Featured Blog | This community-written post highlights the best of what the game industry has to offer. Read more like it on the Game Developer Blogs.

Maybe we can get some clues from Nintendo's latest analysis.

[The GameDiscoverCo game discovery newsletter is written by ‘how people find your game’ expert & GameDiscoverCo founder Simon Carless, and is a regular look at how people discover and buy video games in the 2020s.]

This week's GameDiscoverCo starts out with a look at the state of the Switch, filtered through Nintendo’s own folksy slide deck.

The information we get from the large video game platforms about a) financials and b) the state of their userbase can sometimes be frustratingly non-transparent. Which is why select tidbits from Nintendo’s annual ‘corporate management policy’ briefing [.PDF link] can be so fascinating.

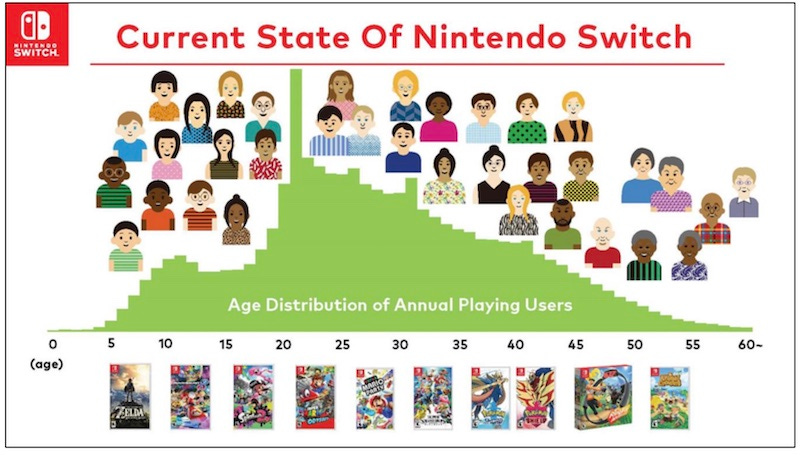

Firstly, this age distribution of ‘annual playing users’ (above) on Switch is intriguing, since it’s showing there’s a decent set of players into their 40s - and a tiny bit into their 50s. Thinking about it, those who were school-age when the NES came out still seem to have interest in Switch, but if they were older than that… not so much.

Unfortunately, we can’t compare to PlayStation or Xbox demographics. Veteran journo Owain Bennallack had an interesting reaction on Twitter, though: “Isn’t a positive response to this graph really showing how terribly low gaming’s ambitions are? TV, iPhones, Facebook would all have a FAR more broad/equal distribution.”

Outside of console gaming, free-to-play smartphone titles have captured a lot of the much older and more casual market. The fact you still have to use (relatively fiddly) joysticks and buttons is probably the accessibility snag to reach an audience that didn’t grow up playing that way. But it’s still impressive to me, at least.

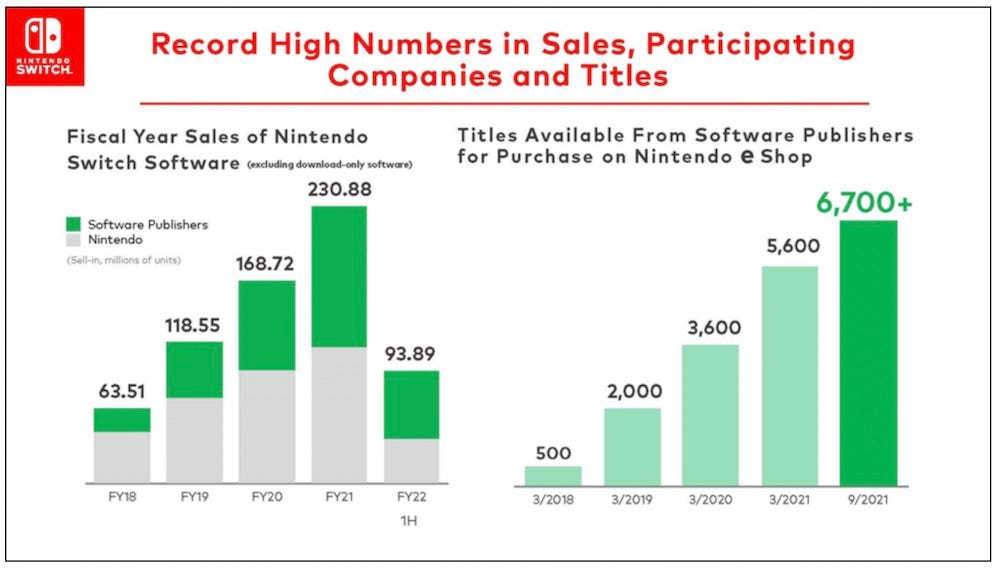

Oh, now this is interesting - a break down of first party vs. third party sales in ‘millions of units’. Except… we just read the small print, and it says ‘excluding download-only software’. Why, Nintendo? Why would you do this?

Actually, I probably know why they would do this: because by just showing games that have both physical and digital versions - the highest cost title - the company will get a more gradual and investor-understandable view of the increase of third-party sales on Switch. (And they are still using ‘retail sell-in’ as a metric, I guess.)

This enables them to say: “Last fiscal year, titles by other software publishers accounted for more than half of the total unit sales for packaged software and its downloadable versions on Nintendo Switch.” I’m sure if you included eShop-only games, it would be more like 80% or more non-Nintendo units - but those units averaging one tenth of the sales price of Nintendo games.

Another view: Embracer’s Martin Lindell was kind enough to point out, via the detailed Nintendo financials [.PDF link], that Nintendo’s first-party game sales (by revenue?) declined from 80.6% of total game sales in the first half of FY21 to 70.6% in the first half of FY22. Could be seen as a ‘broadening out’ - or could just be Animal Crossing’s 10 million launch sales in FY21 normalizing, haha.

Also notable in the presentation? It’s great that Nintendo releases precise ‘legacy’ units sold even for smaller titles - in this case for thirteen of the standout Switch back catalog titles over a 6-month period.

Some of these numbers are truly impressive - especially since these games are very rarely discounted more than 30%. 3.2 million units of Mario Kart 8? 1.6 million units of the 2018 release, Super Mario Party? To us, these shows two things: the power of IP, and the value of having variants of your top IP available in enhanced form on the latest console.

For example, some IP holders might have scoffed at making yet another Mario Kart game, or rebooting Super Mario Party yet again (a newer iteration just dropped, too!) But these games just keep selling and selling. 14 of the 18 million-sellers in FY22 so far were from first-party games. Switch is Nintendo’s world - we just live in it?

We could keep going for a while here, and WorkingCasual has a deeper dive through the numbers. But just summing up the other notable things from the presentation about Nintendo’s general direction - and what it means for the Switch discovery ecosystem:

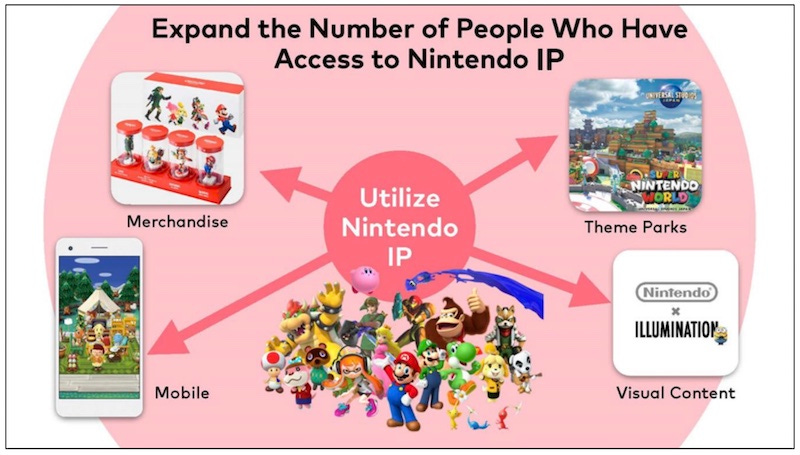

After a long time of sticking to ‘we just make games for Nintendo consoles’, the company is finally unlocking its IP in more modern, transmedia ways - the Illumination movie collab is almost out, the theme park areas are getting sorted, and so on.

There’s now over 32 million Nintendo Online members, and the company says generically: “we will continue to improve and expand” both the base Nintendo Online service and the (slightly lumpy/odd) Expansion Pack service in the future.

The company is yet again downplaying acquisitions as a way to build new content. In fact, Nintendo president Shuntaro Furukawa says: “We are not dismissing the possibility of M&A activities”, but the priority is to spend money “to organically expand our own organization” and retain Nintendo’s existing culture.

There’s a lot of other detail - and any slowdown in the company’s hardware numbers looks like it’s due to supply chain issues, rather than lack of interest. But the message seems to be that Switch will be Nintendo’s main console for at least 2-3 years (there’s a very vague tease that there will be more hardware eventually, coming in 20XX.)

With lifetime Switch hardware sales now at 93 million units, and the OLED version of the console just rolling out? Even though the eShop’s pretty darn busy, it�’s still a place to be, given Nintendo’s general mastery of the space right now. So let’s all get on that.

[We’re GameDiscoverCo, a new agency based around one simple issue: how do players find, buy and enjoy your premium PC or console game? We run the newsletter you’re reading, and provide consulting services for publishers, funds, and other smart game industry folks.]

Read more about:

Featured BlogsAbout the Author(s)

You May Also Like