Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs.

Mobile games are at the peak of glory, and the previous 12 months showed that the industry will continue its growth. Let's try to identify key trends and next steps for game developers to compete in this rapidly changing environment next year.

The article was originally posted on Today's Web.

2014 has been a jammy year for the mobile games industry. In the last 12 months, games have been shining at the top of grossing charts on mobile app marketplaces like the Apple’s App Store and Google Play. Despite the visible success, it’s not as easy as it seems to figure out the landscape of mobile gaming in the upcoming 2015, as this industry probably remains the most disruptive and dynamic in the modern hi-tech segment.

Below are the major trends that, as stated by different experts in mobile gaming, will affect the industry above all in 2015.

Games are the best money generating mobile apps

Games drive the most revenue on both App Store and Google Play, compared to other categories of apps.

According to App Annie Index: Market Q3 2014 report, the lion’s share of Google Play’s worldwide revenue has been generated by gaming apps. From July to September 2014, this trend continued to persist, that led to the increase of games’ share in overall revenue on Google Play. The highest earnings occurred in the United States and South Korea, where games accounted for nearly all revenue of the platform.

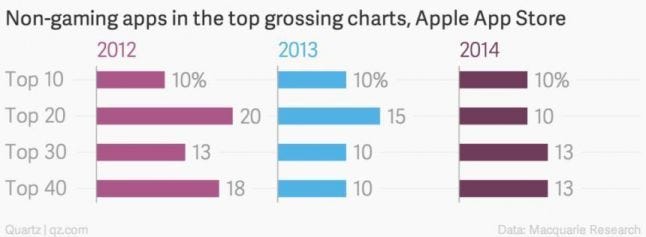

This becomes even more evident when you look at the “Best of 2014″ list released by Apple earlier this month. 9 of top 10 grossing apps throughout 2014 were games, and only 1 was a non-gaming app. Macquarie Research reveals that in 2014, games will deliver an estimated 75% of income on the App Store. Huge, isn’t it?

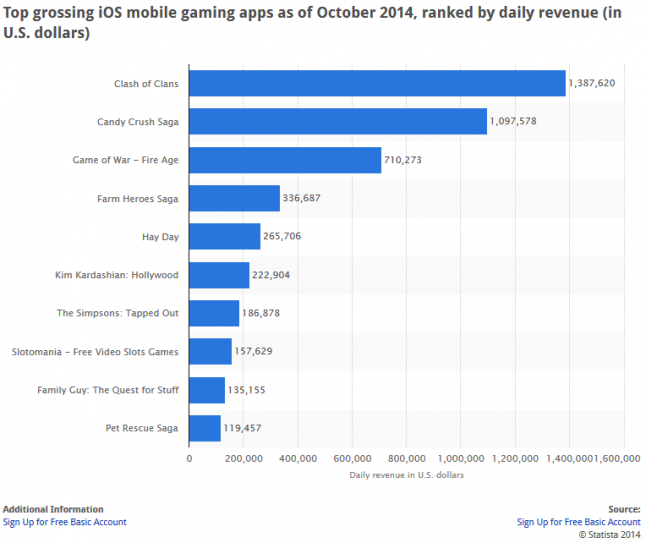

On average, each of the two best selling games earned more than 1 million dollars a day on the App Store during October 2014. Supercell’s Clash of Clans, which is a #1 top grossing game, had an average daily revenue of $1,387,620, and King’s Candy Crush Saga, which is a #2, made $1,097,578 a day.

Gamers want it for free

Since mobile gaming became an integral part of modern pop culture, the so called ‘devaluation of games’ began. An average user no longer wants to spend any money at all to install the game. 90% of revenue generated by games on App Store this year came from free-to-play titles.

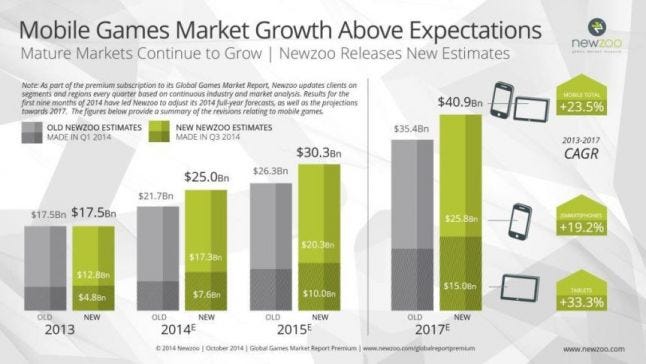

Research from Newzo published in Q3 of 2014 estimates the total revenue of mobile games industry at $25 billion, $4 billion of which will be gained by Apple and $3 by Google. It’s surprising, but all that revenue is driven by a very tiny segment of gamers. Only 2.2% of users ever pay in free-to-play games, and 46% of the total revenue comes from just 0.22% of the total amount of mobile users, Swrve reports.

Big players get hold of app stores

2014 was the year when massive game publishers monopolized cash flows from app marketplaces. Two companies (King and Supercell) own nearly half of top 10 grossing mobile apps in the US (hence, they get the major portion of revenue). No wonder, there’s a lack of new products in top charts: 8 of top 10 grossing games were published in 2013 or earlier. At the same time, 80% of 1.2 million apps available on the App Store got no downloads at all.

Under such conditions, small game developers approach big publishers for marketing expertise and promotion. This makes some game industry giants that used to focus solely on in-house games launch publishing programs for third-party game developers. For instance, Rovio Entertainment, a company behind Angry Birds title, announced its mobile game publishing ititiative for game developers under the new brand named Rovio Stars in May 2014.

Next steps for game developers in 2015

New approaches to marketing games

Given the fact that an average cost of install in mobile advertising is overpriced and probably will rize up to $10 for native mobile apps next year, indie game developers and publishers need to find alternatives to get their apps discovered. And maybe, the solution can be found in the technology that game developers used to pay no regard for. Yes, it’s HTML5.

PuzzleSocial, a game develpment studio based in NYC, unveiled a case study about leveraging mobile web to drive high-quality installs for their game called “Daily Celebrity Crossword”, which is available for iOS, Android and Kindle Fire. They built a lite version of the game on HTML5 and distributed it via mobile web. In 4 months, this resulted into 320,000 unique game plays and, which is more important, 10% of those players proceeded to download the native mobile app.

Roughly, this new marketing model can be presented as follows:

An HTML5 based lite virsion of a game provides limited game play with a few levels available for free;

Users discover the lite game version via one of the mobile web distribution networks and can start playing it right from a mobile web browser without needing to install an app;

If they like the game, they can follow the link to download the full game version from an app store, that is shown to them at game over;

A game developer is charged by a distribution network only when a user downloads a native app.

Another promising user acquisition channel is at the back of social video services like YouTube and Twitch. So called “Let’s Players”, people streaming their game play with comments online, have been on the stage since the establishement of YouTube. But in 2014, game developers fully realized the strong potential of Let’s Players which became a full-fledged, powerful media. It’s highly important for game developers to build relationships with popular Let’s Players, who can broadcast a game to millions of their own fans. PewDiePie, a Let’s Player of the year 2014, has 33 million subscribers on YouTube. He’s also popular on Twitch (440,000+ followers), a game-specific video broadcasting service with 60+ million monthly active users. There’s a lot more Let’s Players who are interested in new games to comment, check them out.

Alternative mobile app stores

It’s been a while since the messaging service Kakao Talk, which is no.1 in South Korea, succeeded as a mobile gaming platform. At the end of 2013, it had 140 million registered users, $203 million revenue and 426 games available. However, Europe and North America always preferred traditional mobile app stores. 2015 may become the year of revolution for mobile games in this area, since Viber decided to follow Kakao’s path. Earlier this year, Viber announced the launch of Viber Games, a marketplace for mobile games. The company plans to make this feature available globally in January 2015. Yet, 5 countries have been selected for soft-launch in December 2014: Ukraine, Belarus, Israel, Malaysia and Singapore.

Initially, Viber Games launched with two titles from Storm8 (Viber Candy Mania and Viber Pop) and one title from Playtika (Wild Luck Casino). All of them are free-to-play, and Viber will make money from in-app purchases inside those games. Besides, users can synchronize games with their Viber account in order to send gifts and share achievements with friends. Viber Games is not a stand-alone platform, it’s rather a separate section within Viber messenger which redirects to a native store to install a game on a user’s device.

As we can see, Viber is taking the leaf from Asian messengers like KakaoTalk and Line, and that will probably cause a shift in the way users discover games.

Pay attention to emerging markets

China, Japan, South Korea and other Asian countries attract more and more interest from game developers. Indeed, Eastern market looks stronger than ever: Japan and China took positions #2 and #3 respectively (right after the United States, which still holds #1) by downloads and revenue on the App Store in Q3 of 2014. On Google play, Japan surpassed the United States by revenue taking the #1 from the US, South Korea reached #3 and Taiwan closed the top 5. Other emerging markets to consider are Brazil and India, which gained #2 and #3 by downloads on Google Play respectively.

Follow Todaysweb for more stuff about mobile apps and games industry: http://todaysweb.net

Read more about:

Featured BlogsAbout the Author(s)

You May Also Like