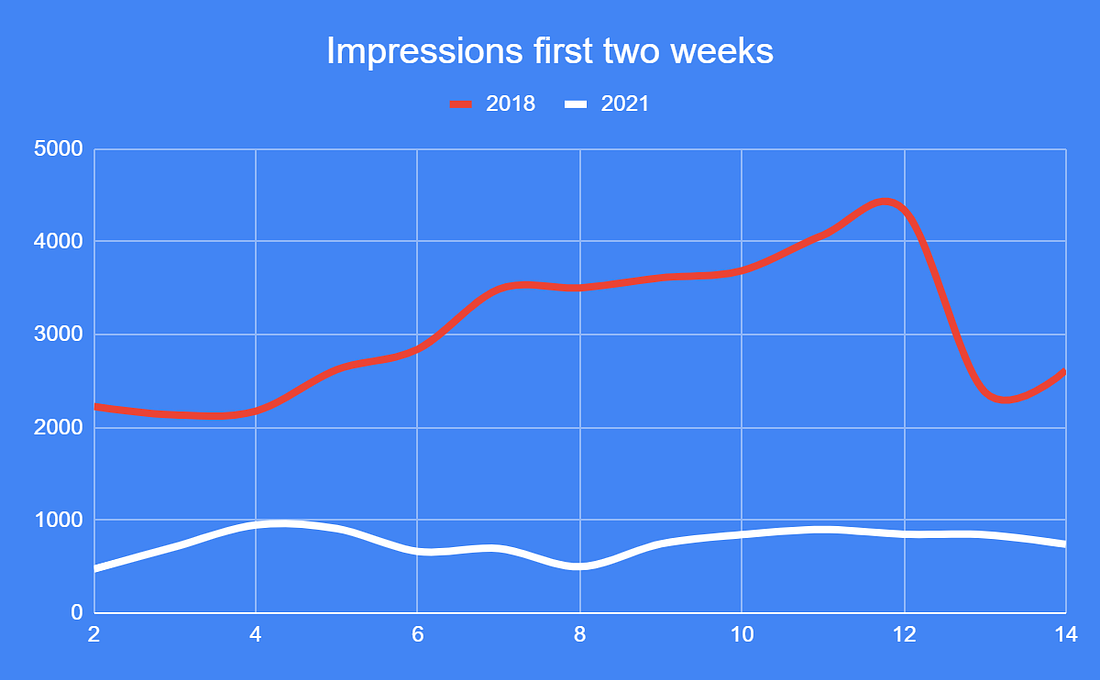

But if I remove all those traffic sources from the 2021 data, we end up with a graph like this, for page visits on both games’ Steam pages:

It looks like the games are getting somewhat similar traffic after a week or so, ignoring the announce spike in 2018. (And it’s pretty slow overall - less than 100 page visits per day. A big reminder that just putting a game on Steam alone isn’t an act of marketing!) But the source of the traffic may have changed.

In 2018 most of the referral traffic - 63% in this case - was coming from the Discovery Queue. Yet in 2021, this percentage went down to only 8%. Maybe this reflects the Discovery Queue being tuned away from unreleased games, or just more games on Steam? And the traffic sources from within Steam in 2021 are now more diverse - which is probably good.

When it comes to ‘impressions’ - the places where an image/link to your game was shown elsewhere on Steam - these are significantly down in 2021. But I’d argue that their quality may have improved in aggregate.

What do I mean? Well, 2018 saw 61% of the impressions coming from the game’s icon/title on “Coming Soon - Full List”. You’re part of a giant list, and this is somewhat useless, unless your capsule burns itself directly into the consumer’s eyes. Not all impressions on Steam are created equal - some are far higher-yield than others!

Conversely, remember the “More Like This” section? In 2018, I still got 13% of the game’s impressions from there. But in 2021 this category didn’t make my chart - maybe reflecting the lack of smaller pre-release games appearing on ‘main’ game pages since algorithm changes. Or just many more games being available?

And overall, in 2021 the majority of the impressions came from “Browse Search Results by Tags”. This once again shows the importance of having your game tagged correctly, and how deep and wide the Steam catalog now is for themed searches and tag homepages.

The week before Steam launch

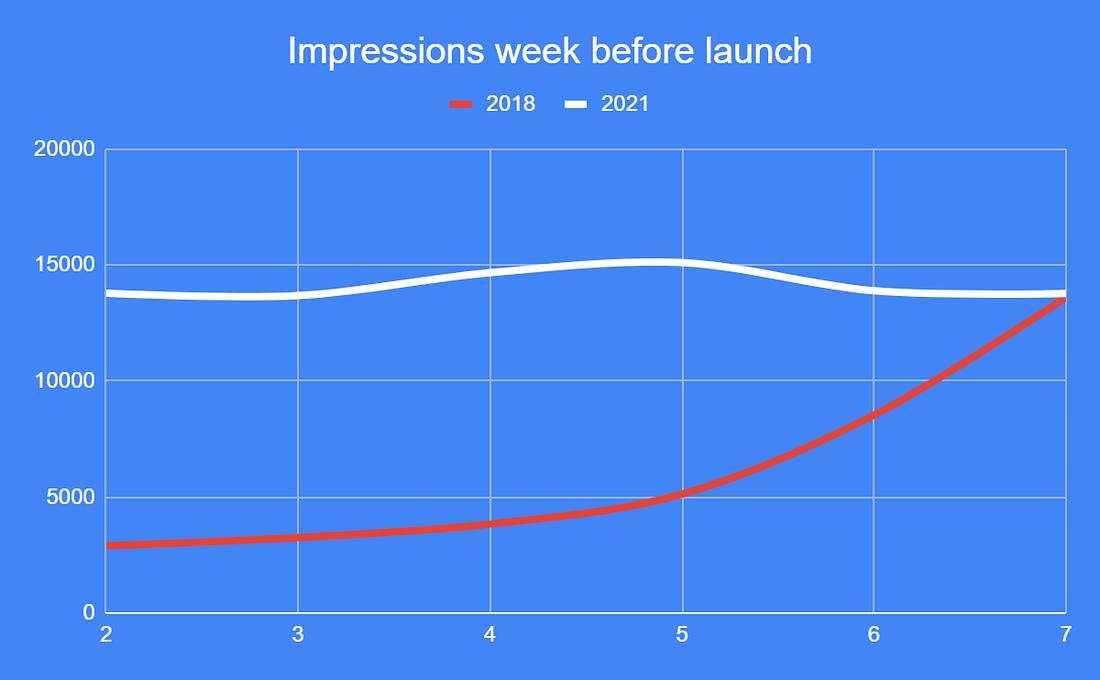

It is interesting how the impressions seem to line up as the games reach launch (on day 7), even three years apart, perhaps showing how Steam has grown in size, even as it’s grown the number of available games:

Once again, the “Coming Soon - Full List” impressions were dominating in 2018. But the overall amount of impressions didn’t increase as I got closer to launch in 2021. This may be since, if you’re not in the Popular Upcoming section, which launched in July 2018, you don’t get much visibility immediately pre-launch? So - really try to get into that section!

The majority of impressions I saw in 2021 were coming from “Browse Search Results”, which provided a much better click-thru rate (0.95% in 2021, vs 0.16% in 2018). But I’m not sure this is representative for the majority of games, because I did not see these numbers from any other game I worked with in 2021. So please bear that in mind.

The launch week on Steam

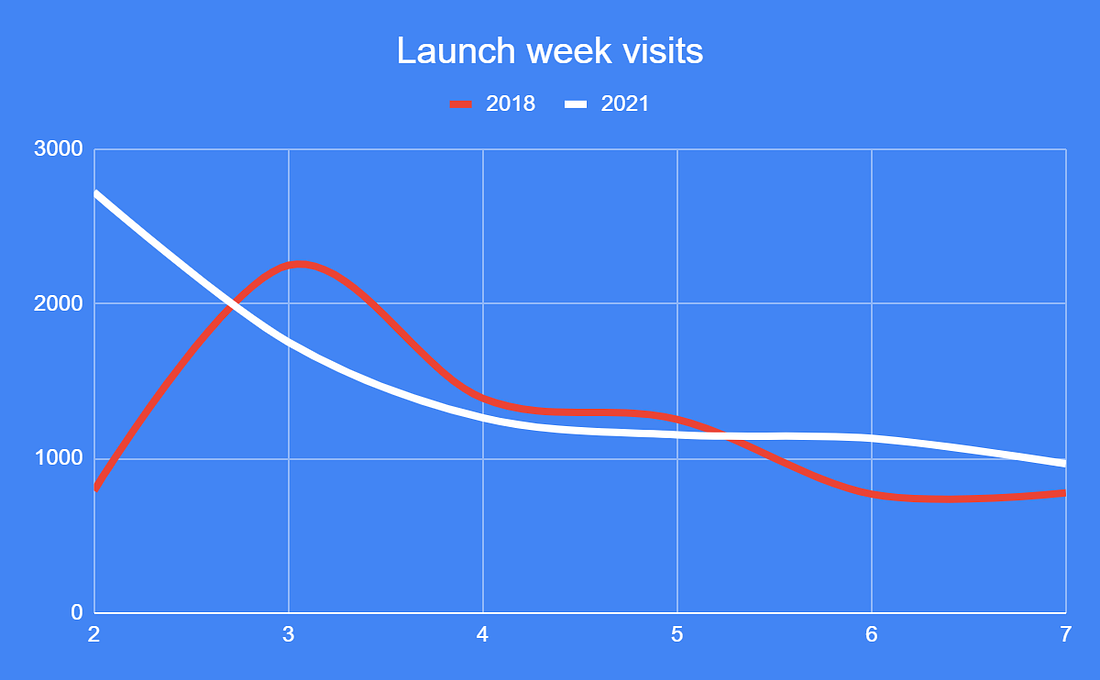

At first glance it doesn’t look like much has changed - besides 2021’s game receiving a lot more visits on launch day. (2021’s game had accumulated six times as many wishlists before launch, because it was on the store for much longer before it was released.)

The distribution of the traffic creating the visits appears to still be the same for both 2018 and 2021: “Discovery Queue”, followed by “Tag Page”. But the amount of initial “Discovery Queue” visits has been reduced from 2018. And the newer game has a bunch more visits from a wider range of sources instead - again showing the extra discovery options Valve has built into Steam since 2018.

One review to rule them all?

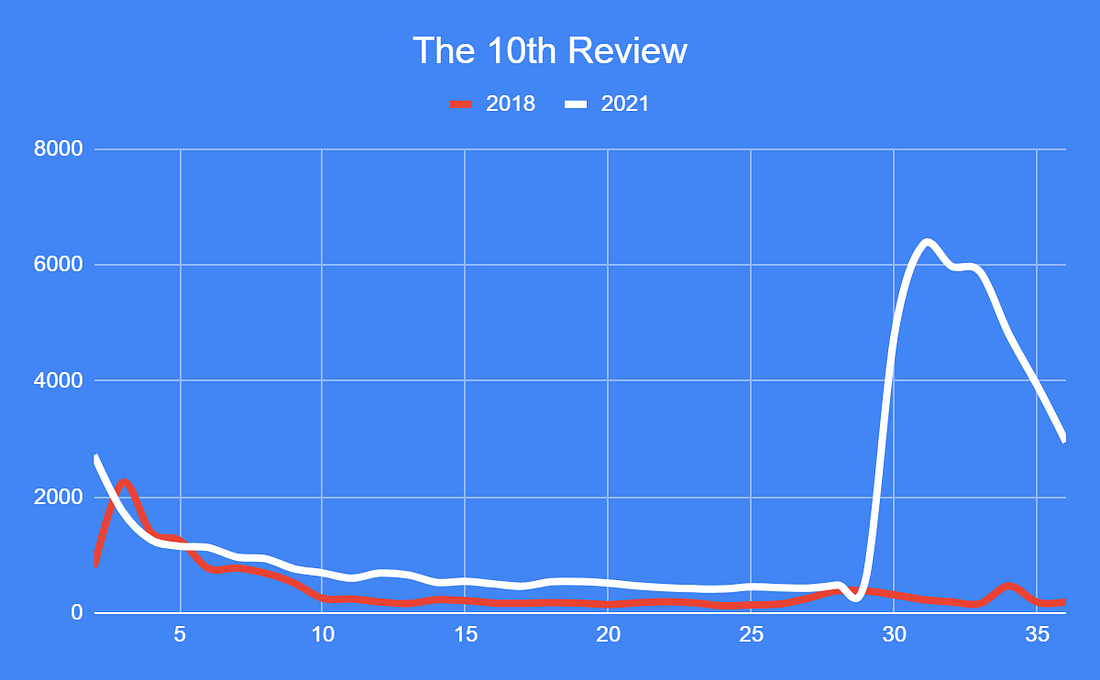

With every game launch coming up, I tell my partners how important it is to reach 10 Steam reviews ASAP. Once you reach 10 reviews, the game unlocks an entire ‘visibility layer’ - including summary score (‘Positive’), thumbs up/down on search results, and more. In addition, your game can start potentially showing up in the New & Trending sections of tag pages and other important places on Steam.

I knew this was a very important metric to reach. But boy, seeing the effect it had on Steam page visits was mind-blowing - and worlds ahead of 2018:

Yup, it’s insane. The source of the spike is - of course - the “Discovery Queue”, which now showed the game as “New on Steam”. The initial peak lasted about a week, and it took a bit more than a month until the line stabilized again.

If we compare to the previous game, in 2018, the 10th review was reached at about day 27. This has a way smaller change, and is visible by a slight bump in visits in the chart above on the red line.

Because it looks so spectacular, here the actual 2021 graph from the Steam backend, with the yellow line being the traffic from the “Discovery Queue”:

General takeaways

I could go on forever with showing you graphs. But let’s slowly bring this to an end with a few general takeaways that I noticed:

In 2018, I saw a lot of Steam achievement hunters jumping onto my game right away. This was completely absent in 2021. This is because Steam is now limiting Profile Features - like publicly displayed Achievements and Trading Cards - until a game has proved itself, e.g. generated enough sales. This is a system which was not yet in place when I launched in 2018.

2021’s game had a brief period of having a “Mixed” rating, where sales dropped by 80%! (Valve has said that it only penalizes on the algorithm level at below ‘Mixed’ - so this must be players choosing not to buy.) This was fascinating to see for me, because I experienced the same drop in sales back in 2017 while working on someone else’s game. Both Game 1 and Game 2 have >80% positive Steam reviews currently, by the way.

If someone leaves a Steam review and refunds the game afterwards, the review still counts towards the overall rating. Or at least until the person deletes the review. I had always assumed it would stop counting because this could be abused - but apparently it is not the case? (It is marked as ‘game refunded’ next to the written review, though.)

Overall, 2021’s game has been generating twice the revenue in its first 1.5 months compared to 2018. And I’m very eager to see where the long-term comparison will fall out.

So I guess the indiepocalypse didn’t happen after all? (Just kidding!)

[Thanks so much for providing the guest column, Patrick. You can find him on Twitter at @somniumlg - where he sometimes posts about Steam. Or you can reach out to him directly at [email protected].]

[We’re GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]

Read more about:

Featured BlogsAbout the Author(s)

You May Also Like